- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I got an IRS letter (3064C) stating that I had deferred $175 from 2020 (something from CARES act). I didn't intentionally defer. Is this really owed and how do I pay?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got an IRS letter (3064C) stating that I had deferred $175 from 2020 (something from CARES act). I didn't intentionally defer. Is this really owed and how do I pay?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got an IRS letter (3064C) stating that I had deferred $175 from 2020 (something from CARES act). I didn't intentionally defer. Is this really owed and how do I pay?

If you are a W2 employee, it is probable that your employer deferred and that your employer will pay the funds back by withholding from your wages and sending them to the IRS. You can contact your employer for details.

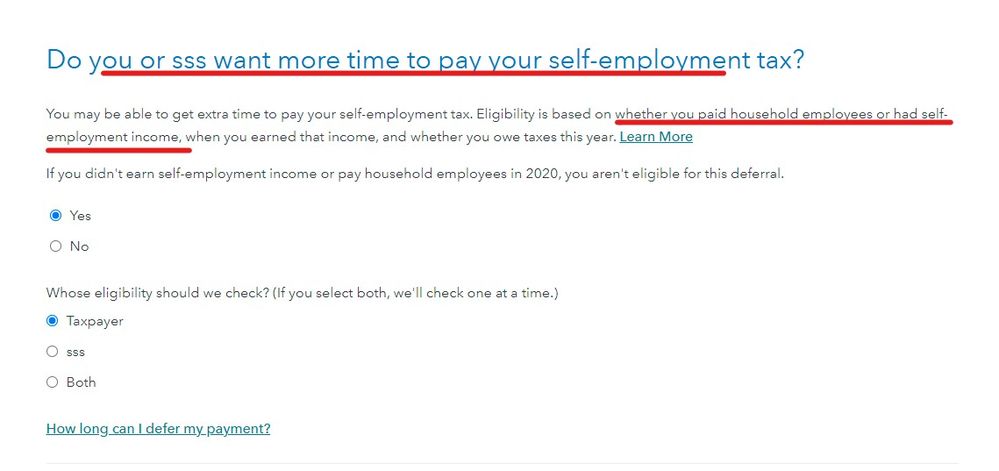

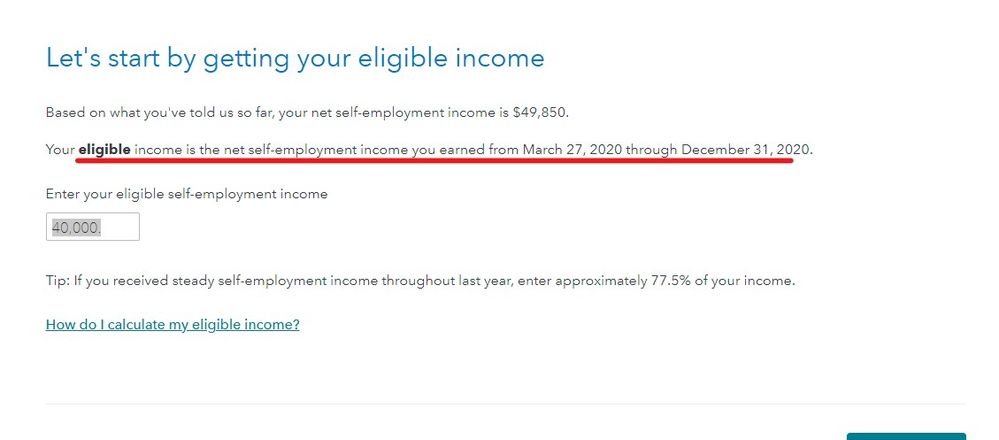

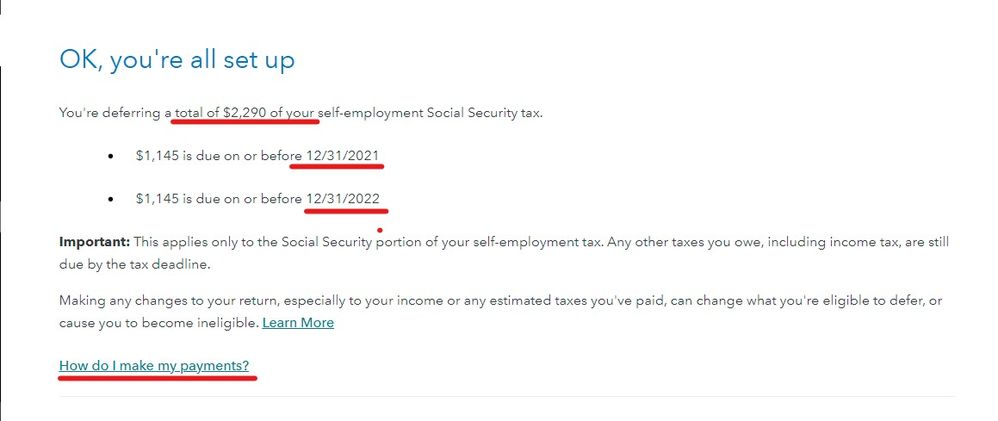

If you are self-employed, check your return to see if you checked the option to have the payment deferred. Then pay the deferred funds, if any, by using IRS EFTPS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I got an IRS letter (3064C) stating that I had deferred $175 from 2020 (something from CARES act). I didn't intentionally defer. Is this really owed and how do I pay?

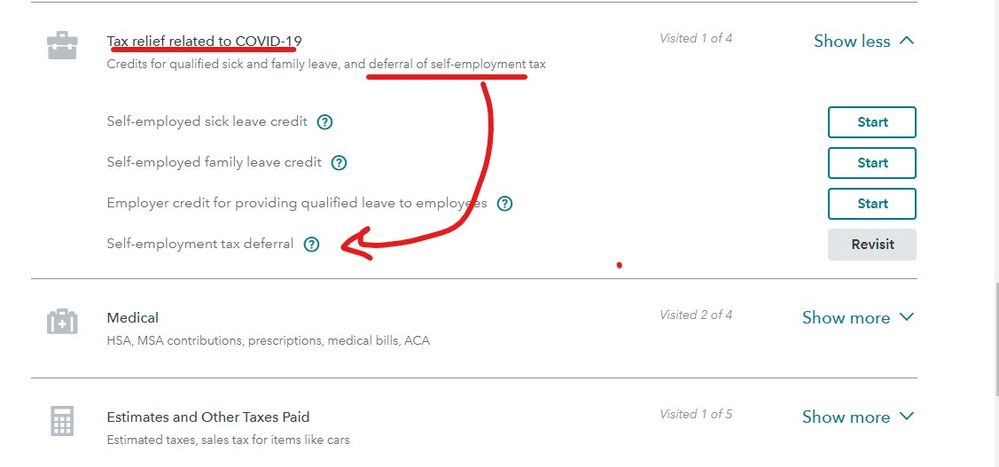

You choose to defer part or all of the SS taxes ... the program doesn't make the election automatically ... do you remember these screens ?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sethness

Returning Member

Dirkburns55

Level 1

Juliaxyw

Level 2

DFH

Level 3

rntaxQs

Returning Member