- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Did I set up auto payment of estimated taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

Neither of us work anymore, so no W-2's involved. What I read, I'm pretty sure was for FIRST quarter of 2022 payments. At first I thought it was 2nd quarter, but I found that again when I was poking around and it definitely said FIRST payment (now I'll have to stumble on it again and find out if in fact it was for 2022 and not 2021, but I'm reasonably certain).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

Scratch that. July 2021 last year was probably the tax due date for 2020 returns and maybe the first quarter 2021 estimate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

I found it:

2020 Extended Due Date of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax PDF, for additional information.

So it was for 2020 and they fooled me. I guess I will just maybe set up a direct payment and double up on one if I can... Wish me luck 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

You can schedule future federal estimated tax payments using Direct Pay or EFTPS on the IRS web site, but you have to do it yourself. You cannot do it in TurboTax.

The two facilities have different advantages and disadvantages. With Direct Pay you can only schedule two payments in one day. If you want to schedule four payments you have to go back the next day to schedule the additional two payments. With EFTPS you have to enroll before you can schedule any payments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

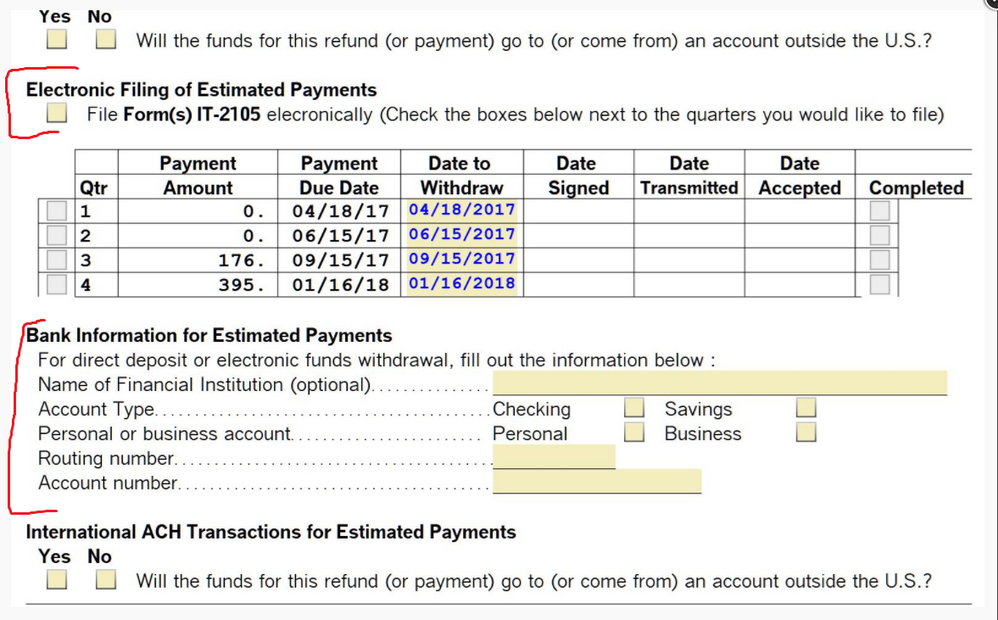

@mtiede If you go to FORMS and look at the NYS Information Sheet you will see if you set up estimated taxes to be withdrawn. It is under part IX on the form.

You would not have been able to do this federally, you only could have had the taxes paid from your refund.

"For Federal estimated tax purposes: You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app.

Using the Electronic Federal Tax Payment System (EFTPS) is the easiest way for individuals as well as businesses to pay federal taxes."

Hope this was helpful.

@SteamTrain just saw the message.

***Say "Thanks" by marking as BEST ANSWER and clicking the thumb icon in a post and that I solved your question

**Mark the post that answers your question by clicking on "Mark as Best Answer" I am NOT an expert and you should confirm with a tax expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

@xmasbaby0 Yes for NYS and some states you can set them up directly in TT. I do it for my mom and sister every year. To confirm, they are set up it is on The information worksheet.

***Say "Thanks" by marking as BEST ANSWER and clicking the thumb icon in a post and that I solved your question

**Mark the post that answers your question by clicking on "Mark as Best Answer" I am NOT an expert and you should confirm with a tax expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

Yeah, I had a picture of the section of the NY "Information Worksheet" which showed the TTX section for NY quarterly estimates D.Debit setup (below, but not fully filled out yet)....but I didn't want to get into an involved handwaving discussion on how to get it to print out in the PDF file if the User happened to be using the "Online" software (Add a state...yadda yadda yadda, print with all woksheets).

_________________

I like EFTPS too, but years ago, when I set it up, it took a month or so to get it setup initially, with snail-mailed confirmation PIN sent back to me....not sure what the registration procedure is now though...they might have streamlined it more.

___________________________________________________________________________

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jtmcl45777

New Member

lodami

New Member

k-young-y

New Member

stephen-doherty25

New Member

paul22mcintosh

New Member