- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- The CTC is automatically entered on the return by the pro...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

You do not select the Child Tax credit (CTC). If you are entitled to it, TurboTax (TT) will automatically give it to you. So, why do you think you need to file an amended return to claim the CTC?

Retroactive claims are no longer allowed for earned income credit (EIC), child tax credit (CTC) or American Opportunity Tax Credit (AOC) for any taxable year for which the taxpayer has a taxpayer identification number that has been issued after the due date for filing the return for such taxable year. That is, a taxpayer who files a return with an ITIN and later receives a SSN may not amend prior year return to claim EIC or amend a prior year return to claim CTC or AOC for a dependent who later received an ITIN or SSN.

http://taxprep4free.org/OSHC/Tax%20Training/Policy_Tax%20Law/Recent_Changes_to_TY15_Tax_Law_v2.pdf http://www.thetaxadviser.com/newsletters/2016/jan/congress-makes-changes-to-popular-tax-credits.html

______________________________________________________________________________________

There are 6 possible reasons; you aren’t getting the Child Tax credit (CTC):

1. You’ve entered something wrong. In the personal Info section, for the dependent, you must select answers that indicate that he/she is your dependent child. If the child was born during the year, say he/she lived with you all year (note: TurboTax changed how this section is done two years ago, you may need to go thru the interview again or even delete your dependent and start over). If the child was born in 2016, you have to answer that he lived with you all year.

2. Your child may be too old (over 16). This comes as a big surprise to many parents the year their child turns 17. A child over age 16 no longer qualifies for the Child Tax credit (CTC). Although a child can still be a student dependent through age 23, and a qualifying child for EIC, the Child Tax Credit expires the year they turn 17 and you no longer get the $1000 CTC.

3. Your income is too high. The Child Tax Credit (CTC) is phased out at higher incomes starting at $110,000 for joint filers ($75K single). You lose $50 for each $1000 (rounding up) your income is over that threshold.

4. Your income is too low. The child tax credit (CTC) is also limited to your tax liability. The CTC is a non-refundable credit and can only reduce your income tax to 0, It can not help you beyond eliminating your tax liability. But, if you have more than $3000 of earned income, some or all of it is usually given back to you thru the "Additional Child tax credit". That is, part of the CTC may be on line 43 of form 1040A instead of line 35 (lines 67 & 52 of form 1040). In the on-line version of TT, the main Form 1040, 1040A or 1040EZ can be seen through Tools, View Tax Summary, Preview My 1040 or go to Print Center and then choose to Preview. The ACTC is calculated on form 8812; that form is not viewable in the online version of TT until you have paid for your return. But, the ACTC is basically 15% of your earned income over $3000.

5. You are the custodial parent and the non-custodial parent is claiming the dependent this year. The CTC goes with the dependency, even though the custodial parent still gets the Earned Income Credit, Dependent care credit and Head of Household.

6. Another possibility is that part of your tax due is not regular income tax, but is self-employment, early distribution penalty or another type of additional tax, for which the CTC cannot be used.

To get a 'second opinion' on-line direct from IRS, try https://www.irs.gov/uac/is-my-child-a-qualifying-child-for-the-child-tax-credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

Why do you think you didn't get the CTC or the ACTC ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

• Form 1040 - Line 52, or if you had zero tax liability, look at Line 67

• Form 1040A - Line 35, or if you had zero tax liability, look at Line 35

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

You do not select the Child Tax credit (CTC). If you are entitled to it, TurboTax (TT) will automatically give it to you. So, why do you think you need to file an amended return to claim the CTC?

Retroactive claims are no longer allowed for earned income credit (EIC), child tax credit (CTC) or American Opportunity Tax Credit (AOC) for any taxable year for which the taxpayer has a taxpayer identification number that has been issued after the due date for filing the return for such taxable year. That is, a taxpayer who files a return with an ITIN and later receives a SSN may not amend prior year return to claim EIC or amend a prior year return to claim CTC or AOC for a dependent who later received an ITIN or SSN.

http://taxprep4free.org/OSHC/Tax%20Training/Policy_Tax%20Law/Recent_Changes_to_TY15_Tax_Law_v2.pdf http://www.thetaxadviser.com/newsletters/2016/jan/congress-makes-changes-to-popular-tax-credits.html

______________________________________________________________________________________

There are 6 possible reasons; you aren’t getting the Child Tax credit (CTC):

1. You’ve entered something wrong. In the personal Info section, for the dependent, you must select answers that indicate that he/she is your dependent child. If the child was born during the year, say he/she lived with you all year (note: TurboTax changed how this section is done two years ago, you may need to go thru the interview again or even delete your dependent and start over). If the child was born in 2016, you have to answer that he lived with you all year.

2. Your child may be too old (over 16). This comes as a big surprise to many parents the year their child turns 17. A child over age 16 no longer qualifies for the Child Tax credit (CTC). Although a child can still be a student dependent through age 23, and a qualifying child for EIC, the Child Tax Credit expires the year they turn 17 and you no longer get the $1000 CTC.

3. Your income is too high. The Child Tax Credit (CTC) is phased out at higher incomes starting at $110,000 for joint filers ($75K single). You lose $50 for each $1000 (rounding up) your income is over that threshold.

4. Your income is too low. The child tax credit (CTC) is also limited to your tax liability. The CTC is a non-refundable credit and can only reduce your income tax to 0, It can not help you beyond eliminating your tax liability. But, if you have more than $3000 of earned income, some or all of it is usually given back to you thru the "Additional Child tax credit". That is, part of the CTC may be on line 43 of form 1040A instead of line 35 (lines 67 & 52 of form 1040). In the on-line version of TT, the main Form 1040, 1040A or 1040EZ can be seen through Tools, View Tax Summary, Preview My 1040 or go to Print Center and then choose to Preview. The ACTC is calculated on form 8812; that form is not viewable in the online version of TT until you have paid for your return. But, the ACTC is basically 15% of your earned income over $3000.

5. You are the custodial parent and the non-custodial parent is claiming the dependent this year. The CTC goes with the dependency, even though the custodial parent still gets the Earned Income Credit, Dependent care credit and Head of Household.

6. Another possibility is that part of your tax due is not regular income tax, but is self-employment, early distribution penalty or another type of additional tax, for which the CTC cannot be used.

To get a 'second opinion' on-line direct from IRS, try https://www.irs.gov/uac/is-my-child-a-qualifying-child-for-the-child-tax-credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

Looks like a BUG in TurboTax software with respect to 2018 tax year filing...At the time of my 2018 tax year filing the ITIN was active and I have used ITIN for many years. I became permanent resident in 2015 and continued using only ITIN for tax filing years 2016, 2017.... Later due to TCJA in 2018 looks like taxpayer should claim CTC only using SSN...turbo tax hasn’t given any hint or message that claiming with ITIN was disallowed for CTC in 2018 and tax payers are supposed to use SSN.

Due to this I lost getting my refund from IRS and also paid about 525 back to IRS!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

Sorry but this is your error alone ... once a SS# is issued you MUST stop using the ITIN for everything ... your failure to properly use the SS# as directed in the paperwork you must have gotten when the number was issued to replace the ITIN means you lost the credit not the TT program. It is not the program's job to police what number you enter in the program since it is a DIY situation ... it is your responsibility to use the correct number that was issued.

Per the IRS :

What do I do when I am assigned a social security number (SSN)?

Once you receive a SSN, you must use that number for tax purposes and discontinue using your ITIN. It is improper to use both the ITIN and the SSN assigned to the same person to file tax returns.

It is your responsibility to notify the IRS so we can combine all of your tax records under one identification number. If you do not notify the IRS when you are assigned a SSN, you may not receive credit for all wages paid and taxes withheld which could reduce the amount of any refund due. You can visit a local IRS office or write a letter explaining that you have now been assigned a SSN and want your tax records combined. Include your complete name, mailing address, and ITIN along with a copy of your social security card and a copy of the CP 565, Notice of ITIN Assignment, if available. The IRS will void the ITIN and associate all prior tax information filed under the ITIN with the SSN. Send your letter to:

Internal Revenue Service

Austin, TX 73301 - 0057

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

Sorry ... I just re read your post ... the 2018 program would not allow the CTC on an ITIN once the program was updated to include the new rule. If you filed early, before the change was made, there was the possibility the return was done incorrectly. You may have a claim using one of the guarantees ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

I sued TT and the software did not give the the tax credit. What went wrong with the software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

@kpehe5 wrote:

I sued TT and the software did not give the the tax credit. What went wrong with the software?

Did you READ the answer at the top of this thread?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

What about the Child Tax Credit for 2021? If I filed but didn't check the box, can I amend my return? And if so, how do I do it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

The new (expanded) Child tax credit ($3000; $3600 for kids under 6) is effective for 2021. There is a provision for advanced monthly payments being made in 2021. The payments will come from the IRS, similar to the stimulus payments.

Getting the expanded child tax credit has nothing to do with filing your 2020 tax return. Whether you already filed, file now or file later, the additional money will not be part of your 2020 tax refund. Nor will the $1400 third stimulus.

There will be monthly child tax credit payments going out beginning in JULY 2021, with some of the CTC still left as a refundable credit on your 2021 tax return next year.

use this IRS portal

https://www.irs.gov/credits-deductions/child-tax-credit-update-portal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I go back and get my child tax credit for my last year's tax return?

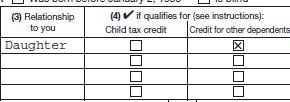

Thank you Critter-3. However when we go check on the IRS site to see if we're eligible for the Child Tax Credit we're told that if we didn't check the box next to our baby's name we're not eligible. As you can see the box isn't checked.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Puckett

New Member

ekwilson38

New Member

kspeterson13

New Member

sonjakud28

New Member

Lord_Tasho

Returning Member