- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Where is my amended refund?!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is my amended refund?!

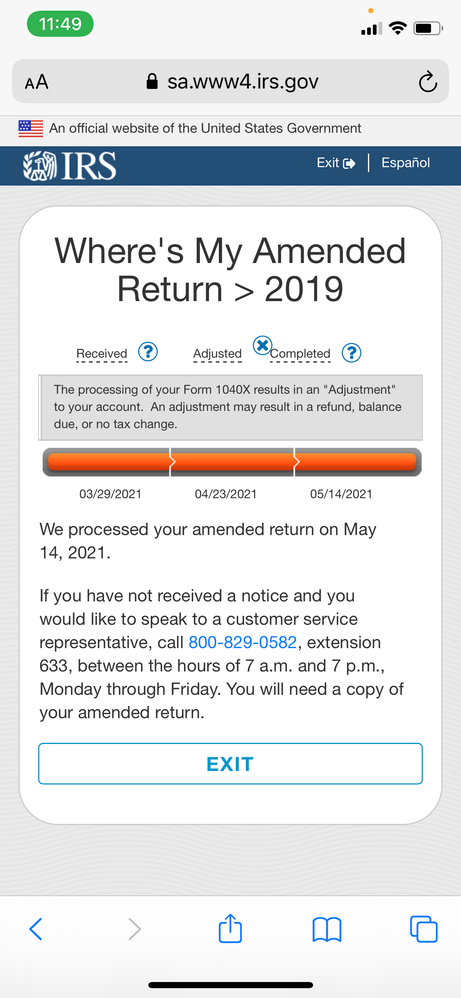

I filed my 2019 1040x Amended Return in March 2021. According to the IRS website my amended return has been received, adjusted, and completed. However, I have not received a return or "notice". I have called the customer service number over 10 times but I am never able to speak with anyone and it says there is no one available to take my call. Do I just keep waiting until I receive a notice in the mail? Is this normal? Help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is my amended refund?!

Try at 7am your time zone for better results ... and sadly this is normal as the IRS is very short staffed.

Amended return refunds are mailed to the address on the return so if you need to update the address mail in a form 8822 : https://www.irs.gov/forms-pubs/about-form-8822

And you can log in or set up an online account with the IRS to see all your account information including IRS notices ... https://www.irs.gov/payments/view-your-tax-account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is my amended refund?!

You simply need to wait.

I know several people, including a couple of former clients, who have not received refunds due from their timely filed 2019 returns (i.e., filed in Q1, 2020).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is my amended refund?!

Thanks for your help!

I'll keep waiting and calling.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dareyeg1

New Member

l-melisa-taylor

New Member

in Education

bertkesj

New Member

jvmorrow

New Member

prototype777

Level 2