- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Computer Purchase

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computer Purchase

HI I purchased a new computer for business, its used in 2 businesses and personal, do I write off the computer based on % in both businesses for the current year? The amortized option has over 15 years and computers don't last that long, I typically upgrade every 4-5 years.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computer Purchase

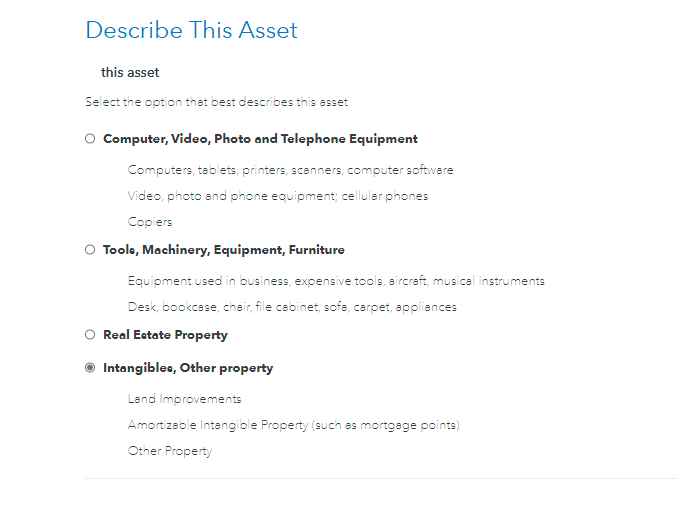

Computers are 5 year property. First, you will need to allocate the total cost to all activities that benefit from the asset. Then enter the allocated portion to each activity as is appropriate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computer Purchase

Computers are 5 year property not 15 year property.

Assuming you made no other asset purchases you could deduct the computer purchase (also assuming the business use is more than 50% business or less than 50% personal use) as Section 179 expense.

You may want to talk to a tax professional depending on the size of your 2 businesses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Computer Purchase

You would have to prorate the usage between the two businesses and personal use. For example, you might use it 20% for one business, 30 percent for the other and % personal use. You can depreciate over 5 years 20% of the cost and 30% of the cost, but he 50% personal use is not an expense.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

d-hocamp

New Member

noellematthews

Returning Member

lindaruthe

Level 2

user17714517748

New Member

in Education

user17714471989

New Member