- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- made a mistake at foreign tax credit section and wanted to restart, but I can no longer see filed dividends I worked on during my first attempt how I can really reset?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

made a mistake at foreign tax credit section and wanted to restart, but I can no longer see filed dividends I worked on during my first attempt how I can really reset?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

made a mistake at foreign tax credit section and wanted to restart, but I can no longer see filed dividends I worked on during my first attempt how I can really reset?

The dividend income would be reported on your Form 1099-DIV entry in the Wages and Income section of TurboTax, then Interest and Dividends, then Dividends on 1099-DIV. That entry should not have been affected by entries you made in the Foreign Taxes section of TurboTax.

Choose the Foreign Taxes option under Estimates and Other Taxes Paid, in the Deductions and Credits section of TurboTax:

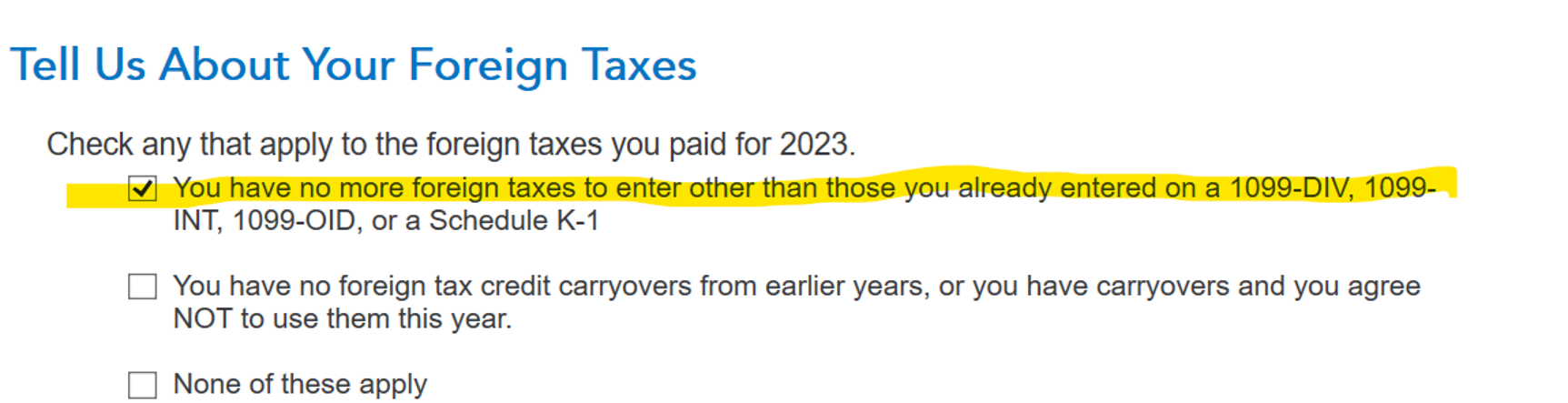

If your only foreign taxes were reported on your 1099-DIV or 1099-INT or similar statements, choose that option on the screen that says "Tell us About Your Foreign Taxes.

Then, indicate that you have no more foreign taxes to enter other than those you already entered, if that is true:

Assign your foreign income to a country and later you will be asked to enter your foreign income:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

igal

Level 1

lencoh82

Level 1

sinan_onder

New Member

Mudflap1963

Level 1

rkoz0502

New Member