Yes, it should be SC exempt.

But if the SC state amount ended up being a small $$ amount, the change may not have been enough to affect the actual SC tax assessed.

_________________________

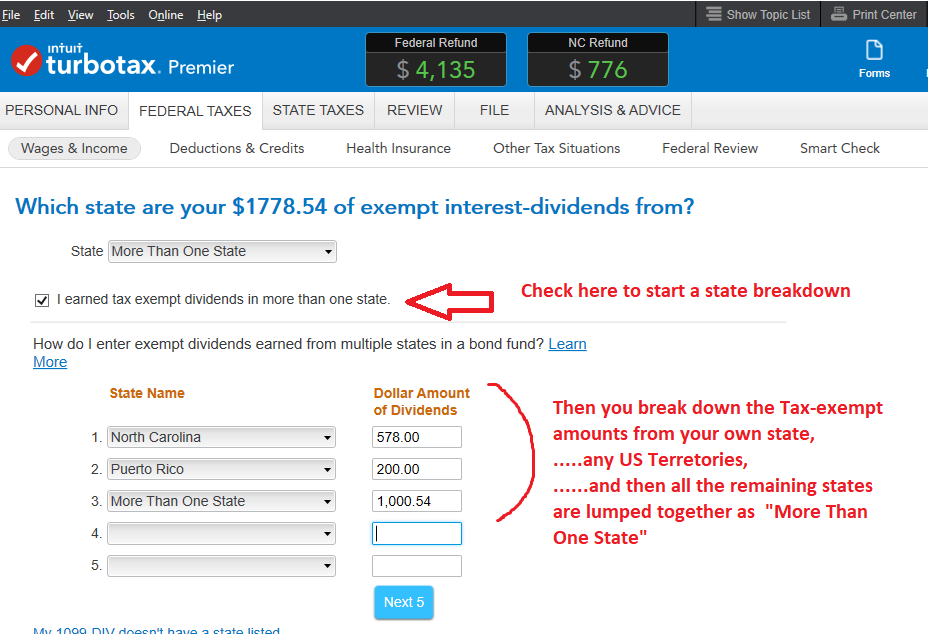

And a side note, in case you are overworking, you only break out the SC $$ and any US territories (like Puerto Rico, Guam etc)....the remainder is lumped together a "More than one state" (or Multiple States if you are using Online software).

Example for an NC resident:

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*