- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- How would I change my status from independent to dependent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

To change the dependent status within your tax return, please use the following steps:

- Log into TurboTax.com,

- Click on Personal Information,

- Click on You & Your Family,

- Click Edit next to your name ,

- You will see you name, D.O.B. and SSN,

- Click continue,

- On the next screen tilted Does Any of These Apply,

- Check or uncheck the third box down that says; Someone else can claim you on their tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

I can't find this option anywhere. In order for my taxes to be accepted I have to change dependent status but don't see the option anywhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

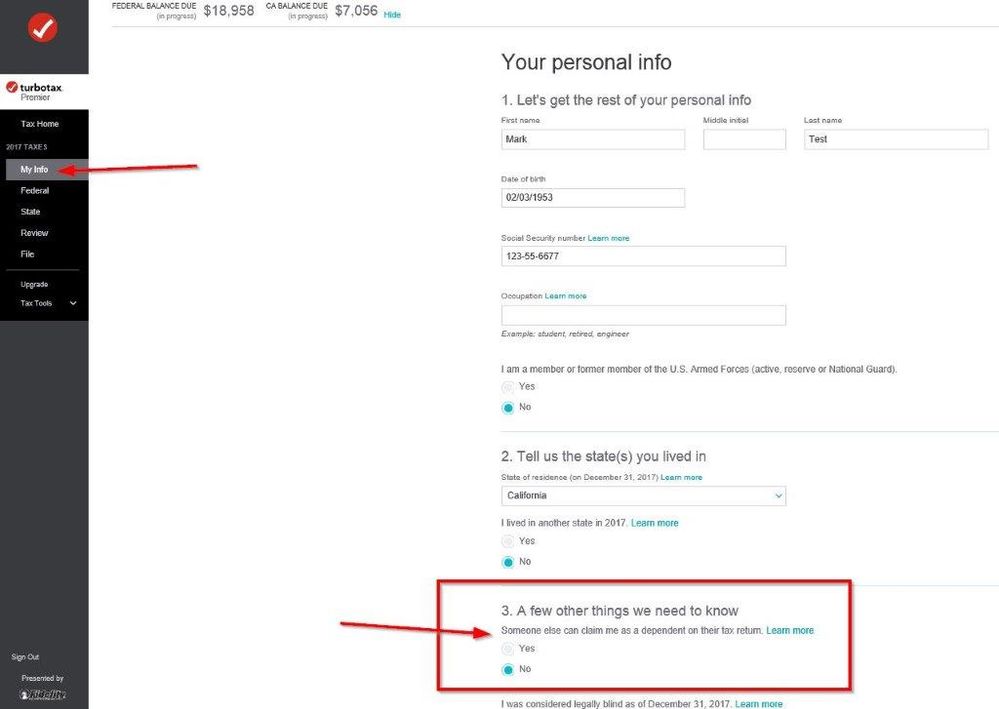

Go to My Info click EDIT by your name

Then scroll down to #3 Can someone else claim you?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

YOU ARE THE BEST!! The screenshot helped so much. There is a similar Personal Info area that is being confused with this. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

If I already finished my 2019 taxes, would I have to amend my taxes to change this status?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

@farebearr Correct, you would need amend your tax return. If the return was already filed, you will need to wait until it has been processed and you have received your refund or confirmation that any tax due was paid. (If you file an amended return while your first return is being processed, it can cause extended delays for both returns)

- How do I amend my 2019 TurboTax Online return?

- What taxpayers should know about amending a tax return

Amended returns can only be mailed. It is suggested that it be mailed certified with return receipt (or other tracking service) to verify that the IRS receives it.

You can check the status of the amended return here, but allow 3 weeks after mailing.

How do I track my amend status?

If the IRS would reject your return for any reason, then you would be able to go in and make any necessary changes to your tax return and resubmit.

How do I fix a rejected return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

how do i get there?? i am so confused

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

How do I get to that page?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

How do I get to that page? @VolvoGirl

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

Are you logged into your tax return? Click on Add a State to let you back into your retun.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

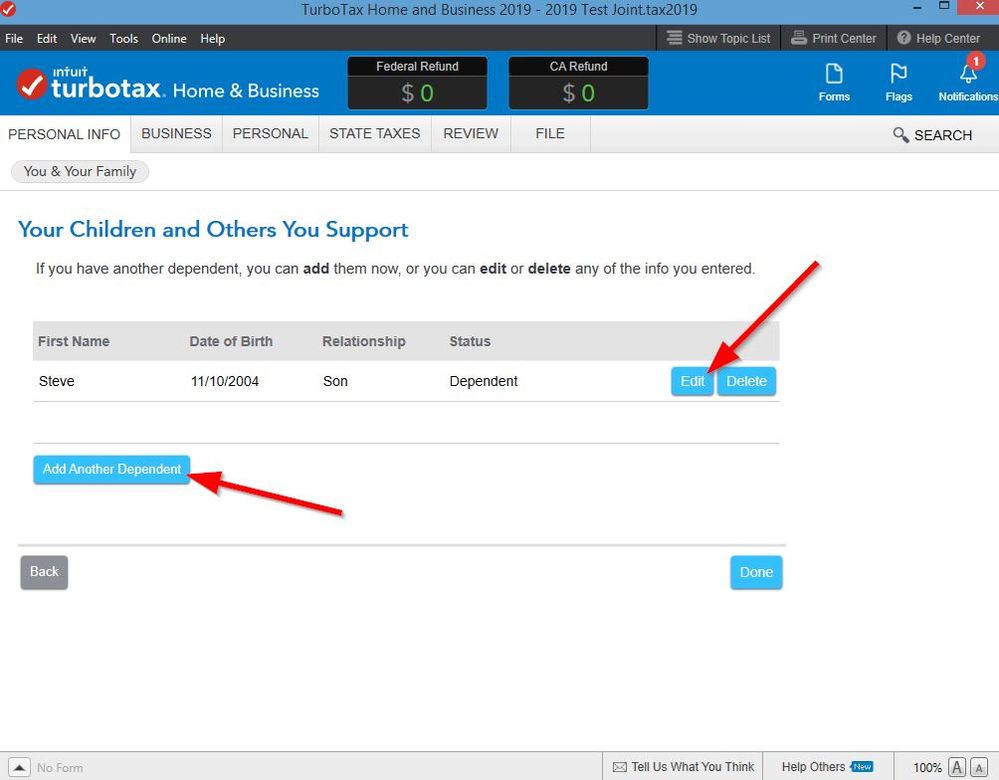

I surmise that the screen shot is from the online version?

How do I change the status of my daughter (listed on the Personal Info Summary) under You & Your Family as not a dependent this year to dependent?

I am using download/CD version

Ugh! Why is this hard?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

Go to Personal Info at the top and Edit or Add a Dependent. Then go though the screens and answer all the questions about them. Did you already add them? Can you get to these 2 screens?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

It’s been about 5 weeks since mailing my amendment and I still cannot track it on the irs tracker. Should I take any action?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How would I change my status from independent to dependent?

Just keep waiting. They are not processing mailed returns right now. The mail is stacking up in trailers at the IRS.

See this IRS page for the latest information

https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

trapezewdc

Level 4

AJH4

New Member

HollyP

Employee Tax Expert

HollyP

Employee Tax Expert

i-am-andrewchun

New Member