- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- When printing my tax return stuff from here it prints 112 pages and the IRS doesn't want all does papers, Which papers are the exact ones to send to them?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When printing my tax return stuff from here it prints 112 pages and the IRS doesn't want all does papers, Which papers are the exact ones to send to them?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When printing my tax return stuff from here it prints 112 pages and the IRS doesn't want all does papers, Which papers are the exact ones to send to them?

@madera-deborah - any reason you can't efile? Efile will probably take 3-4 weeks to process at the IRS. a paper submission is going to take 6-9 MONTHS, given the IRS backlogs....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When printing my tax return stuff from here it prints 112 pages and the IRS doesn't want all does papers, Which papers are the exact ones to send to them?

I attempted to but the IRS Keeps denying my 2020 return because of my 2019 AGI and for some reason turbo tax isn't letting me efile my 2020 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When printing my tax return stuff from here it prints 112 pages and the IRS doesn't want all does papers, Which papers are the exact ones to send to them?

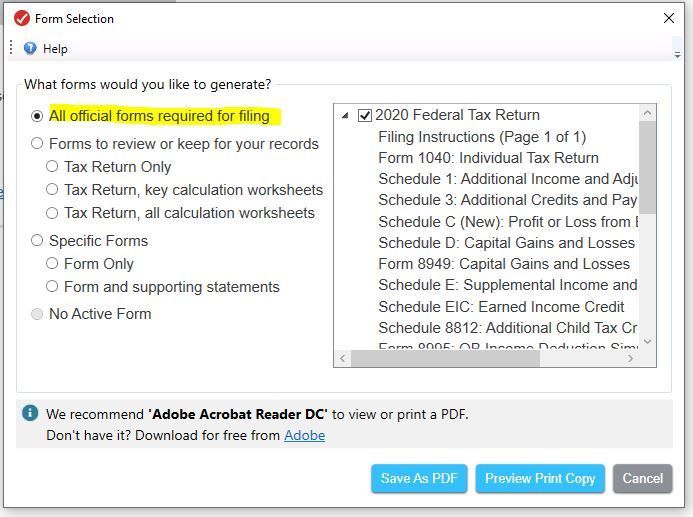

there should have been an option to print for filing which would only print those pages required and the filing instructions. if you can't or don't want to reprint. the forms and schedules that need to be filed are pages 1 and 2 of the 1040 and all other forms and schedules with an attachment sequence number in the upper right. keep them in that order.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When printing my tax return stuff from here it prints 112 pages and the IRS doesn't want all does papers, Which papers are the exact ones to send to them?

2020? E-filing for 2020 returns has been permanently closed since mid-October of 2021. The ONLY way to file a 2020 return is by mail. If you chose to print for mailing it will print out with just the pages you need to mail to the IRS. The IRS does not want 112 pages! If you are working on a 2020 return you must be using the desktop software since you can no longer use online to prepare a 2020 return. Choose that you will file by mail and it will print the pages you need.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

And....expect it to take six months or more before it has been processed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When printing my tax return stuff from here it prints 112 pages and the IRS doesn't want all does papers, Which papers are the exact ones to send to them?

When using the downloaded program ... click on the PRINT CENTER and choose the file only forms ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When printing my tax return stuff from here it prints 112 pages and the IRS doesn't want all does papers, Which papers are the exact ones to send to them?

The tag below your question says that you are using TurboTax Online. You can't use TurboTax Online for a 2020 tax return. TurboTax Online is only for 2021. If you entered your 2020 information into TurboTax Online, do not file it. To file for 2020 you have to use the CD/Download TurboTax software for 2020.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thompsonangel539

New Member

walkerkelis

New Member

KarenL

Employee Tax Expert

lorettavanheel4

New Member

harris1324

New Member