- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- depreciation cannot be exceed business basis

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation cannot be exceed business basis

I purchased a hay trailer in 2010 for $5000. I sole the trailer in 2020 for $3500. The trailer was already depreciated and full amount deducted on section 179. When I entered this information in Turbo Tax, I get an error that the "depreciation cannot exceed business basis". All of this information is correct, but somewhere Turbo Tax is seeing an error. I am not sure what to change to correct this error. Any ideas?

Thanks for your help

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation cannot be exceed business basis

Here is a workaround.

Say that your retired your vehicle to personal use. Enter it in Sale of Business Property where you can enter your full amount of depreciation and report the sale. Your basis after depreciation should be zero.

1) Wages and Income

2) Other Business Situations

3) Sale of Business Property

4) Other Property Sales

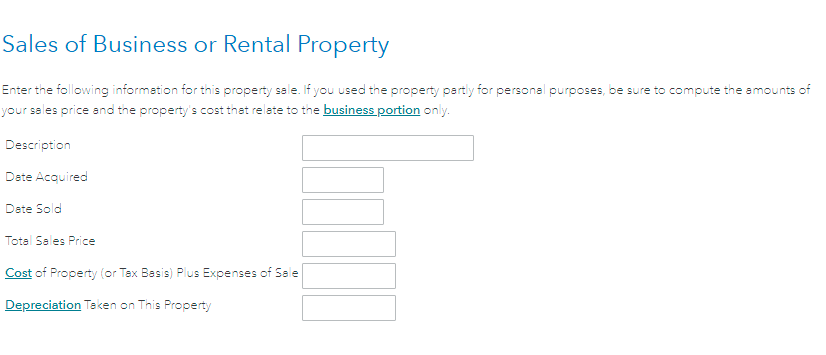

5) Select Sales of Business or Rental Property that you haven't already reported

6)Choose No to the question, "Do all of the following apply to the property you sold?".

7)Choose Yes to the following screen that asks, "Do any of the following descriptions apply to the items you sold?".

8)Select the type of property from the drop down box.

9)Enter the information for your sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation cannot be exceed business basis

Found on Form 4797 that the depreciation allowed was doubled by the software so I placed a zero in prior depreciation and it corrected the depreciation allow and cleared the error.

Thanks for you guidance.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ldh312

Level 2

Asaxena2

Level 2

nospam

New Member

ecbeane

Returning Member

brianfreno

New Member