- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I can't remember if I filed as dependent or independent. How can I find out?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't remember if I filed as dependent or independent. How can I find out?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't remember if I filed as dependent or independent. How can I find out?

If you have a Form 1040 or Form 1040-A as your main form, see if the box on line 6a is checked. If so, you are not filing as a dependent (i.e. you are claiming yourself). If it is not checked, you are filing as a dependent, and someone else can claim you.

If you have a Form 1040-EZ as your main form, see if the box on line 5 is checked. If so, you are filing as a dependent (i.e. not claiming yourself).

Your Form 1040 will be included in your 2016 tax return. Here's how you can download/print your tax return filed in TurboTax Online:

- Sign into your Turbo Tax online account.

- From the Welcome Back screen, select Visit My Tax Timeline

- From the list of Some Things You Can Do on your Tax Timeline, select Download /Print My Return (PDF

- Create the PDF of your tax return.Then open the PDF and scroll to your Form 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't remember if I filed as dependent or independent. How can I find out?

I don’t even have a line 6a? I think I filed as independent, but I didn’t get a stimulus check, so I’m checking to see.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't remember if I filed as dependent or independent. How can I find out?

Same for me I'm in the same boat

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't remember if I filed as dependent or independent. How can I find out?

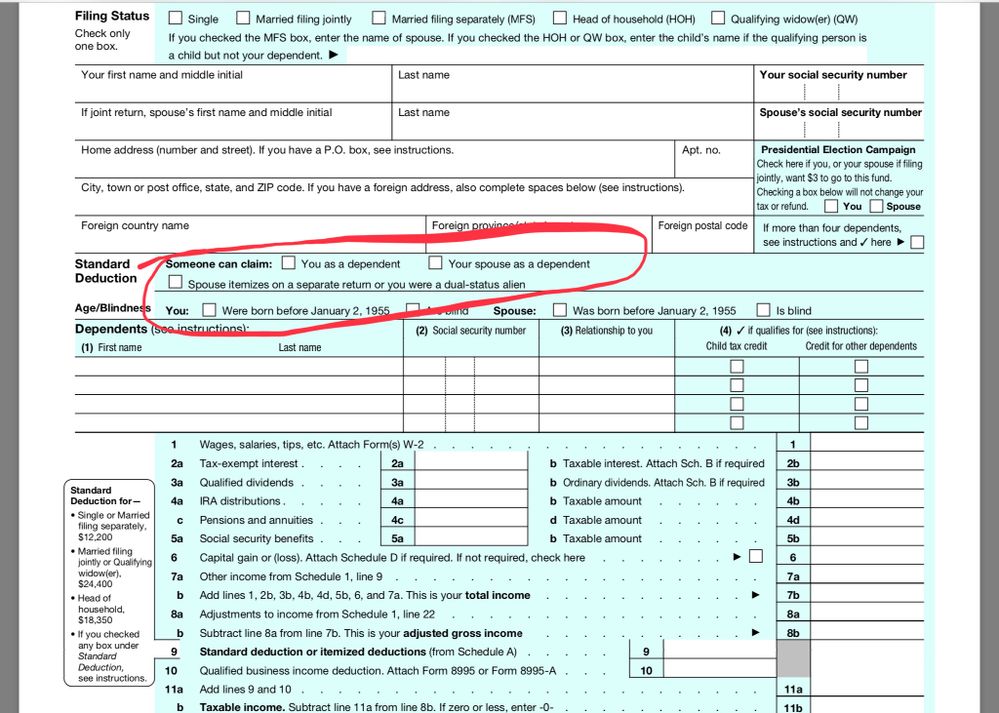

The question about whether you can be claimed as a dependent is on the Form 1040, directly under the Address section. It says: Someone can claim (box) You as a deduction. If the box is checked, you are a dependent. If it is unchecked you are not a dependent.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't remember if I filed as dependent or independent. How can I find out?

i have the same issue, did you ever figure it out?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't remember if I filed as dependent or independent. How can I find out?

For 2019 look at your 1040 page 1. If you are a dependent the box will be checked. If you are independent and claiming yourself the box is not checked.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lomurph

New Member

erinsiebenaler1

New Member

litzyrios13

Level 1

kbwhaley99

New Member

kanonical10

New Member