- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I filed as dependent for 2019 which left me out of receiving the two stimulus checks. I am filing as independent in 2020. Any way I can go about collecting what I missed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed as dependent for 2019 which left me out of receiving the two stimulus checks. I am filing as independent in 2020. Any way I can go about collecting what I missed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed as dependent for 2019 which left me out of receiving the two stimulus checks. I am filing as independent in 2020. Any way I can go about collecting what I missed?

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check this year, you can get it when you file your 2020 return in early 2021—if you are eligible.It will end up on line 30 of your 2020 Form 1040.

https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed as dependent for 2019 which left me out of receiving the two stimulus checks. I am filing as independent in 2020. Any way I can go about collecting what I missed?

If you are not a dependent on the 2020 federal tax return and are otherwise eligible you will receive the Recovery Rebate Credit on your Form 1040 Line 30.

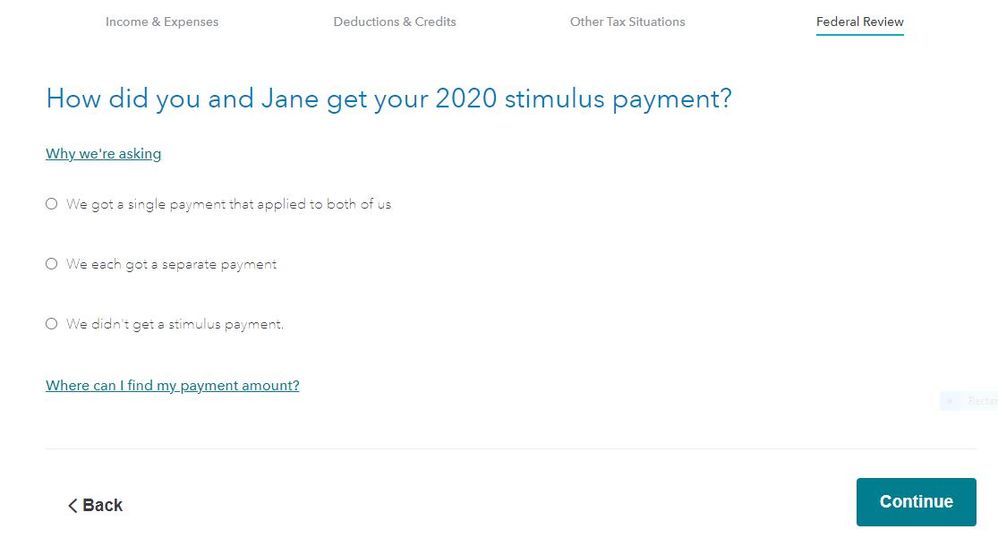

TurboTax will ask about the stimulus payment received or not received in 2020 after the Other Tax Situations section is completed.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

monorom-heng7

New Member

charliebrown-0217

New Member

vetgirl

Level 2

johnnyschine2355

New Member

tyrahlj

New Member