- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Trouble filing please help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

I live in New York State I wanted to E-File but I can’t now I printed out the forums and I got my federal all set up and ready to be sent in but it says that I need to E-File my State taxes Because it was done electronically, it says I can E-File it if I go back to turbo tax but I go there and I see no options on TurboTax to do I literally looked everywhere can some one please help or how can I solve this problem

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

Ok ... to efile the fed AND state login then scroll down and click on ADD A STATE to access the account then complete the FILE tab until you click on the big orange TRANSMIT NOW button.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

Are you going to mail federal? If you mail federal you have to mail state, even N.Y. Ignore the warning that you have to efile N.Y.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

Would this also E-file my federal to? Or do I still need to send in mail

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

Well if I do send it by mail is there a penalty? And do I just need to send in my it-2s? Or all of the ITs? Like it-2, IT-201and IT-215

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

If you efile there is nothing to mail in. That's one of the big benefits with Efiling.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

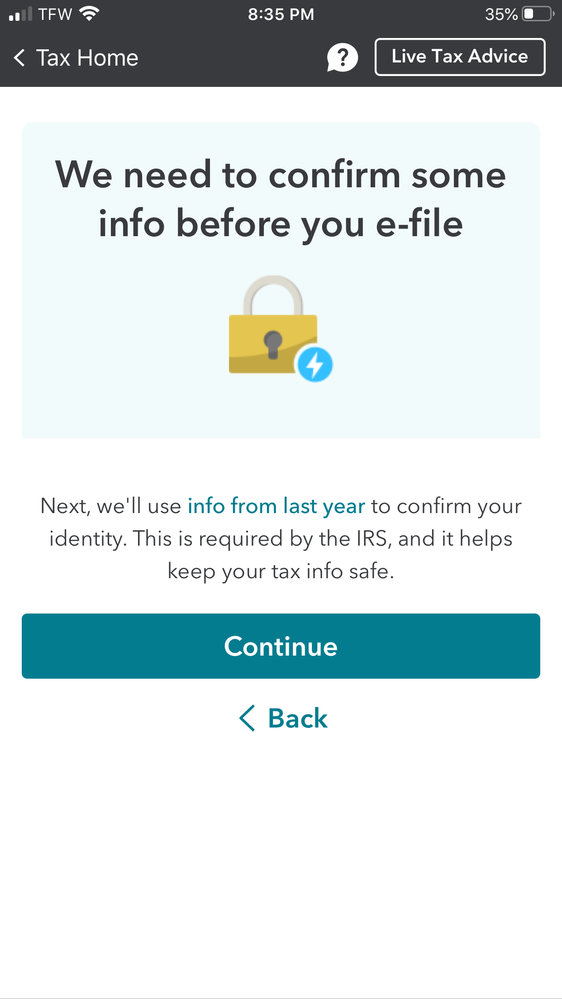

Yeah but it asks me information about my 2018 w2s witch I don’t know if I have

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

Wait a minute ... are you completing the 2018 return using the downloaded program ??? If to BOTH the fed & state MUST be mailed in and you must attach the W-2 forms plus any other form that has withholding on it. If you do not have the required papers then get another copy from the employer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

No I’m doing the 2019 forums but when I e-file it’s asking me information from my w2s from 2018

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

You need your 2018 AGI to efile 2019. The AGI is on 2018 1040 line 7. If you filed a Joint return you use the same AGI for each spouse.

How to find the AGI.

https://ttlc.intuit.com/community/agi/help/how-do-i-find-last-year-s-agi/01/25947

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trouble filing please help

Well now we got down to the brass tacks ... the AGI from the 2018 return is not always the total of the wages on a W-2.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alanahatch06

New Member

bhens02

New Member

marc.kaplan

New Member

Hkyounger

New Member

schuett-mk

New Member