- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- My employer owes me a refund? Never heard of that before?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

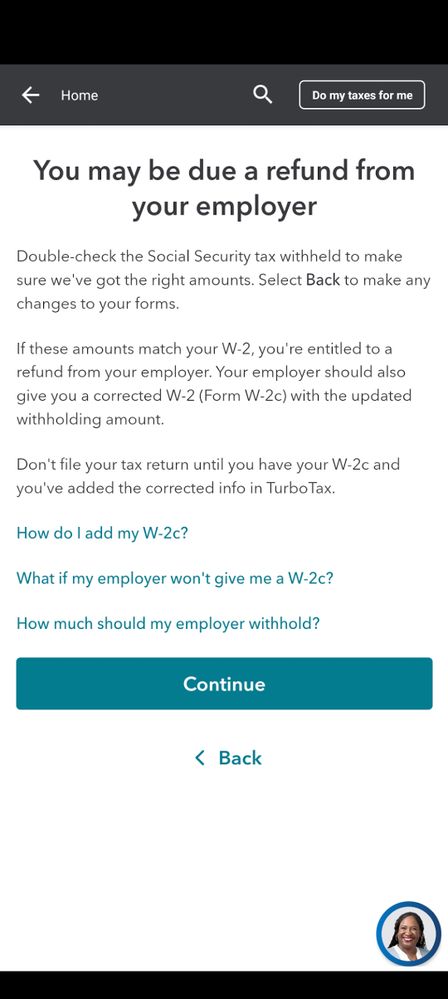

My employer owes me a refund? Never heard of that before?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My employer owes me a refund? Never heard of that before?

Where are you receiving that message? If you are receiving that message in TurboTax, please copy and paste that message in your response so we can look into it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My employer owes me a refund? Never heard of that before?

Probably this

There are 2 different situations when it will say Employer may have paid too much Social Security. It's saying either 1 employer took out too much SS -OR- that you paid too much SS because you had more than 1 employer. This should cover both.

More than 1 Employer:

For 2019, If you had more than one employer and the total of box 4 (only box 4 not box 6) on all your 2019 W2s for Social Security is more than $8,239.80 you get the excess back on your tax return. And it is for each spouse separately, not combined. Check 1040 schedule 3 line 11 for it. Then schedule 3 goes to 1040 Line 18d. If only one employer took out more than $8,239.80 you have to get the difference back from that employer and get a corrected W2 form.

One Employer:

Check boxes 3 & 4 on your W2. Box 4 should be 6.2% of box 3 up to a max of $8,239.80. So take the amount in box 3 and multiply it by .062. If box 4 is more than that you need to get a corrected W2 from your employer. But also go back and double check your W2 entries, you may have entered box 3 & 4 wrong. A lot of people who have asked this found they did enter an amount wrong.

Or check W2 box 12. You may have entered Code A by mistake.

A sure way to fix this is to delete the W2 and re-enter it. That may clear something out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My employer owes me a refund? Never heard of that before?

What do I do if I already filed? I have a wage claim with my former employer and thought something like this would happen. What do I do? HELP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My employer owes me a refund? Never heard of that before?

If you have already e-filed, you will need to wait until the return is processed by the IRS (refund issued / payment processed) before going back into TurboTax.

Revisit the W-2 section. In addition to the steps suggested by VolvoGirl to the previous poster, if you are filing a joint return, check to see if you have identified each W-2 correctly as "self" or "spouse". If a W-2 is mislabeled as belonging to the wrong spouse, TurboTax will see the Social Security withholding as belonging to one person instead of two.

Please also see this TurboTax help article for more information and steps to correct.

There are times when you should amend your return and times when you shouldn't. Here are some common situations that call for an amendment:

- You realized you missed out on claiming a tax deduction or credit.

- You accidentally claimed the wrong tax filing status.

- You need to add or remove a dependent.

- You forgot to claim taxable income on your tax return.

- You realize you claimed an expense, deduction, or credit that you weren't eligible to claim.

See this article for more information on filing an amended return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rkp29

Level 1

evalim4819

New Member

barbarella369

New Member

alien1676

New Member

Perez2017

Returning Member