- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Where do I find my magi?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

Your tax return does not display your MAGI, you will need to calculate it by first checking your AGI. To locate your AGI:

- With your return open, click My Account

- Then, Tools

- Under "Other Helpful Links", click View Tax Summary

- Your Adjusted gross income should be third on the list

Next, to calculate your modified adjusted gross income (MAGI), take your AGI and add back certain deductions. Many of these deductions are rare, so it's possible your AGI and MAGI can be identical. According to the IRS, your MAGI is your AGI with the addition of the following deductions, if applicable:

- Student loan interest

- One-half of self-employment tax

- Passive loss or passive income

- IRA contributions, taxable social security payments

- The exclusion for income from U.S. savings bonds

- The exclusion under 137 for adoption expenses

- Rental losses

- Any overall loss from a publicly traded partnership

Read more here: https://turbotax.intuit.com/tax-tools/tax-tips/IRS-Tax-Return/What-Is-the-Difference-Between-AG...

Also, you may enter an amount of Roth contribution as if you contributed, and TurboTax will let you know if your MAGI is too much, then will list your MAGI. To visit this section and determine your financial eligibility to contribute to a Roth, follow the steps below:

- Click the Federal Taxes tab

- Then, Deductions & Credits

- Scroll down to the "Retirement and Investments" section.

- Next to "Traditional and Roth IRA Contributions", click Start or Revisit

- Check the box for Roth IRA on the next screen and click Continue

- Follow the interview screens. You will come to the final screen that will tell you if you qualify and will list your MAGI if you don't

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

Your tax return does not display your MAGI, you will need to calculate it by first checking your AGI. To locate your AGI:

- With your return open, click My Account

- Then, Tools

- Under "Other Helpful Links", click View Tax Summary

- Your Adjusted gross income should be third on the list

Next, to calculate your modified adjusted gross income (MAGI), take your AGI and add back certain deductions. Many of these deductions are rare, so it's possible your AGI and MAGI can be identical. According to the IRS, your MAGI is your AGI with the addition of the following deductions, if applicable:

- Student loan interest

- One-half of self-employment tax

- Passive loss or passive income

- IRA contributions, taxable social security payments

- The exclusion for income from U.S. savings bonds

- The exclusion under 137 for adoption expenses

- Rental losses

- Any overall loss from a publicly traded partnership

Read more here: https://turbotax.intuit.com/tax-tools/tax-tips/IRS-Tax-Return/What-Is-the-Difference-Between-AG...

Also, you may enter an amount of Roth contribution as if you contributed, and TurboTax will let you know if your MAGI is too much, then will list your MAGI. To visit this section and determine your financial eligibility to contribute to a Roth, follow the steps below:

- Click the Federal Taxes tab

- Then, Deductions & Credits

- Scroll down to the "Retirement and Investments" section.

- Next to "Traditional and Roth IRA Contributions", click Start or Revisit

- Check the box for Roth IRA on the next screen and click Continue

- Follow the interview screens. You will come to the final screen that will tell you if you qualify and will list your MAGI if you don't

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

I was surprised that TT didn't provide a spot to view this value.. Paraphrased the following from the IRS instructions for Form 8962:

Worksheet 1-1. Taxpayer's Modified AGI—Line 2a

1. Start with your adjusted gross income (AGI)* from Form 1040 or 1040-SR, line 8b, and Form 1040-NR, line 35

2. Add any tax-exempt interest from Form 1040 or 1040-SR, line 2a, or Form 1040-NR, line 9

3. Add any amounts from Form 2555, lines 45 and 50

4. Form 1040 or 1040-SR filers: If line 5a is more than line 5b, subtract line 5b from line 5a and add the result 5. Total is MAGI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

Please review this Turbo Tax link as it accurately explains the difference between AGI and MAGI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

It seems ludicrous that MAGI is not easily viewable from Turbo Tax. Pretty disappointing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

How do you check this once you have filed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

Your modified adjusted gross income is different in different situations. Your adjusted gross income is a constant and is always the starting point. You may need to modify your adjusted gross income for a credit or alternative minimum tax or a number of different scenarios and each scenario modifies your AGI differently. So to ask for your MAGI is not a straight forward answer. For what purpose are you modifying your AGI? Then you can determine how you modify your AGI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

The MAGI used to determine IRA limits (e.g. the MAGI used to determine if you can deduct a Traditional IRA contribution or if you can contribute to a Roth) are addressed by Turbo Tax "Tax Tips"; but not the MAGI used for other purposes like Net Investment Income Tax. The MAGI for Net Investment Income Tax is quite different and is defined on the top of page 19 in IRS Form 8960 instructions. Also the MAGI on healthcare.gov web site is different. On healthcare.gov, the MAGI for the health care marketplace adds back in tax exempt interest; but for IRAs, apparently tax exempt interest doesn't need to be included, unless it is "excludable qualified savings bond interest from Form 8815." This is important to me as we have tax exempt interest from municipal bonds.

Other web sites, like Investopedia, add to the confusion. Investopedia's web site on MAGI says: "MAGI can be defined as your household’s adjusted gross income with any tax-exempt interest income and certain deductions added back." I think Investopedia is wrong (or misleading anyway) but I am concerned about this definition nonetheless. I plan to hold back a little on the amount to convert from a traditional IRA to a Roth, in case I am wrong about the tax exempt interest. I think it would be helpful if Turbo Tax tips could help explain the complexity. It is really not so simple though I suppose most people don't pay net investment income tax or have municipal bonds.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

The MAGI value is needed to determine Roth IRA contribution eligibility so it's important to get it right. So for the love of God Turbotax, can you please do this calculation and display it in the software so that your tens of thousands of users don't have to do this calculation BY HAND after buying your software??!?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

You can calculate it yourself by using the IRS worksheet 2-1 https://www.irs.gov/publications/p590a#en_US_2019_publink1000230985

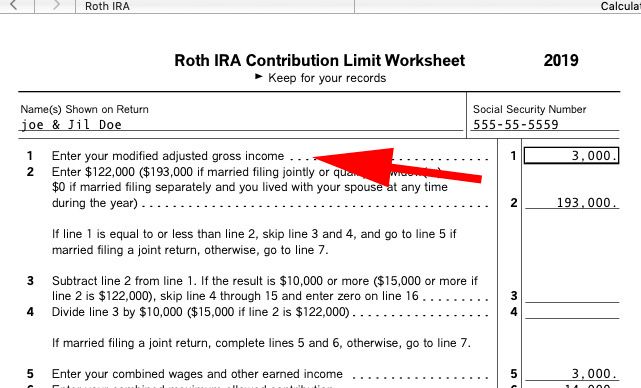

or after entering all income into TurboTax and entering a Roth contribution then the "Roth Contribution Limit Worksheet" line 1 will show the calculated MAGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

THanks so much for providing the workbook. I still don't understand why Turbortax can't calculate this value in the software since it has all our tax information. Does Taxcut, or other software, calculate the MAGI?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

Thank you for your post. It was not precisely what I was looking for, but it clued me in on exactly where I needed to look within TurboTax for the specific information I needed for my issue. I concur with others that TT could do better with the MAGI information. I also think TT woud do well to alert folks if they have put Excess Contributions into their IRA in a given year and will be paying a penalty. I'll get that suggestion to TT. Thanks for taking the time to help folks out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

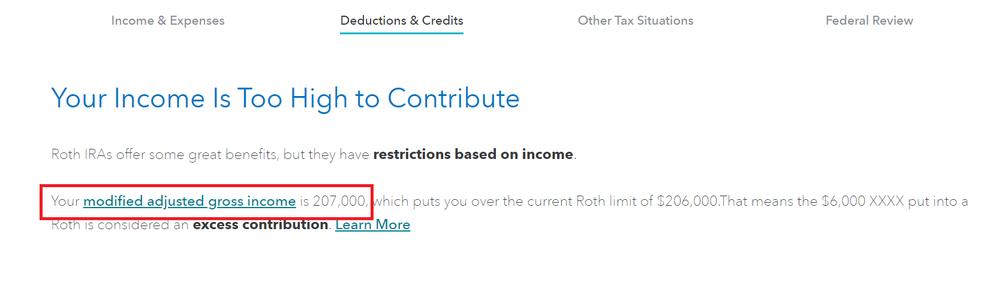

I'm able to find my MAGI only if I exceed the current limits to contribute to a Roth IRA. If you try to do a Roth contribution and you're over the contribution limit, you'll see a screen with your MAGI like this:

I know this won't trigger for everyone, but it's the only consistent way I've found to have TurboTax determine it for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

MAGI is used for more that IRAs. In my case, I want the information for for preventing Medicare excise tax. I want to do conversions from my IRA to Roth to keep our RMD value down. Right now it isn't critical because of the joint filing values. But when one of us dies that benefit goes away. It seems like no money planner takes that into consideration. TT has all the information now so why not show it. If there is more than one MAGI then show them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my magi?

MAGI is defined is several ways in the tax law depending on what it is used for.

The Medicare calculations do not go on a tax return so there are no IRS forms for it on a tax return. TurboTax files a tax return and nothing else.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

iannolillo

Level 1

bluepalm

New Member

jenhowze

New Member

dstautz1

Returning Member

mel_free

New Member