- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Filed as a dependent, but actually independent

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent, but actually independent

My boyfriend claimed me as a dependent, but I am actually independent. I have already submitted my return and he has submitted his. (We got our money) How do I fix this? I didn't initially want to be claimed, but my boyfriend claimed me and I assumed that it was my parents that had claimed me.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent, but actually independent

Your BF cannot claim you if you did not live with him the entire year, he paid MORE than half of your total support for the year, AND your gross income was less then $4,200. If you are required to file a tax return the your income is probably above that limit.

He needs to amend and remove you and pay back part of his refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent, but actually independent

Will I need to submit anything to change my status to independent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent, but actually independent

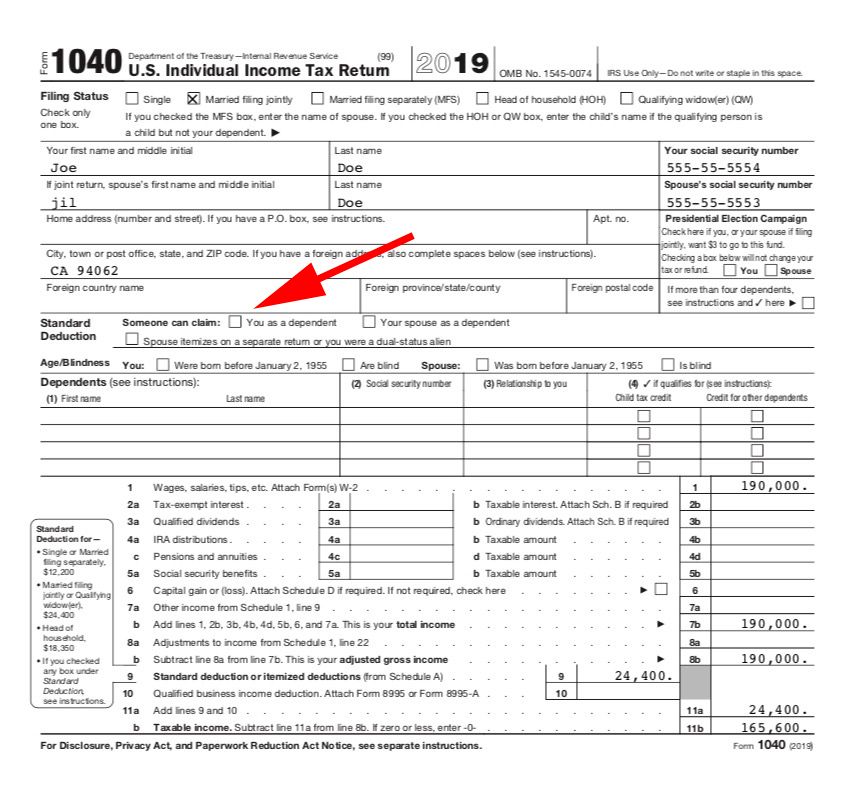

If you checked the box that you could be a dependent then it might make a difference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent, but actually independent

this is exactly my situation.

I checked that box believing my parents claimed me.

(Was going over the stimulus package and saw dependents weren't eligible so i told them I won't be getting anything because they claimed me.)

which is when they informed me that they were unable to claim me due to age and other things. However, I selected that box, do I need to amend my whole tax return or does that fact that no one claimed me now constitute as me being independent. ( I don't believe it does, just hoping more-so in regards to the stimulus since i have been put out of work due to this pandemic and don't want that little check on that box to prevent me from the package when no one even claimed me)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent, but actually independent

It depends on several factors if it matters at all. You can start to amend and see if there is a change.

Amended returns can only be mailed. It is suggested that it be mailed certified with return receipt (or other tracking service) to verify that the IRS receives it.

See this TurboTax FAQ for detailed amend instructions:

https://ttlc.intuit.com/questions/1894381-how-to-amend-change-or-correct-a-return-you-already-filed

You can check the status of the amended return here, but allow 3 weeks after mailing.

https://www.irs.gov/filing/wheres-my-amended-return

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wirgauchris74

New Member

user17636770084

New Member

fletcherrachel27

New Member

morgwat1193

New Member

W16VA

Level 2