- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: How can I get my W-2 when my recent job is very unprofessional? On January 31st I reached out to my employer about getting it and he will not answer. Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get my W-2 when my recent job is very unprofessional? On January 31st I reached out to my employer about getting it and he will not answer. Any suggestions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get my W-2 when my recent job is very unprofessional? On January 31st I reached out to my employer about getting it and he will not answer. Any suggestions?

If you’re unable to get your Form W-2 from your employer, contact the Internal Revenue Service at 800-TAX-1040.

- The IRS will contact your employer or payer and request the missing form.

- Let them know: •

- your name, address, Social Security number and phone number; •

- your employer’s name, address and phone number; •

- the dates you worked for the employer; and •

- an estimate of your wages and federal income tax withheld in 2022.

- You can use your final pay stub to figure these amounts.

If, after contacting the IRS, you still do not have your Form W-2, you have two choices:

- File your return by the April due date and use Form 4852, Substitute for Form W-2, Wage and Tax Statement. Try to estimate your wages and withholding as best you can.

- Ask for more time to file by using Form 4868, Application for Automatic Extension of Time to File U.S Individual Income Tax Return. You can even e-file the request.

Also see: What To Do If You Haven't Received a W-2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get my W-2 when my recent job is very unprofessional? On January 31st I reached out to my employer about getting it and he will not answer. Any suggestions?

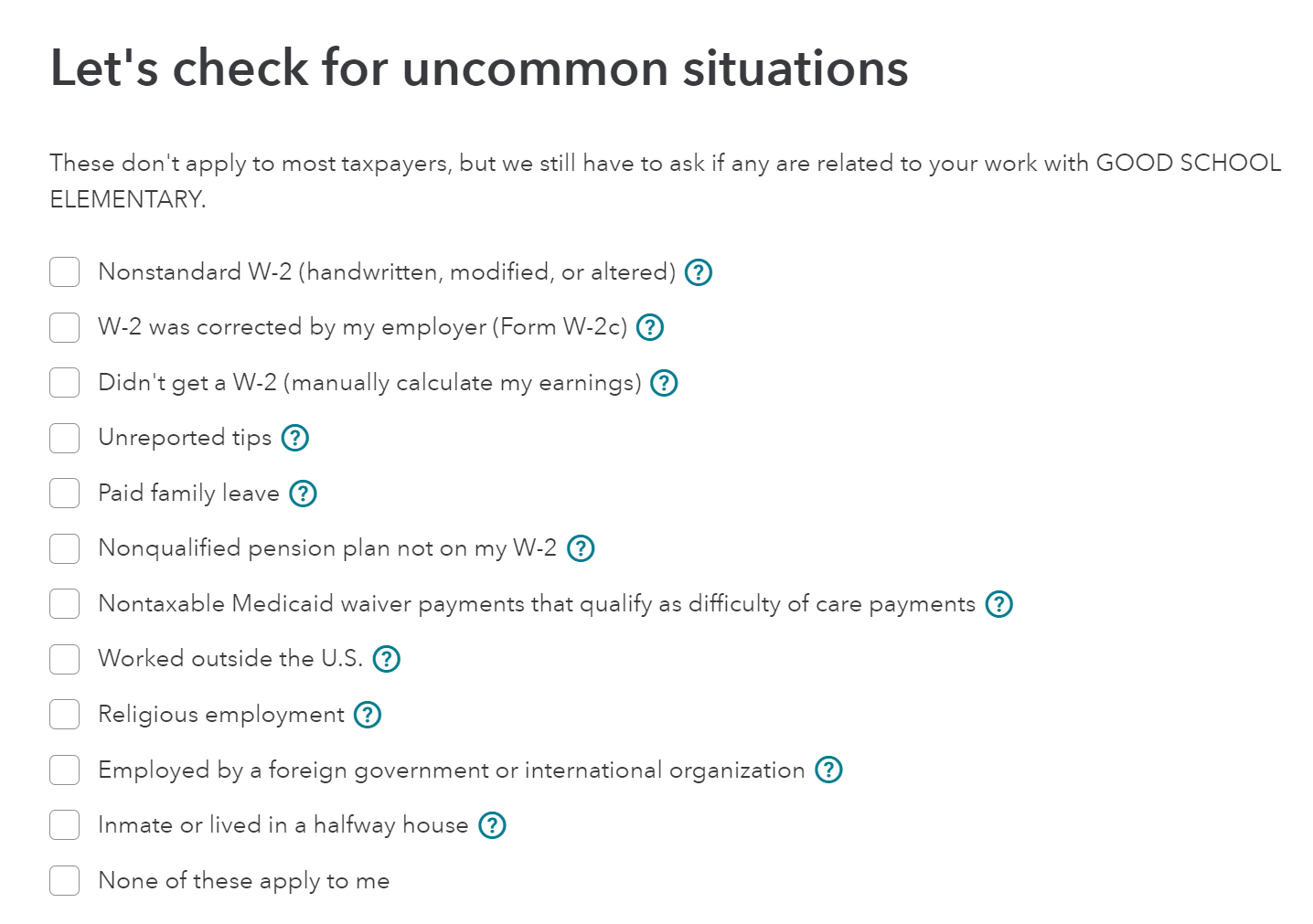

You can contact the IRS for assistance. If you have your last paystub from 2022, you may be able to get some of the infoprmation (like the withholding) so that you can prepare a 4852 in TurboTax. Look for the Uncommon Situations page (see below). See Topic No. 154 Form W-2 and Form 1099-R (What to Do if Incorrect or Not Received).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sfp1000

Level 1

bj-voorh

New Member

ishant89

New Member

Sk98

Level 2

bmhall84

Returning Member