- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

TurboTax only gives the general IRS (most returns are processed withing 21 days) date. The actual date is known only by the IRS. TurboTax also does not adjust the general date for anything on the tax return. TurboTax receives no feedback from the IRS after filing.

The IRS says most refunds will be issued within 21 days - some faster, some longer.

Each tax return is evaluated on it's own merits. There is no first-in-first-out. Two similar tax return submitted at the same time can have totally different processing times based on IRS criteria for examining tax returns that the IRS does not divulge.

Some returns will be held for ID verification or other verification. The IRS will send a letter if they require more information to process your tax return.

The 2015 PATH ACT passed by Congress mandated that tax refunds be held if the tax return claimed the Earned Income Credit or Additional Child Tax Credit in order to allow the IRS time to match wage statements (W-2's and 1099's) against the claimed income to combat fraudulent tax returns claiming income that did not exist and receive refunds before the IRS could process the wage statements.

Beginning in 2016, if you claim the EITC or ACTC on your tax return, the IRS must hold your refund until mid February This new law (PATH Act) requires the IRS to hold the entire refund.

Those refunds are usually released late February.

https://www.irs.gov/individuals/refund-timing

Check your refund stratus here:

https://www.irs.gov/refunds

Check your state refund here:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

The same thing happened to me and when i check the irs track my refund it says "we have received your tax return and it is being processed." I was supposed to receive my Federal tax refund yesterday but it was a holiday i was really hoping to receive it after midnight its now 11:52am and still nothing and i picked Direct deposit with the TurboTax card.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

Did you call anyone if so what did they say?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

Did you receive your anything yet? My turbo tax estimate arrival said Feb 17,2020 but nothing .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

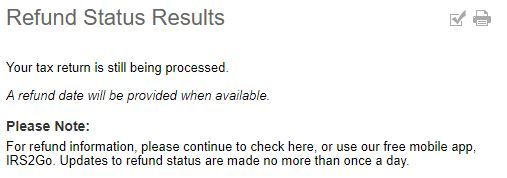

I was supposed to receive mine on 2/17, but got nothing. Last year it took 25 calendar days, so that would mean tomorrow. The wheres my refund link used to give me a progress bar, not it just says it is still being processed. I called and it gave me the same answer with no chance to talk to a human. This is ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

Where do you find out when you get your refund at? Please and thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

@Net84 wrote:

Where do you find out when you get your refund at? Please and thank you

The dates supplied by TurboTax are only estimates.

The IRS target is 21 days from the tax return being Accepted to issue a tax refund. It is NOT a Guarantee

Only the IRS and your State control when and if a Federal or State tax refund is Approved and Issued.

Once a tax return has been Accepted by the IRS or a State, TurboTax receives no further information concerning the tax return or the status of any tax refund.

If accepted by the IRS use the federal tax refund website to check the refund status - https://www.irs.gov/refunds

If accepted by the state use this TurboTax support FAQ to check the state tax refund status - https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

After the tax return has been Accepted by the IRS (meaning only that they received the return) it will be in the Processing mode until the tax refund has been Approved and then an Issue Date will be available on the IRS website.

See this IRS website for federal tax refund FAQ's - https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

Mine says 2/17/20 too but nothing 😑

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

same here since 01/27 accepted. just checked now still processing ! please let me know if you have any update and vice versa.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

I read on the IRS website today that refunds claiming EIC or ACTC will begin processing on February 17, with refunds expected by the first week of March. It says that refund dates will be updated on the "Where's My Refund" page or app on Feb. 22.

I'm in the same boat - TurboTax said estimated direct deposit date was Feb. 17, but it was a holiday, so I figured Feb. 18. I filed with them every year and it's always been accurate, so I trusted it this year. Now I'm in a big financial pinch because I relied on it being correct, even though TurboTax gives no guarantee. Big bummer.

Anyone know what time of day the IRS releases refunds, or is it any time?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

I agree, it is ridiculous. Last year I got my refund exactly when they said I would get it. All my info is basically the same, but I am starting to worry that the IRS has found something wrong. I do, however feel better that everyone here is claiming the same issue. Maybe there is a glitch with the IRS and it's not us. Fingers crossed. I also read somewhere that the IRS only does direct deposits on Thursday nights.... IDK. Mostly, the only answers we get is "wait". This is a true test of patience.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

I had to mail in my return as the AGI for my spouse was not ever correct that I entered and it got rejected so many times I had to mail it in. I just saw on IRS where's my refund site that it had gotten accepted a few days ago and approved today and refund should be received by Feb 24th. I hope this is accurate as I have the Earned Income Credit on my return. But it did take awhile for them to show they even received the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax told me was supposed to receive my refund 2-17-2020. And since it was a holiday I would get it between 12 and 6 am 2-18-2020 and still nothing.

I spoke with someone yesterday at the IRS. If you are a PATH client They did not start the direct deposit processing up until the 18th of this month. They were supposed to start on the 15th of this month but it landed on a weekend following Monday being a holiday. If you dont know there was an update today! Hope this helps anyone in need right now cuz we are all broke lol😂

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hickmond38

New Member

az148

Level 3

reneesmith1969

New Member

lmunoz101923

New Member

Lydia5181

New Member