in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check this year, you can get it when you file your 2020 return in early 2021—if you are eligible.It will end up on line 30 of your 2020 Form 1040.

https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

We know that the IRS is already revising the 2020 Form 1040 to include the 2nd stimulus, but that change will entail a lot of re-programing at the IRS and for the tax software programs. It may be at least a month — or longer— before the forms are changed. Do NOT be in a hurry to file your 2020 tax return until more is known. Give some extra time to the IRS and the software programmers so that the software can handle the new 2nd stimulus, so that you can get it all by filing ONE time. You will need to visit the recovery rebate section AFTER the form and software revisions are complete in order to do this correctly. It is never a good idea to file too early; filing your 2020 return too soon may result in a lot of extra confusion that can be avoided if you wait and file a little later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check this year, you can get it when you file your 2020 return in early 2021—if you are eligible.It will end up on line 30 of your 2020 Form 1040.

https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

We know that the IRS is already revising the 2020 Form 1040 to include the 2nd stimulus, but that change will entail a lot of re-programing at the IRS and for the tax software programs. It may be at least a month — or longer— before the forms are changed. Do NOT be in a hurry to file your 2020 tax return until more is known. Give some extra time to the IRS and the software programmers so that the software can handle the new 2nd stimulus, so that you can get it all by filing ONE time. You will need to visit the recovery rebate section AFTER the form and software revisions are complete in order to do this correctly. It is never a good idea to file too early; filing your 2020 return too soon may result in a lot of extra confusion that can be avoided if you wait and file a little later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

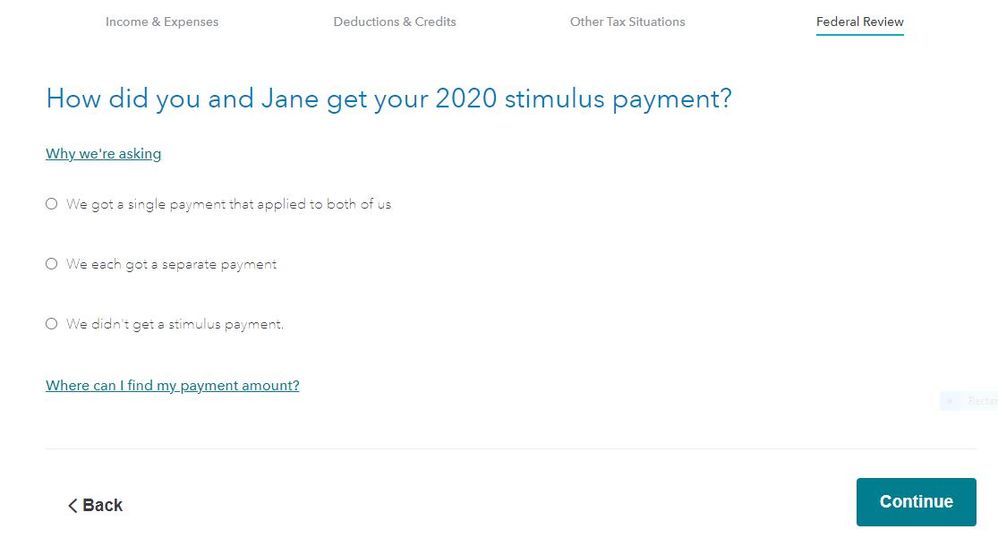

After you complete the Other Tax Situations section it will be on the following page requesting information the stimulus payment received in 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

Line 30 on form 1040 - you can back click it through a couple of worksheets until you come to an actual form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

I have the same issue!

I've tired different devices, browsers etc. I'm using Premier and the I am NOT prompted for the stimulus check.

HELP!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

@jamleach1 wrote:

I have the same issue!

I've tired different devices, browsers etc. I'm using Premier and the I am NOT prompted for the stimulus check.

HELP!

There are two reasons why you will not see the stimulus questions in the Federal Review section of the program.

1. You selected in the My Info section of the program that you are a dependent

2. Your 2020 AGI on the 2020 Federal tax return is higher than the phase out amounts for your filing status -

• $150,000 if married filing jointly or qualifying widow(er)

• $112,500 if head of household

• $75,000 if single or married filing separately

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

@DoninGA I believe your statement is inaccurate. My understanding is that the stimulus paymnets are based on 2019 returns NOT 2020. I have yet to encounter IRS documentation that runs counter to this. See below:

There are two reasons why you will not see the stimulus questions in the Federal Review section of the program.

1. You selected in the My Info section of the program that you are a dependent

2. Your 2019 AGI on the 2019 Federal tax return is higher than the phase out amounts for your filing status

A3. No, there is no provision in the law that would require individuals who qualify for a Payment based on their 2018 or 2019 tax returns, to pay back all or part of the payment, if based on the information reported on their 2020 tax returns, they no longer qualify for that amount or would qualify for a lesser amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

DoninGA is correct. When they sent out advance payments, they used information from your 2019 return. However, the recovery rebate is dependent upon your tax situation in 2020. The recovery rebate is a 2020 tax credit. To claim the credit in 2020 - -

Go to the search bar up top and type in stimulus (make sure you are all the way inside of your return or search does not function), hit enter and then use the Jump to stimulus link to be taken to the questions. You will enter 2 amounts. It is important that you enter the amount you received for the first payment in the 1st box and the amount you received for the 2nd payment in the 2nd box. Because the amounts paid out were different, if you transpose these 2 numbers, you may generate a recovery rebate that you are not qualified for or forego claiming one that you do qualify for. Anytime you need to get back to that section, searching stimulus is the way to do it. @jamleach1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

@DawnC thanks for the prompt reply.

Where are you sourcing this information? Can you share an IRS link? They seem to be the authority here. Or is there a section of the Recovery Bill you're referencing?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

TO GET TO THE STIMULUS SECTION OF TURBOTAX:

Go into your account and click "Tax Home"

On that screen click "Other Tax Situations"

When the drop-down opens, click "Let's Get Started" or "Review/Edit" to move forward

There may be a delay when opening to this next screen

Scroll to the bottom of this screen and click "Let's keep going"

The next screen should read "Let's make sure you got the right stimulus amount" (If not, click continue to move forward until you do get to that screen)

Scroll down and click "Continue"

The next screens will ask if you received the stimulus, which ones and how much.

The software will calculate a credit if applicable.

below is a link to IRS Question and Answers about the second stimulus and the recovery credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the stimulus rebate recovery in premier? I did not find it under the other tax situations. Is there a particular form I can pull up?

@jamleach1 The Recovery Rebate Credit on the 2020 federal tax return is based on the 2020 AGI.

IRS website for the Recovery Rebate Credit - https://www.irs.gov/newsroom/recovery-rebate-credit

Economic Impact Payments were based on your 2018 or 2019 tax year information. The Recovery Rebate Credit is similar except that the eligibility and the amount are based on 2020 information you include on your 2020 tax return.

The IRS Recovery Rebate Credit Worksheet used to calculate the Credit uses the 2020 AGI from Line 11 of the 2020 Form 1040.

IRS Form 1040 (2020) Instructions for the Recovery Rebate Credit Worksheet page 58 (Line 11 of the Worksheet) - https://www.irs.gov/pub/irs-pdf/i1040gi.pdf#page=58

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

turbosapper

Level 1

elliottulik

New Member

prettytwin32

New Member

kirkpatricklisa69

New Member

m-kominiarek

Level 1