- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- which 1040X form to use for amending 2015 and 2016 tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

which 1040X form to use for amending 2015 and 2016 tax return?

Do I have to use the 1040 X form for each specific year? The 2015 1040x and 2016 1040X?

Or, I should use the most recent 1040x for any prior year amendment?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

which 1040X form to use for amending 2015 and 2016 tax return?

Why are you amending those tax years? It is far too late to get any additional refund for those years. Do you have some other reason that makes you think you need to amend for those years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

which 1040X form to use for amending 2015 and 2016 tax return?

I forgot to include the "non-deductible IRA" contributions for tax year 2015 and 2016 on my 2015 and 2016 tax returns. I mailed the corrected 8606 forms to IRS last year to reflect the correct contributions. However, IRS just sent me a letter asking me to submit 1040X for those two years. Honestly, I don't understand why I have to filll out the 1040x forms. As the non-dedutible IRS contribution does not show on 1040x at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

which 1040X form to use for amending 2015 and 2016 tax return?

In addition, I am wondering if I need to fill out 1040X form on all "Original Amount" if there is no number change at all. I only need to include the missed non-deductible IRA amount which is not shown in the 1040x at all

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

which 1040X form to use for amending 2015 and 2016 tax return?

there are legitimate reasons 2015 and 2016 can be amended. for example carryback of an NOL from 2018,2019,2020 or section 1256 carryback.

then there are cases where amendment is not valid. say you forgot some medical expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

which 1040X form to use for amending 2015 and 2016 tax return?

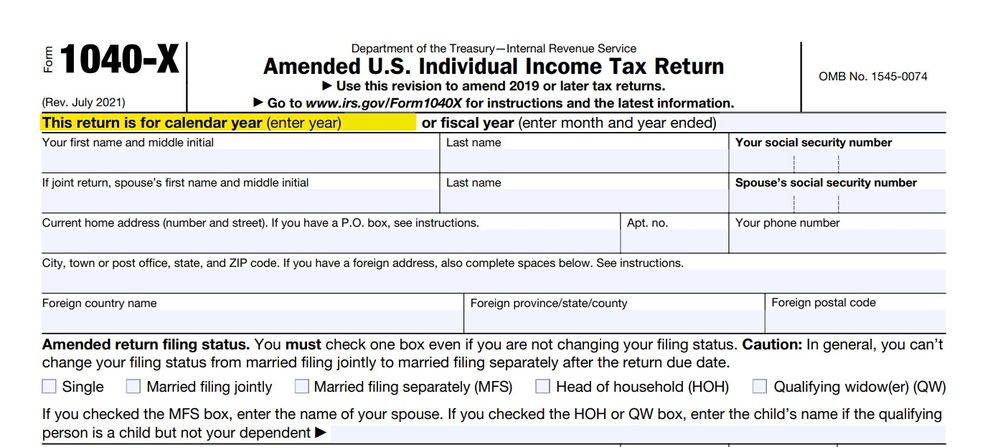

First the 1040X is a generic form where you enter the tax year at the top ... https://www.irs.gov/pub/irs-pdf/f1040x.pdf

And you will fill in only columns A & C with the same amounts and leave column B blank. Then put the reason for filing it on page 2 along with a signature and attach the form 8606 to it ... mail each tax year separately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

which 1040X form to use for amending 2015 and 2016 tax return?

Thanks! Since there is absolutely no number changes on the 1040x form (as none of the non-deductible IRA contribution information would be refleted on the 1040 form), do I still need to fill out column A and C? I see no point of fillling out clumn A and C to be completely identical. Can I just leave entire column A, B, C blank and only fill out personal information section and the "explanation of changes" section?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tazeen-m-ali

New Member

mint

New Member

harshal05

New Member

elenacaballero03

New Member

scornedtorrent

New Member