- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Excess Roth IRA Contributions - How to Fix it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Roth IRA Contributions - How to Fix it?

Hello Tax Experts

Here is my situation and I really appreciate if you could please help me with some pointers.

- In 2018, I contributed to Roth IRA. I now realized that I was not eligible to contribute.

- This was also not reported in the Tax Returns of 2018. I am sure; had I reported in TurboTax it would have pointed out right there and would have completely avoided this sticky situation.

How can I make this right?

- Do I have to file 2018 amended tax return? If yes - what specifically needs changes.

Please help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Roth IRA Contributions - How to Fix it?

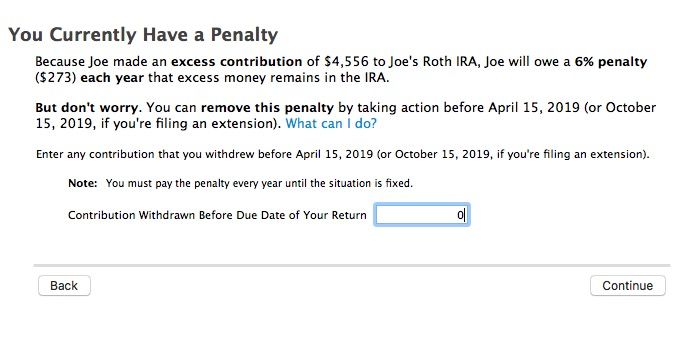

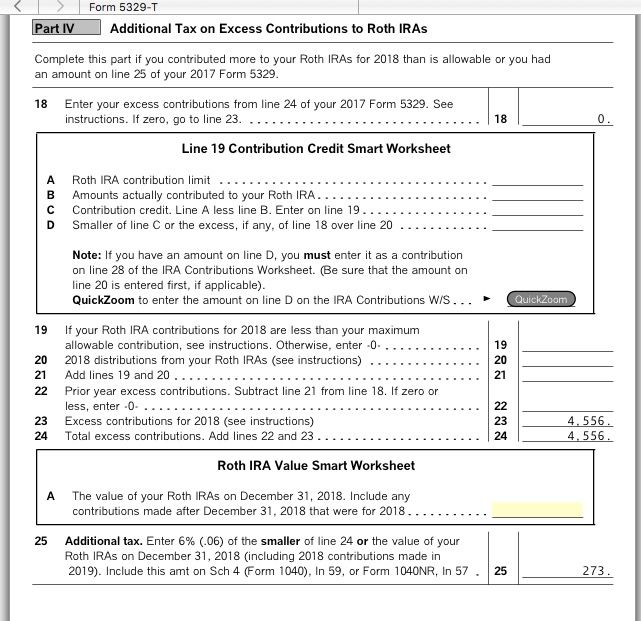

Since you failed to remove the excess before the due date of the 2018 tax return, you owe a 6% excess contribution penalty for 2018. That will require that you amend 2018, report the excess on a 2018 5329 form that will calculate 6% penalty.

That 6% penalty repeated in 2019 since you also failed to remove the excess before Dec 31, 2019. You also need to file an amended 2019 tax return reporting the excess that remained in 2019 and file 1 2019 5329 that will calculate the 2019 penalty.

To avoid another 2020 penalty, the excess must be removed as a normal Roth distribution before Dec 31, 2020. You will receive a 2020 1099-R with a code J in box 7 if under age 59 1/2. That distribution will not be taxable since you are removing your own contribution. Any earnings attributed to the excess will remain in the IRA because the penalties are paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Roth IRA Contributions - How to Fix it?

Since you failed to remove the excess before the due date of the 2018 tax return, you owe a 6% excess contribution penalty for 2018. That will require that you amend 2018, report the excess on a 2018 5329 form that will calculate 6% penalty.

That 6% penalty repeated in 2019 since you also failed to remove the excess before Dec 31, 2019. You also need to file an amended 2019 tax return reporting the excess that remained in 2019 and file 1 2019 5329 that will calculate the 2019 penalty.

To avoid another 2020 penalty, the excess must be removed as a normal Roth distribution before Dec 31, 2020. You will receive a 2020 1099-R with a code J in box 7 if under age 59 1/2. That distribution will not be taxable since you are removing your own contribution. Any earnings attributed to the excess will remain in the IRA because the penalties are paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Roth IRA Contributions - How to Fix it?

Thank you so much for the help and pointers. One more question please - does TurboTax offer the option to do the following (as you suggested)

- Indicate that I contributed to Roth IRA

- Generate entries for Form 5329

- Calculate 6% penalty

Appreciate your time and help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Roth IRA Contributions - How to Fix it?

Yes. Enter the Roth IRA contribution and indicate that you had an excess that was not removed. TurboTax should generate a 5329 form for that year.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

Online for 2018 ended on Oct 15, 2019. 2018 and earlier can only be amended with TurboTax using the CD/download version installed on a PC or Mac computer.

2019 amended Federal returns can either be e-filed or mailed. 2018 and earlier amended returns can only be mailed. It is suggested that it be mailed certified with return receipt (or other tracking service) to verify that the IRS or state receives it.

See this TurboTax FAQ for detailed amend instructions:

https://ttlc.intuit.com/questions/1894381-how-to-amend-change-or-correct-a-return-you-already-filed

-- Amended returns can only be mailed - allow 8-12 weeks - can take up to 16 weeks (4 months) for processing.

You can check the status of the amended return here, but allow 3 weeks after mailing.

https://www.irs.gov/filing/wheres-my-amended-return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Roth IRA Contributions - How to Fix it?

Hello MacUser22

Thank you so much for your help, time and patience with my questions, sincerely appreciated.

I promise, one last question please.

With your previous response, I will be able to amend 2018.

What remains to be done in 2019.

Please help with the last question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Roth IRA Contributions - How to Fix it?

As I said above, you also amend 2019 and enter a Roth IRA contribution the same way but the contribution amount would be zero. the Interview will then ask if you had a prior year excess that was not removed. When you enter that amount a 2019 5239 will be added.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Excess Roth IRA Contributions - How to Fix it?

Thank you!!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bjw5017

New Member

mailsaurin

New Member

meltonyus

Level 1

PCD21

Level 3

Jolmp

Level 1