- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Will I still get direct deposit after amending my tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

Actually the IRS states that the original chosen return option cannot be changed. So if you originally selected check or direct deposit, that cannot be selected and will be done the same way for amended returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

@CjLef Sorry But you misunderstood something. If you are getting a refund for an amended return--a Form 1040X which had to be printed, signed and mailed-- the IRS mails you a check. They do not do a direct deposit for the refund on an amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

You must have read for something else. Where? Can you post a link?

They only mail checks for refunds. No Direct Deposit.

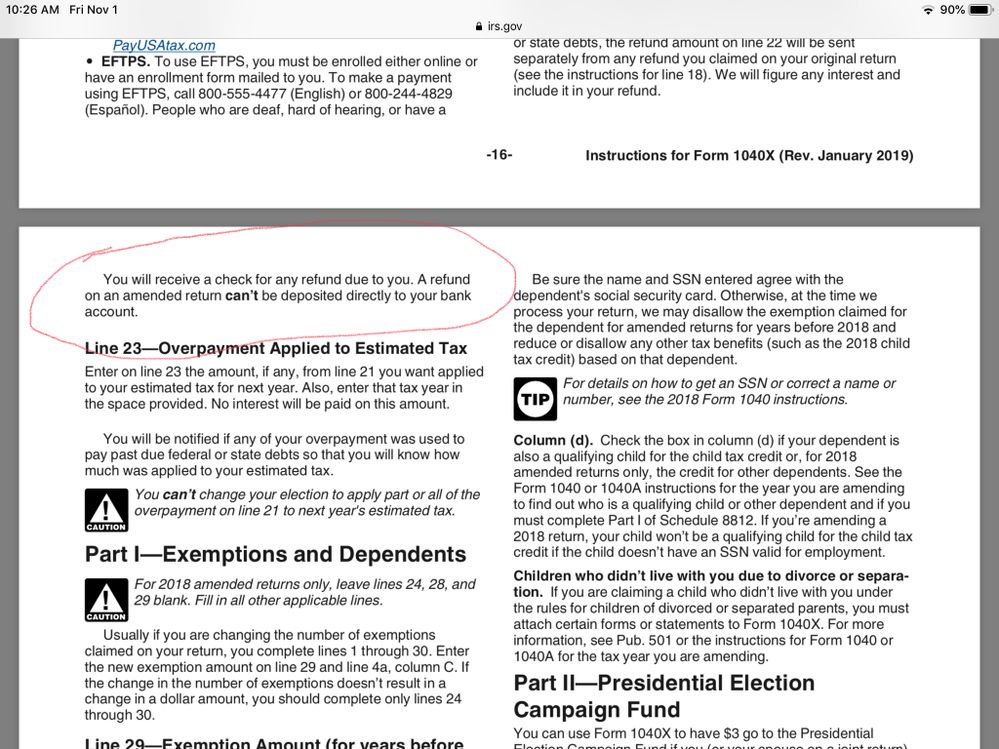

See 1040X instructions top of page 17

https://www.irs.gov/pub/irs-pdf/i1040x.pdf

It says.....You will receive a check for any refund due to you. A refund on an amended return can’t be deposited directly to your bank account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

I wanted to opt to receive a check and was notified it was not allowed to change. I was forced to receive the refund by the original selected method. Other posters say they have received DD. Read the other comment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

Did u recieve the check to your house or did they recieve it i had 2 amend mine and tbe company/tax prep are not answering me so will i get the check sent to my house or will it still go to them and they cutt me a check

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

@Cariebbb The check would be sent to the address listed on your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

Thank you so much for responding i was worried because she will not answer calls or text.....what happens to there fees?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

@Cariebbb There should not be a fee to Amend your tax return. It should just be the fee you paid to have your taxes initially prepared. But I would verify that. If their fee was deducted from your IRS refund, that would still stand because the original tax return will be processed separate from the amendment. How does the refund math work on amendments?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

I went to her to file my taxes she deducted her fees out I never got my tax return I got a 60-day review notice I called a tax advocate and he told me to amend it when I called her 2 to amend it she is not answering my calls or texts so I amended myself

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

It sounds like you need to reach out to the person who filed your tax return. Turbo Tax does not authorize those to charge a fee and file through Turbo Tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

Thank you for your help yeah she charge me a lot to file my taxes but now she is not responding back to me at all so I can't reach out to her that's why I was wondering if the check would go to me or her

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

I noticed an error on my return on the same day I submitted it. I learned a good lesson to double-double check before submitting! Anyway, I immediately completed an amendment. My Fed tax was already approved and is being processed. They are overpaying me, but the amendment says to write a check and mail it with the 1040-X. If I understand correctly, the money will be deposited because it was accepted and then when I receive my refund, I could write the check back for the over payment, right?

I was worried because I amended it as soon as it was approved. I thought maybe they would not send any money until it was fixed and I do not have the money to give to them until they give me the money first.

I also amended the state, just to be sure I did not owe them due to my error, and it is still the same. Do I have to mail in the amended paperwork, even though it is exactly the same with no money due?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

@mlflahe Yes you will get the first full refund. Then the amended return is only for the difference you owe back. You have to send a check when you mail the amended return. In fact you should not amend until the first return is fully processed and you get the refund. In case the IRS catches it or changes your first return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

Oh thanks! I figured, but when it comes to taxes, I don't want to mess around for fear that they thought I was trying to be fraudulent.

What about the State? I probably should not have tried to correct it because I broke even with them, but now I have a paper saying the same thing that it did when I first filed and so I am not sure if the first file was complete, or will they receive record that I amended it and want the signed paper, too?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will I still get direct deposit after amending my tax return?

I never got my taxes they gave me a 60 day letter so a taxpayer advocate told me to amend my taxes the company who did my taxes the lady is not answering for me after I told her I had to amend them so all that I am wondering is well I get a check in the mail from the IRS when they send me my money cuz I do not owe anything or will they send it to the company and they cut me a check because I filed before they were accepting

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jbrooksnw

New Member

gavronm

New Member

dssniezko

New Member

easytrak2002

New Member

dabbsj58

New Member