- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Only amending state

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

Hi all,

I have to amend my MD state taxes for the Unemployment credit, but I was told not to amend my federal. Every time I try to just amend my MD taxes, it automatically sets up to file NY (other state I received income from) and federal.

I am willing to pay someone to do this for me. I am sick of trying to figure out what to do

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

First you will need to "Cancel the amendment". Do that using the "Amend" option. Be sure that everything goes back to the state before you began amending.

Then sign out and sign back in and this time instead of selecting the "Amend" option when signing in to your account, select the "Add a state" option. This will allow you to make changes to your returns without amending the federal return.

Once you are back in your return for editing you should first check that all the amendments are deleted. You can use the "Delete a form" option.

Click "Tax Tools" in the left hand menu

Click "Tools"

Click "Delete a Form"

Find the 1040X and any state amendment forms

"Delete"

"Confirm Deletion"

Click "Back" to get back to the step by step

In the "Wages and Income" tab revisit the "unemployment 1099G" topic by adding in the amount that was excluded in box 1 so that the original taxable amount is correct.

Next go to your MD state interview and click through to the page asking if you want to amend your MD return. Select "Yes" and follow the prompts to start the amend process for the MD return. Part of the amendment interview will be to go back to the federal "unemployment" topic and exclude the income you added back in for box 1.

Continue to follow the prompts to finish the MD amendment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

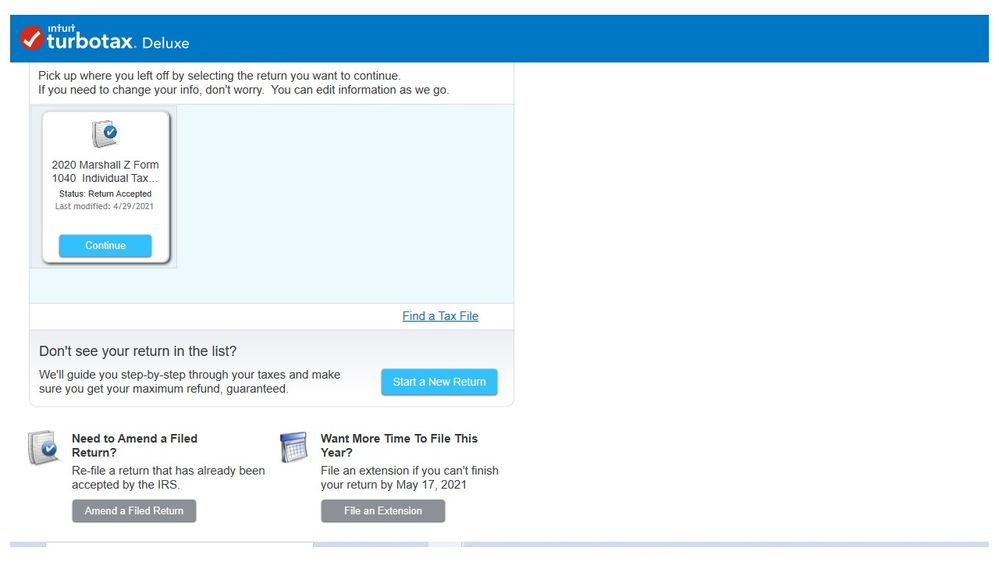

However, when I reopen TurboTax, there is no option to "add a state" in the opening page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

Great. It appears you are using a desktop version. You will not need or see an "Add a state" option. You can simply go into your return now and make the edits. Just don't click the "Amend" option.

As mentioned before start in the federal interview and be sure the interview reflects the same amount of taxable unemployment benefits as the original return. That means you will have to add 10,200 to what is actually shown in your 1099G box 1 to eliminate the exclusion amount.

Once that is updated then go to your MD state interview and click through to the "Other tax situations" page and scroll down to "Amend a previous MD return". "Start" and enter the requested information. Part of the process from there will be to go back to the federal interview and delete that extra 10,200 you added in. Continue following the prompts to complete the MD only amendment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

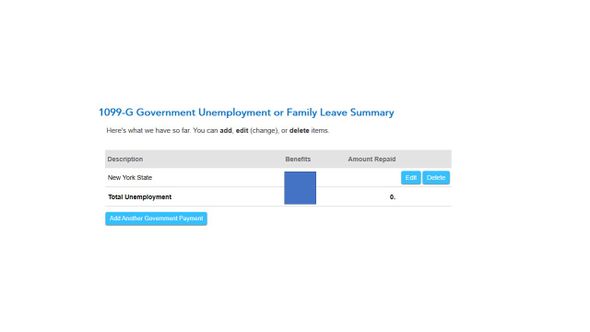

Ok, so I clicked on my 1099-G Federal Section. And this screen comes up:

Let's say my UI Benefits were $20,200. You're saying I would subtract $10,200 from here and put $10,000?

Thank you for your patience.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

It depends on where you are in the process. Remember before you enter the MD amendment option you need to get the 1099G to reflect all of your benefits are taxable. If your originally filed box 1 benefits (what is actually on your form) is 20,200 you need to make it read 30,400 so that the exclusion is eliminated.

Then go find the MD amendment option and during that process you will go back to the 1099G and delete that 10,200 that you added in making box 1 read 20,200 again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

The exclusion was already eliminated. The 20,200 is what I earned last year before taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

What has happened is TurboTax updates have excluded 10,200 from your taxable income. So ,if 20,200 is what is shown on your actual form 1099G then in your tax return 10,200 has been excluded by TurboTax updates. You need to add that back in to get to the original taxed amount. The way to do that is add 10,200 to your box 1 amount making it read 30,400.

Then, once you start the MD amendment you will go back and subtract that 10,200 back out of box 1 making it read as it actually should and allowing the correct exclusion amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

Well, I tried to follow the steps and this is what I got. Why am I paying money back when I am supposed to be getting a tax credit? I am at a loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

Can we do a screen share? I will pay you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

Get a clean slate by deleting any amendment forms. In the forms view delete Federal form 1040X, MD 502X, and the NY IT 201/203X.

Then go back and follow the steps outlined earlier to first get the Unemployment form to 30,400

After that go only to the MD amendment in the MD state interview.

During the MD state amendment interview you will then go back to the Unemployment interview to delete the extra 10,200 you added in the earlier step.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

I erased the MD 502X, and the NY IT 201/203X. There wasn't a 1040x

I added 10,200 to my unemployment income under Federal.

I then went to amend my MD taxes. Box 1 is not editable for me. It's in black ink and I can not edit it.

Something is off. I don't think the Turbo Tax worked for me. It might have gotten deleted.

I would really like to screen share and walk through this with you. I don't think this method of troubleshooting is going to work. I've done everything you've suggested multiple times.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

In this forum as you might surmise we cannot see your return. Here is a page to make contact with a live agent to screen share and step you through as needed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

Ok thanks. I did previously try this and the agent erroneously told me not to amend my Maryland return. Is it a tax specialist or customer service agent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Only amending state

Initial contact will be a customer service agent, but be sure your topic includes a tax topic to help get to a tax expert ultimately.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mlhanson11

New Member

sues1008

New Member

EFHUNTLEY

New Member

lmjb0916

New Member

pquarrier

New Member