- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I didn't get amount I was supposed to as my tax return I wrote & a dependent wasn't on previous returns, they said refile with form 8812. can I do that on turbo tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get amount I was supposed to as my tax return I wrote & a dependent wasn't on previous returns, they said refile with form 8812. can I do that on turbo tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get amount I was supposed to as my tax return I wrote & a dependent wasn't on previous returns, they said refile with form 8812. can I do that on turbo tax?

@emmaluv2 - need more information

1) was this dependent listed on your tax return that you submitted, did you note that the dependent lived with your 'all year', regardless of the month that Baby was born?

2) look over to the right (assumign that you did list Baby), there are two little boxes, is the 'CTC" box checked?

2) what is on Line 28 or form 1040?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get amount I was supposed to as my tax return I wrote & a dependent wasn't on previous returns, they said refile with form 8812. can I do that on turbo tax?

Ok ... so you filed a return but failed to enter the new born on the return at all ? Or you did but did not get the CTC ? If so you will need to amend the return after the original return has been fully processed and you have the original refund in hand.

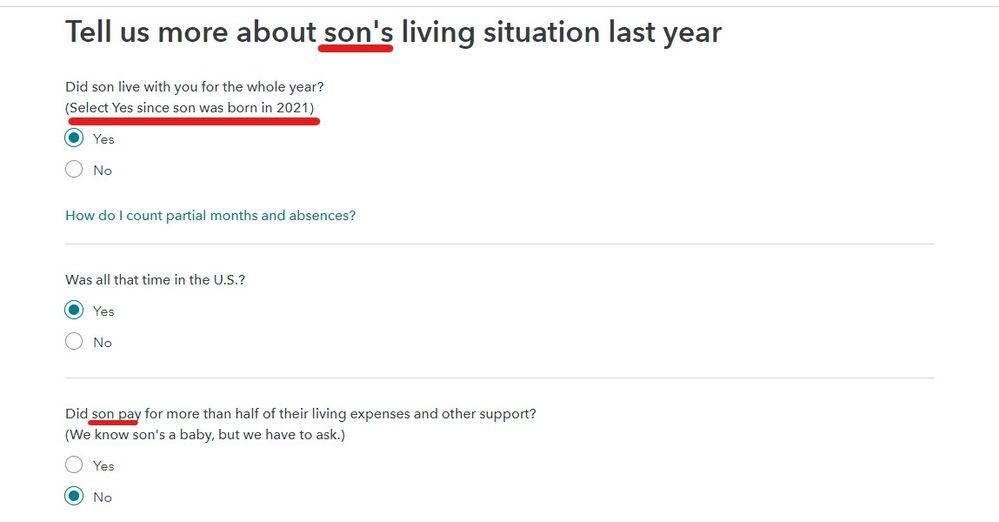

Then in the MY INFO section you will either add the child OR edit the child and pay attention to this screen where it tells you exactly what to choose for a new born :

And then revisit the CTC section again as you complete the interview steps.

How to Amend

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get amount I was supposed to as my tax return I wrote & a dependent wasn't on previous returns, they said refile with form 8812. can I do that on turbo tax?

@NCperson yes I mentioned him on the return and I filled out all the info requested for him as well. In the reply it states he wasn't on my last two returns. And they gave me options, one being update irs child tax portal or two file again with form 8812. When I went to the portal sight it is no longer available. And to be clear what is box 28 or what did I put on box 28? Thank you for your hel

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I didn't get amount I was supposed to as my tax return I wrote & a dependent wasn't on previous returns, they said refile with form 8812. can I do that on turbo tax?

1) look to the RIGHT where Baby is listed on your tax return - is the 'CTC" box checked? (the box is rather small)

2) if yes, then the Child Tax credit should already be part of Line 28 of Form 1040. That is the child tax credit and is automatically calculated by Turbo Tax.

3) what is the amount listed on Line 28 of Form 1040?

Depending on your answers, an amendment may not be necessary.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sakilee0209

Level 2

Questioner23

Level 1

MoisesyDith

Level 1

delgado-e-maria

New Member

user17520079359

New Member