- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

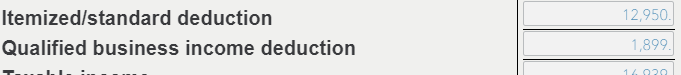

- On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

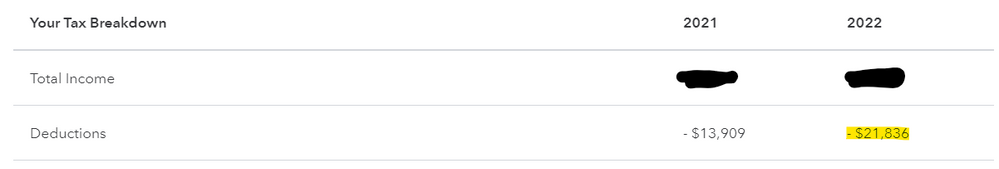

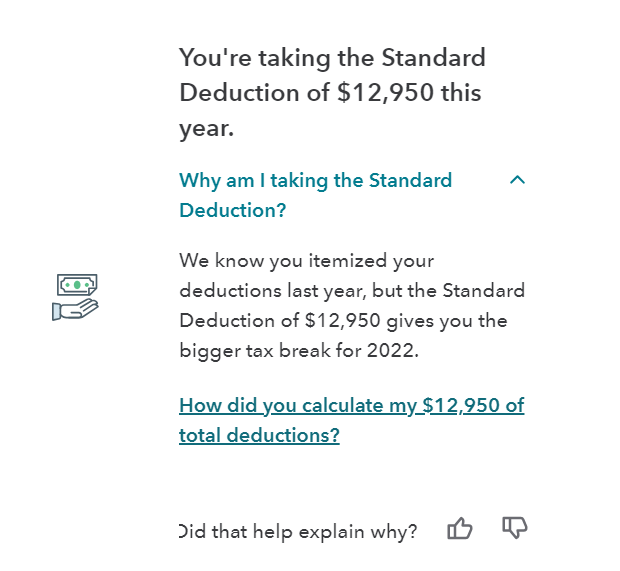

Those are your ITEMIZED deductions and you get to take the larger of the standard deduction or itemized deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

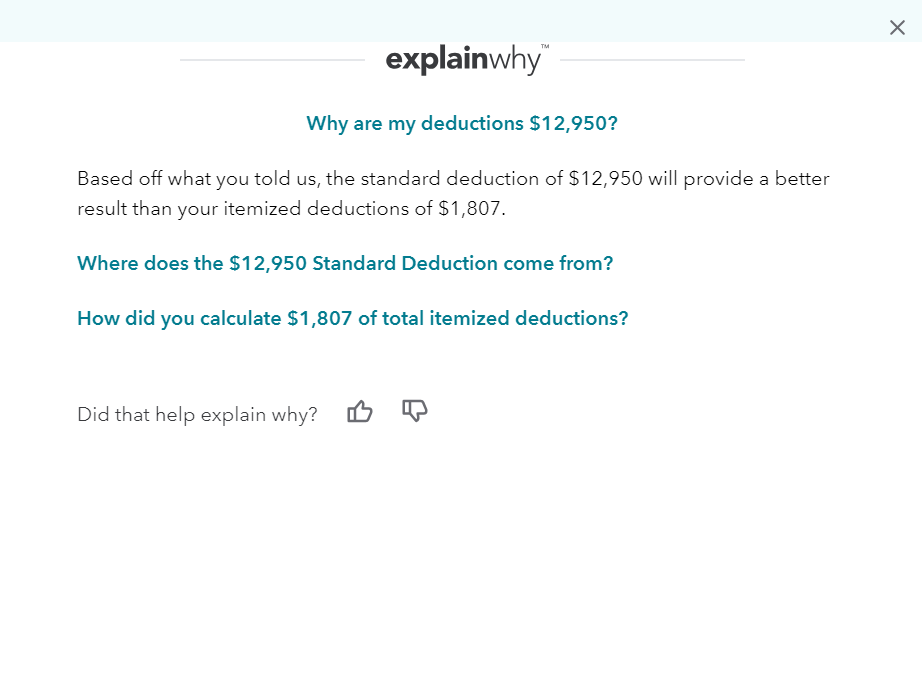

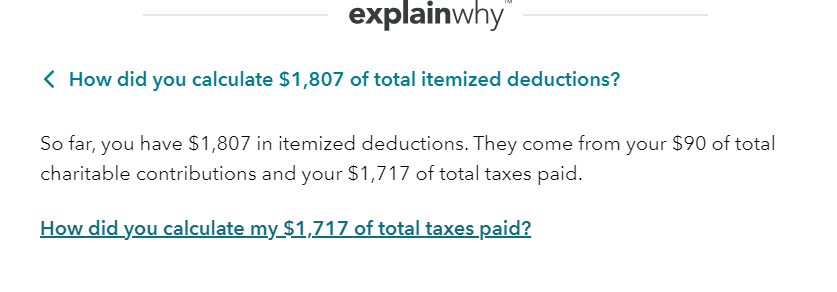

But then why does it say my itemized deduction is only $1,807 when I drill into why they're choosing to give me the standard deduction on the screen in the third screenshot attached?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

Not sure what your confusion is. Your standard deduction of 12,950 is greater than your itemized deductions of 1,807 so the program is correctly giving you the larger standard deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

I see the confusion and have no idea what is causing it. Contact TurboTax support and have them go through this return and see what is causing this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

The $21,836 is probably all the deductions you entered but some deductions are limited like Medical and Taxes. Did you enter any Medical? For Medical only the amount over 7.5% of your AGI is deductible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

VolvoGirl is such an amazing asset for this board. She is so familiar with the software and can identify and then clearly explain the issues. What a great answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

Yes, I did but only $2,086.00 so I don't think that's making up the full difference. Anything else that could be causing this you think? @taxlady28 @VolvoGirl

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

@jloewenberg1 - can you please post a screet shotof the $21,000?

I wonder if you are self-employed and the difference is the QBI deduction?

there are otherwise 4 categories of itemized deductions

1) Medical - limited to the part that is over 7.5% of your AGI

2) State and local taxes - limited to $10,000

3) mortgage interest - limited in certain circumstances (mortgage over $750,000)

4) charitable contributions - limited if exceeds a large portion of your AGI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

I highly recommend you review the actual return to see what is happening ... you can even try it both ways ... standard & itemized so you can understand this concept better.

Click on the tools function ... then print options to see a PDF of the return with & without the worksheets.

See this if you need to learn more about standard vs. itemized deductions: https://ttlc.intuit.com/turbotax-support/en-us/help-article/tax-credits-deductions/standard-deductio...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

Which screen are you referring to? The one where it shows the $21k is shown in an above post by me... but you may be on to something with QBI hunch since I am self-employed. How do you think that's playing into this? @NCperson , a quick response would be much appreciated since I need to file by EOD tomorrow I'm pretty sure...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

On second thought, I don't think just the QBI is making up the difference when I go to the Tax Summary page via the Tools function @Critter-3 mentioned, you can see that the QBI deduction for me is on about $1k... let me know what you think @NCperson

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On the Federal Review Tax Breakdown screen, why does it tell me I have $21,836 in deductions then say I get the standard deduction of $12,950 for a Single filer?

@jloewenberg1 frankly, I would just file the return and worry about it later. It is highly, highly unlikely it is incorrect.

Also, since you are self employed, half the self-employment tax is also an :adjustment"". that could make up the remaining difference.

on the tax return, look at lines, 10 (normally just 1/2 of self-employment tax), line 12 (standard deduction) and line 13 (QBI) - is that the $21k.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cordovasoftball

New Member

rjandbj

New Member

nickzhm

New Member

dalibella

Level 3

Vivieneab

New Member