- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Clergy housing allowance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

In the past I have received a 1099 for income as a contract worker (or similar title) in temporary church ministries. Because I wanted to be sure to receive credible evidence that I had arranged with a church to receive this income as housing allowance, I requested a W-2 on which housing allowance can be listed (box 14) instead of on a 1099. Although the underlying reality remains the same, I have discovered that my self-employment income is diminished (without a 1099 to enter as self-employment income) to a point that my cost for a home office is disallowed. Is there a way to end run this situation legitimately and legally?

NOTE: I prefer that those answering know the particular nuances and idiosyncrasies of ministerial self-employment taxes. Thanks for your help!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

If you were issued a W-2 instead of a 1099-MISC, if the "statutory employee" box on that W-2 is checked, then it's self-employment income. If it's not checked, then its not self-employment income and you will need to have the issuer issue you a corrected W-2 with that box checked. Without that box checked on the W-2, you flat out do not qualify to claim "any" work related expenses at all.

With the "statutory employee" box checked, you'll still enter the W-2 in the W-2 entry section of the program. But the program will transfer it to SCH C where you can claim your HO.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

I have a number of concerns about your situation.

First of all, you can’t “arrange“ to be paid on a W-2 if you are an independent contractor. The nature of the tax document you receive depends on the nature of your employment arrangement and not the other way around. Most ministers are common-law employees of their church and should receive a W-2 even though they are considered self-employed for limited tax purposes. If a minister answers to the denomination or to the church in any way, such as by means of a board of elders, or an administrative council, or some other method whereby the church body determines the hiring and firing, or validates their “call” to ministry at that church, or however you want to describe it, then the minister is a common law employee.

Ministers would only be independent contractors at their regular church if they are truly independent of the congregation, the denomination, or any other body. “Supply pastors”, that is, temporary fill-ins for summer vacations or leaves of absences or sabbaticals, may be more commonly and more properly considered independent contractors.

Second, a housing allowance must be designated by the church in advance and in writing. I have always wondered if a truly independent pastor can ever legally have a housing allowance, since to be really independent, the pastor can’t answer to the church and therefore, there is no one in authority to designate a housing allowance. However, I have never seen this litigated or discussed in the resources I have read. So for the time being, I assume that a pastor can have a housing allowance even if they are an independent contractor.

Third, recording the housing allowance in box 14 of a W-2 has no force of law and does nothing to legitimize the housing allowance. The housing allowance must be designated by the church in advance and in writing, such as in the minutes of the board of elders or your employment contract. Box 14 is merely a memo field and has no force of law. It is just as legal to receive your housing allowance information in a memo from the treasurer or finance committee, and if the housing allowance is not designated in advance and in writing then no amount of other documentation will make it proper.

Fourth, all deductions for work-related expenses for W-2 employees are disallowed under the tax reform of 2018. If your job as a pastor is covered by a W-2, then you simply can’t deduct a home office regardless of the dollar value of the deduction. If you are using a home office partly for a W-2 job and partly for other independent contractor work (assuming that you are doing other pastoral work on the side) then you have to allocate your expenses between the W-2 job and the independent job and reduce your claimed home office amount anyway. You can’t claim home office expenses for a W-2 job on schedule C even if you also have other schedule C employment—you have to properly allocate the expenses between the two jobs. While you can enter work-related expenses In TurboTax as a W-2 employee, they will have no effect on your federal tax return. They might flow to your state tax return depending on your state and if you itemize deductions in that state.

Fifth, if you have work-related expenses as a pastor, even as a W-2 employee, you can deduct them from your income subject to self-employment tax on schedule SE, even though you are no longer allowed to deduct them on schedule A using form 2106. This requires making manual adjustments to the schedule SE worksheet, which requires you to have TurboTax desktop version installed on your own computer from a CD or download. You can’t make manual adjustments using the online program. (According to IRS instructions, it also requires that you prepare a written statement of your expenses and attach it to your tax return which means you can’t e-file.)

Finally sixth, you mention ministerial taxes at the end of your question but you never specifically said you were a pastor. Remember that you are only entitled to a housing allowance if you are both a qualified pastor in your denomination and you are performing pastoral duties in your present position. A qualified pastor who is hired, for example, to provide administrative help in the office and does not participate in leading worship or performing other pastoral tasks is not qualified for a housing allowance. Or, at my former church, we hired a pastor from another denomination as our youth pastor. He was not qualified to offer sacraments in our church until he took two required seminary courses, and so was not entitled to a housing allowance until those courses were completed.

Since you talk about the idiosyncrasies of ministerial taxes, I hope that you are not taking advantage of the church’s ignorance in tax matters to arrange your employment arrangements for tax purposes. I have found nothing concrete that says you can’t have a housing allowance as an independent contractor, despite my doubts. But whether you are an independent contractor or an employee depends entirely on the relationship between yourself and the church and has nothing to do with how you would prefer your income to be taxed. If the church is currently paying you as a employee with the expectation of issuing a W-2 at the end of the year, then they need to be sending form 941 quarterly, or form 944 at the end of the year, along with quarterly state reports—even if they are not doing any withholding they must file the forms to report that you are an employee. Backing out of this in mid year is going to be very difficult for them even if it is legitimate to do so. I would consider it a matter of proper stewardship and ethics to be classified correctly (as either an employee or a contractor) and then work within the tax laws after that, rather than trying to arrange your employment status to fit some interpretation of the tax code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

I don’t believe pastors are ever classified as statutory employees. I have done very little work with the concept of statutory employee but what I just read indicates that statutory employees do not pay self-employment tax because the employer is responsible. This is the exact opposite of clergy. Most clergy are common law employees, and should receive a W-2. Because they are classified as self-employed for limited income tax purposes, box 2 withholding is optional, and boxes 3 through 6 should be zero or blank. The pastor is responsible for self-employment tax on schedule SE even though their wages are reported on form 1040 and not schedule C. Schedule C would only be used if they also have side income. (Some pastors may be truly independent contractors in which case they would file a schedule C and a schedule SE.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

I agree with @Opus 17 in that a minister is not classified as a statutory employee.

Ministers have what is termed "dual tax status"; employee for income tax purposes, but considered self-employed for social security purposes (SECA).

I will provide some thoughts which may have already been stated by @Opus 17 :

- The determining factor as to whether or not you should receive a W-2 or a 1099 must be based on the usual common-law test of employee vs independent contractor.

- Ministers who receive a 1099 (based on facts and circumstances) can most likely still receive a housing allowance, but as noted by @Opus 17 , this MUST be determined in advance. You would need to provide the church with the necessary documents to support your request. The church would then provide you with a letter documenting the "church board" approved housing allowance amount.

- Regardless of what is specified as a housing allowance, at the end of the year you would need to document that the housing allowance meets the test of the lesser of: (1) the amount designated either on the W-2 or other documentation as noted above, (2) the fair rental value of the residence, or (3) actual expenses incurred.

- The third sentence is not real clear. You state "without a 1099 to enter as self-employment income". Regardless of whether a minister receives a W-2 or a 1099, both are considered self-employment income for SE Tax purposes. Maybe you are referring to income as reported on Sch C?

- I believe that ministers that receive a 1099 and claim a housing allowance may be more at-risk for an audit. No proof as I'm not sure anyone understands the IRS algorithms.

- In general, I would recommend you consult with a tax professional (who prepares multiple 1040's for ministers) who can have a one on one with you to discuss your particular situation. In this day and age, this individual does not even have to be in your same area.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

Opus17, I've been trying to find the answer to "does a Minister have to file Schedule C" for 24 hours now! My husband has a W-2 with housing in box 14. I know we need to file Schedule SE but somehow I got confused going through TurboTax 2020. It just didn't seem clear to me. Please confirm that we don't have to file Schedule C. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

You would only file a schedule C if you have additional outside income to report, such as if your husband did consulting, or was paid independently to perform weddings or funerals, or was a per diem chaplain at a local hospital, or something like that.

It’s important to understand that pastor is our only “considered self-employed“ for certain tax purposes, but most pastors are common-law employees and will receive a W-2. Box 1 should have wages and boxes 2 through 6 should be blank. If boxes 3 through 6 have monetary amounts, TurboTax will get confused and you will need to perform manual adjustments or seek extra assistance. If you have a W-2 with boxes 3 through 6 blank, then after entering the W-2 and getting past a couple of nag screens where TurboTax asks you to make sure you entered it correctly, there will be a screen listing special circumstances and you will check the box for “religious wages.“ This will cause TurboTax to prepare a schedule SE for the self-employment tax. But you will not require a schedule C unless there was additional outside income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

Thank you for your reply. For whatever reason Schedule C popped up so I started to complete it although didn't remember doing it in the past. Now I can't get rid of/delete Schedule C so if you know how I can do that in Turbo Tax Deluxe CD, I would appreciate the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

I don’t believe pastors are ever classified as statutory employees.

I highly appreciate your clarification of things in this thread. Helps quite a lot! I was paying more attention to the comment, "In the past I have received a 1099 for income as a contract worker (or similar title) in temporary church ministries." Therefore, I was assuming this was in fact, SCH C type work being referenced here. Thus my reference to "statutory employee" on the W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

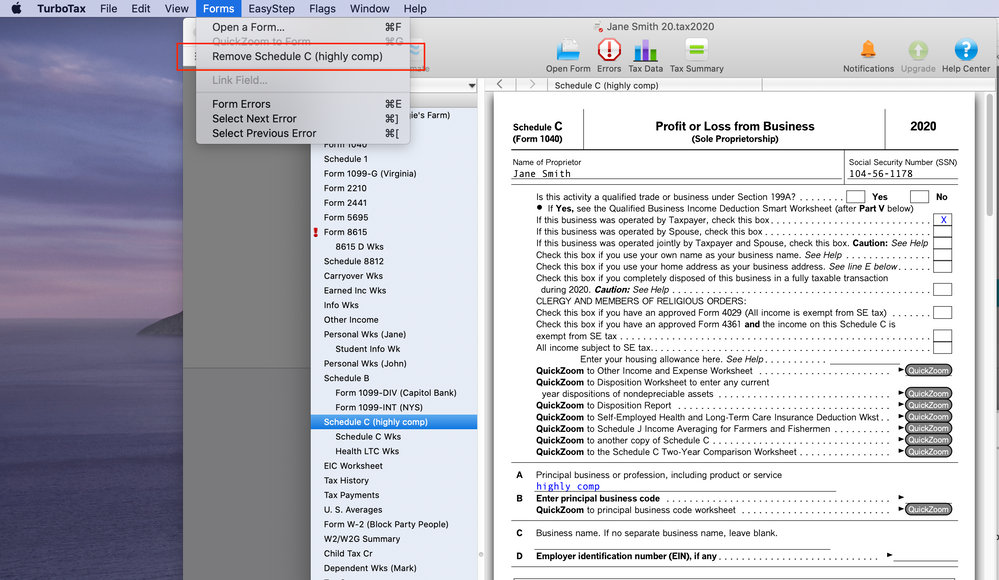

if you are using the desktop version, you can switch to forms mode by clicking the “forms“ icon at the top of the page. On the list of forms, choose schedule C and then find the menu item that says “remove a form.“

Normally, a schedule C would only be created if you entered some kind of 1099 form, or if you deliberately created a business before entering the business income. If you did either of these things, the schedule C might be re-created and we would have to go further to diagnose why it is there and how to get rid of it.

Do you have a 1099 – MISC or 1099 – NEC? If so, what was it for?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

@MelGib59 wrote:

Don't have a 1099. I think it's "user error" that created Schedule C. At this point I can't remember exactly what happened that led me to Schedule C and at this point that doesn't matter. I already attempted to delete Schedule C as you've referenced and didn't see anything that said "remove a form" so I'm wondering if I just need to start over with a whole new return.

You can start over if you like, sometimes that is cleaner.

Here is what "remove a form" looks like on the Mac version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Office deduction disqualified

That screen shot was VERY helpful (obviously a visual learner haha). I was totally focused on the TurboTax app itself rather than looking at the ribbon at the top of the screen on my MAC. Thank you, thank you, thank you, for hanging there with me!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ftermine

New Member

pizzagirl34

New Member

sbcus10

New Member

southernana

Returning Member

cammoman43

New Member