- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Forgot to claim Frontline Worker Pay

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

Have you gone through the entire State interview? Somebody else has mentioned it asked a question about the Frontline Worker pay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

I figured it out. On Federal claim it as other 1099 miscellaneous and then on the state return "prepare state" write down the amount you claimed on federal. It worked. $487.45

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

If you received the frontline workers pay in MN, it gets reported on your federal return under Miscellaneous Income as if you received a 1099-misc. That will include the income on your federal return. Then when you get to that section on the MN state return, you can enter the same amount which will subtract it on the state return. It is taxable on your federal return but nontaxable on your state return. @distant55

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

Likely a really dumb question...

Where exactly do I find Miscellaneous Income in my federal return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

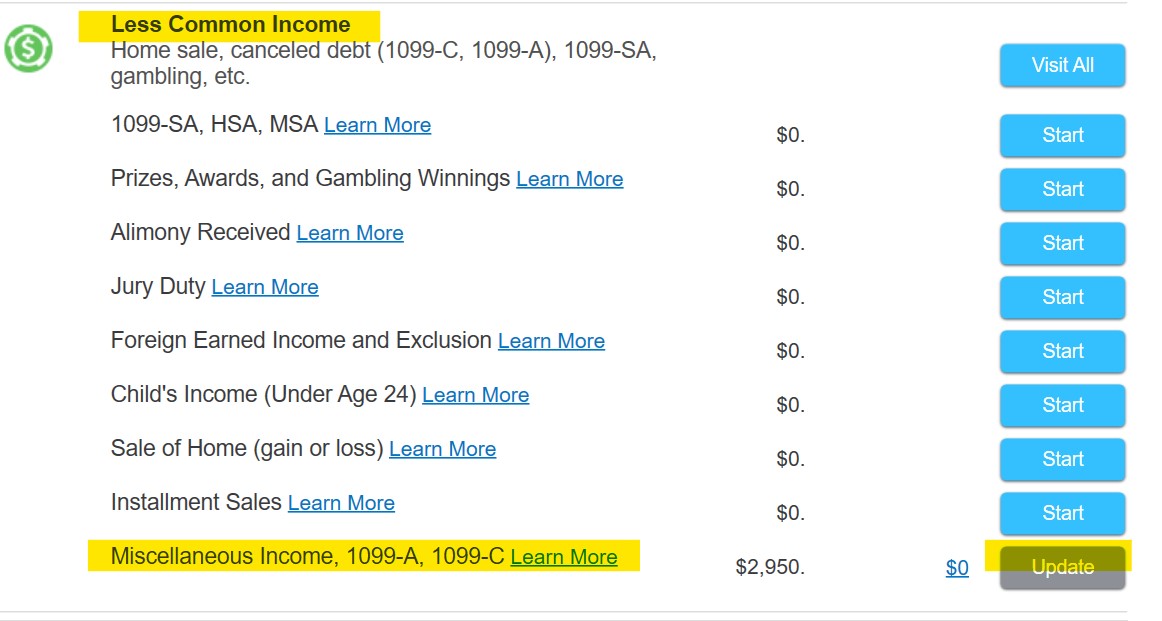

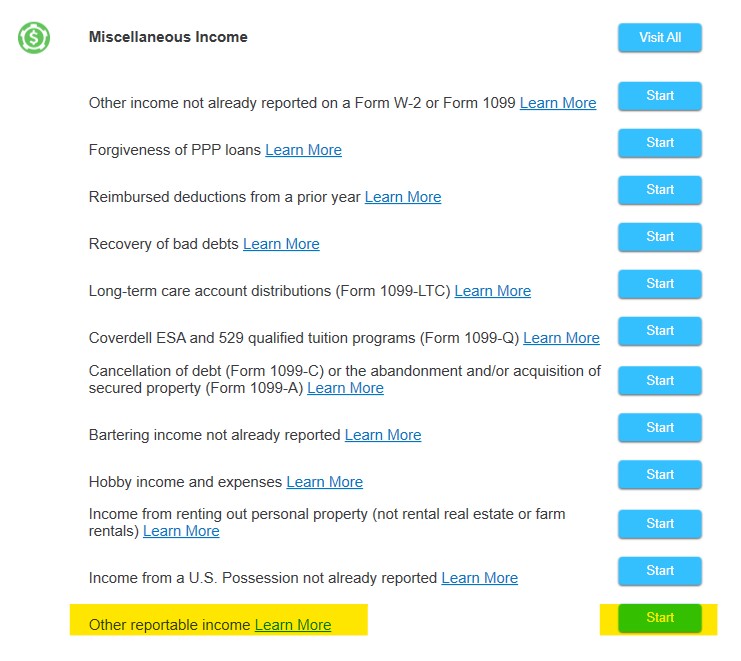

In the left panel, click Federal->Wages and income-> scroll down to miscellaneous income

Edit--> other reportable income

Type in MN Frontline worker pay, and 487

Then click State return, and Prepare State Return. Do the whole thing over and it will prompt you if you did the frontline pay on your federal. Say yes, fill it out, and that's it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

On the federal return - go to Less Common Income and then Other Reportable Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

I got a message from Mn Dept of Revenue it’s only taxable in federal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

I put my wife and I total down on state and not federal. Will I have just amend federal when accepted?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

Wait until you have received your Federal refund before Amending your Federal return.

The Amended Return does not 'catch up' with your original return and correct it. It's processed separately and can take several weeks to complete.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

What section in Turbotax do we enter this? I was thinking under Wages & Income- 1099MISC and Other Common Income

Instructions say:

How do I report Frontline Worker Pay on my 2022 tax returns?

This payment:

- Is taxable federally. Report it on line 8 of federal Schedule 1 (Form 1040).

Thanks!

Would be a helpful update 😉 for guidance of those that received it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

Line 8 is for Other Income- if you enter it as above in TurboTax, TurboTax will report it on the correct line. You can always check what your actual return looks like before you file, see How do I preview my TurboTax Online return before filing?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

Well, I already filed for my wife and I so I will have to wait to amend my federal in February.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

For information on how to amend a federal tax return for the current year, please visit the help article below.

How do I amend my federal tax return for the current year?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

I am hunting too. You must have gotten the same email I did earlier in the week.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Forgot to claim Frontline Worker Pay

THANKS DIANNE. Everyone posting here must have got the same email earlier this week.

Have a great weekend, mine just got a lot better thanks to your reply.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

acabrales98

Level 2

rubs1998

Returning Member

dkmndkmn1

New Member

avtrayne

New Member

chixenlegs80

New Member