- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Dependent to Independent on 1040x What do i Include?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

Hello,

I wanted to file as Independent the 2019 tax season. It was accepted by both state and federal. I received the refund already declared myself Dependent after filing. My dad was ineligible to declare me as a dependent. So i amended my Turbo-tax file. What do I need to include on my by-mail filing? Do i need to include my w2? even though i only changed my dependency status?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

According to the IRS:

"When filing an amended or corrected return:

- Include copies of any forms and/or schedules that you're changing or didn't include with your original return. To avoid delays, file Form 1040X only after you've filed your original return. Generally, for a credit or refund, you must file Form 1040X within 3 years after the date you timely filed your original return or within 2 years after the date you paid the tax, whichever is later.

- Allow the IRS up to 16 weeks to process the amended return."

You are only changing dependency status, so you do not need to include copies of your W-2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

Hi,

I am in the same situation in which I inaccurately filed as a dependent though no one can claim me. What exactly do I need to fill out on the Form 1040-X to change my dependency status? I am doing it manually as TurboTax is not allowing me to amend my return without paying more to upgrade. Do I just fill out the top section, my filing status, and Part III? Thanks for your help in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

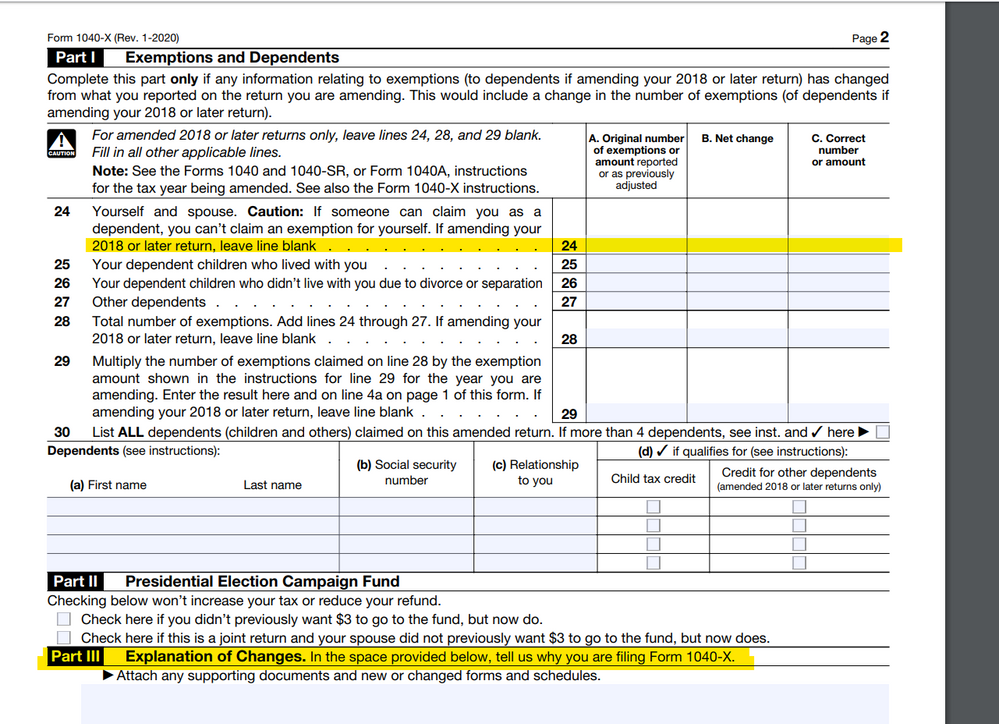

You will update your filing status, and typically the amounts on:

- Line 9 - Standard Deduction

- This will change from the odd amount likely listed, to the actual standard deduction for your filing status (most likely $12,200, for a single filer

- Line 11b - Taxable Income may or may not change

You will then need to complete, on Form 1040X Columns A, B, and C listing the old amount, the net change, and the correct amount for each line that has a different value on the new form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

How do you change yourself from dependant to Independant on the 1040 x I am trying to do the same thing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

First, be sure that no one else claimed you. If they did, your return will be rejected.

Once you've started the amendment, Go to:

- Personal Info or My Info

- EDIT your name

- Continue to screen that says Do Any of These Apply to You

- DO NOT select Someone else can claim me on their tax return.

- Select None of the above

- Continue to the end of the questions

You can now file your amended tax return.

If you've filed your return and need to add additional information, then you will have to prepare an amended return in TurboTax. I suggest you wait at least 3 weeks before sending it to ensure that the IRS does not confuse the returns. You have three years to file an amended return.

If you used TurboTax Online, simply log in to your account and select “Amend a return that was filed and accepted.”

If you used our CD/download product, sign back into your return and select “Amend a filed return.” You must file a separate Form 1040X for each tax return you are amending.

Amend ONLINE OR Amend CD/Download Amend 2016 - 2019

You will have to mail the amended return. The IRS limits the system to only one Social Security number or Tax ID to be E-Filed. This is to guard against fraudulent tax returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

TurboTax is not giving me an option to amend my 2019 return though I have already received my refund. So if I were to do it manually on 1040x form how would I fill it out to change my status as non dependant

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

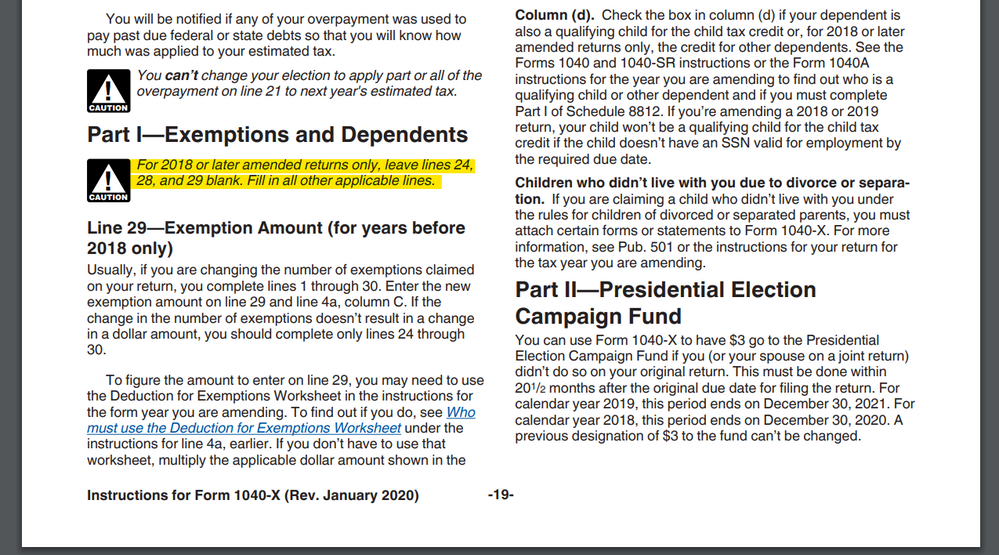

Leave line 24 blank ... read the instructions : https://www.irs.gov/pub/irs-pdf/i1040x.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

Can you go step by step with me by any chance? I do no see anywhere instructions on changing your status as a dependant of someone

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

Ok ... if the ONLY thing you are changing on the return is the exemption ... then column A & C of page 1 should have the same amounts in them from the original return and you will put in an explanation of why you are amending in part 3 ... leave part 1 blank as instructed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dependent to Independent on 1040x What do i Include?

Thank you I appreciate that also how would I inform than that my return is supposed to be more since it was reduced when I marked myself as dependant

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

flagflingr

New Member

HollyP

Employee Tax Expert

f404

Level 3

f404

Level 3

mjm77

Level 3