- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Armed Forces Reservist Education Expense (Form 2106)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Armed Forces Reservist Education Expense (Form 2106)

Hi,

Is Grammarly considered deductible as an armed forces reservist?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Armed Forces Reservist Education Expense (Form 2106)

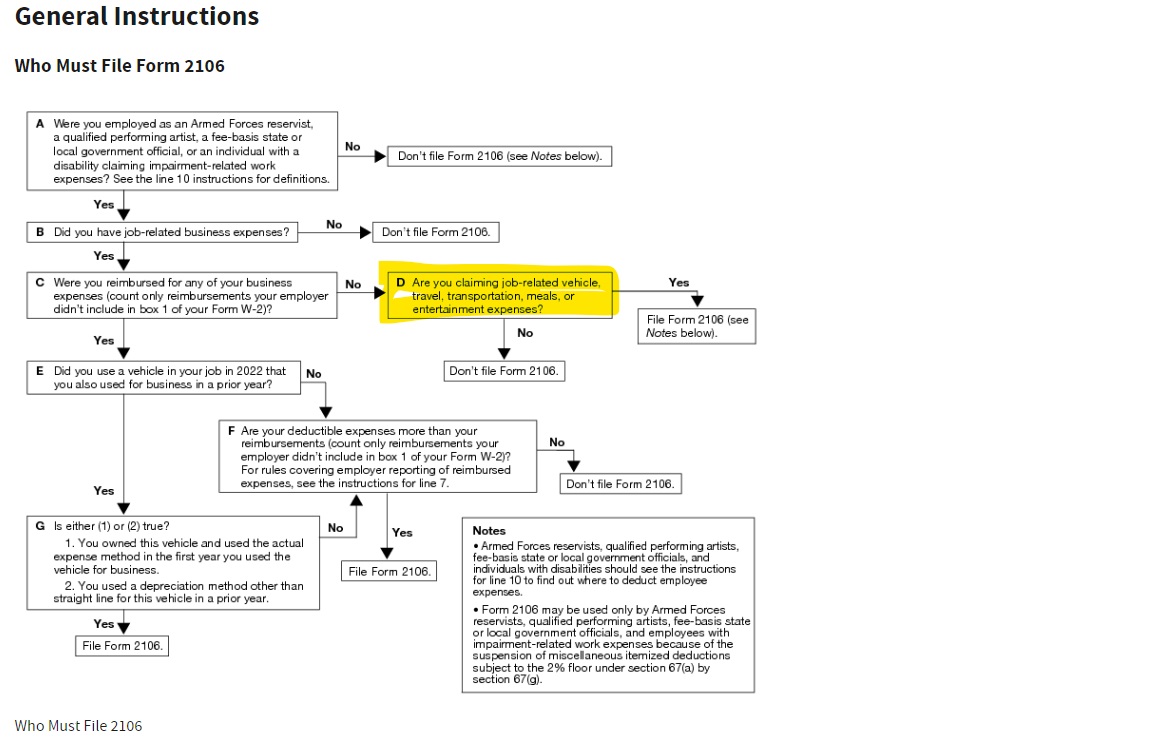

No. According to the Form 2106 instructions extracted below you only deduct the unreimbursed expenses related to travel more than 100 miles from your home.

"If you qualify, complete Form 2106 and include the part of the line 10 amount attributable to the expenses for travel more than 100 miles away from home in connection with your performance of services as a member of the reserves on Schedule 1 (Form 1040), line 12, and attach Form 2106 to your return. The amount of expenses you can deduct on Schedule 1 (Form 1040), line 12, is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses), plus any parking fees, ferry fees, and tolls. These reserve-related travel expenses are deductible whether or not you itemize deductions. See Pub. 463 for additional details on how to report these expenses."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Armed Forces Reservist Education Expense (Form 2106)

Okay, but why would CourseHero apply, and not Grammarly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Armed Forces Reservist Education Expense (Form 2106)

No. CourseHero is not an approved expense because it is not a qualified job-related, travel, transportation, meals, or entertainment expenses.

The previous post you reviewed was posted in error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MythSaraLee

Level 4

MythSaraLee

Level 4

jpgarmon1

New Member

in Education

robinsonmd109

New Member

in Education

rachaa44

New Member