- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: S-corp taxes owed on form 1120s

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-corp taxes owed on form 1120s

I filed my 2020 taxes with turbotax business for my S-corp and turbotax premier for personal. I received a letter from the IRS stating that I have taxes due on my form 1120s. If an S-corp is a pass through entity and the company doesn't pay any taxes, how can I have a tax due on an 1120s? Has anyone experienced this before?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-corp taxes owed on form 1120s

Read the notice again ... does it say a late filing penalty and not income taxes ? If so when did you file the 1120-S?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-corp taxes owed on form 1120s

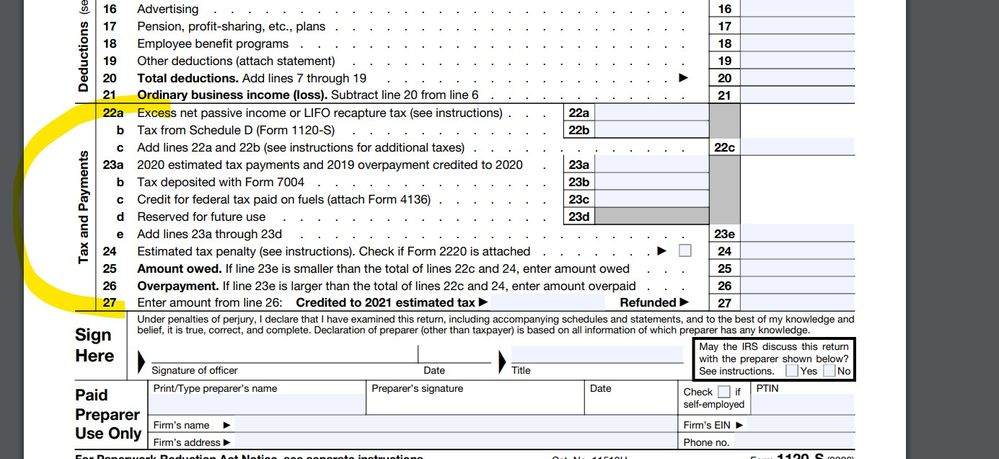

And although the income is usually passed thru on a K-1 form it is not unheard of for the 1120-S to have a balance due for itself ... review your 1120-S form :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-corp taxes owed on form 1120s

I filed on March 7th and lines 22 through 27 are blank on my 1120s. The letter states "We are required to send you this notice informing you of the amount of taxes due on for your Form 1120s for the tax period ending December 21, 2019" It states to call the IRS with questions, but every time I do that it says they're busy and to try again tomorrow.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-corp taxes owed on form 1120s

we are hamstrung because we can't see the notice. if you could post the details, except for any info identifying the corp, that would help. if the corporation is on a fiscal year did it file form 8752, a tax would be computed but it's not reported on the 1120S. did you convert your C-Corporation to an S-Corporation? It might owe the B(uilt)I(n)G(ains) T(ax).

in 1986 Congress enacted the built-in gains tax (see Internal Revenue Code § 1374). In general, the built-in gains tax is a special tax imposed on an S corporation that was previously a C corporation. The tax applies with respect to appreciated assets that the corporation owns on the date it converts to an S corporation and sells within a prescribed number of years after the conversion. The built-in gains tax also applies to profit attributable to any assets received by an S corporation from a C corporation in certain nontaxable transactions. The built-in gains tax is imposed at the highest corporate rate, currently 35%. was the

there could be a passive income tax or LIFO recapture tax

These taxes can apply if the corporation was previously a C corporation or if the corporation engaged in a tax-free reorganization with a C corporation.

Excess net passive income tax. If the corporation has AE&P at the close of its tax year and has passive investment income for the tax year that is in excess of 25% of gross receipts, the corporation must figure its excess net passive income and pay tax on it. To make this determination, complete lines 1 through 3

and line 9 of the Excess Net Passive Income Tax Worksheet for Line 22a. If line 2 is greater than line 3 and the

corporation has taxable income (see the instructions for line 9 of the worksheet), it must pay the tax. Complete a separate statement using the format of lines 1 through 11 of the worksheet to figure the

tax. Enter the tax on line 22a, page 1,Form 1120-S, and attach the computation statement to Form 1120-S.

Reduce each item of passive investment income passed through to shareholders by its portion of any excess

net passive income tax reported on line 22a. See section 1366(f)(3).

LIFO recapture tax. The corporation may be liable for the additional tax due to LIFO recapture under Regulations section 1.1363-2 if:

• The corporation used the LIFO inventory pricing method for its last tax year as a C corporation, or

• A C corporation transferred LIFO inventory to the corporation in a nonrecognition transaction in which those assets were transferred basis property. The additional tax due to LIFO recapture is figured for the corporation's last tax year as a C corporation or for the tax year of the transfer, whichever applies.

See the Instructions for Form 1120 to figure the tax. The tax is paid in four equal installments. The C corporation must pay the first installment by the due date (not including extensions) of Form 1120 for the

corporation's last tax year as a C corporation or for the tax year of the transfer, whichever applies. The S

corporation must pay each of the remaining installments by the due date (not including extensions) of Form 1120-S for the 3 succeeding tax years. Include this year's installment in the total amount to be entered on line 22a. To the left of the total on line 22a, enter the installment amount and “LIFO tax.”

there are a couple of other reasons why an S-Corp would owe the IRS see instructions for page 1 lines 22b,c

other than above the corp could owe penalties and interest if it didn't timely file payroll tax returns or made payroll tax payments late.

other possibilities include the IRS computers being wacko or you answering a question incorrectly to make the IRS computers think it owes taxes when it doesn't. we can not see the return you filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-corp taxes owed on form 1120s

Make sure you are reviewing your 2019 tax return that was filed a year and a half ago, since that’s the tax return referenced in the letter. Your 2020 tax return filed this March is not the issue.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CULLERE4

New Member

robglobal

New Member

ew19

New Member

rbeladia

New Member

FierceFabrication

New Member