- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

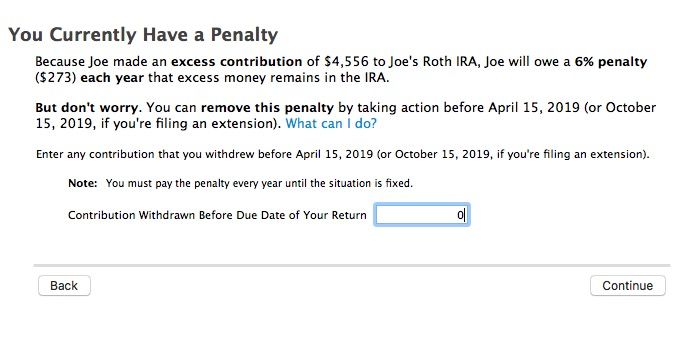

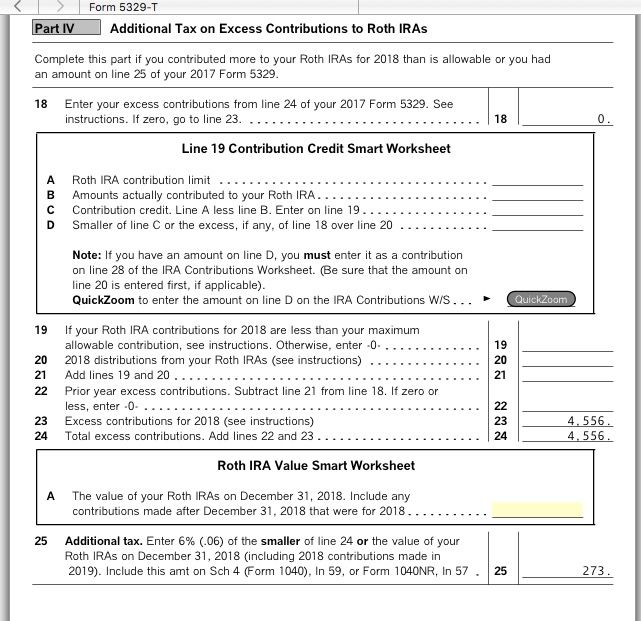

Yes. Enter the Roth IRA contribution and indicate that you had an excess that was not removed. TurboTax should generate a 5329 form for that year.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

Online for 2018 ended on Oct 15, 2019. 2018 and earlier can only be amended with TurboTax using the CD/download version installed on a PC or Mac computer.

2019 amended Federal returns can either be e-filed or mailed. 2018 and earlier amended returns can only be mailed. It is suggested that it be mailed certified with return receipt (or other tracking service) to verify that the IRS or state receives it.

See this TurboTax FAQ for detailed amend instructions:

https://ttlc.intuit.com/questions/1894381-how-to-amend-change-or-correct-a-return-you-already-filed

-- Amended returns can only be mailed - allow 8-12 weeks - can take up to 16 weeks (4 months) for processing.

You can check the status of the amended return here, but allow 3 weeks after mailing.

https://www.irs.gov/filing/wheres-my-amended-return