- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Error Qualified Dividends tax rate not used

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

IRS reviewed my return and found an error - TurboTax neglected to apply the lower tax rate for Qualified Dividends and Capital Gains. Per the Tax Smart Worksheet, TurboTax selected the “A1 Tax Table” to determine tax due, but should have selected “A4 Qualified Dividends and Capital Gains Tax Worksheet” since I entered interest and dividend income. I had no AMT or other offsets or phase-outs. Why did TurboTax make this error? How do I determine if IRS’s re-calculation of my tax due is correct?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

The program is really very good at calculations ... so did you enter the qualifying dividends & cap gains in the program correctly ? Review your entries and the worksheets to determine where the disconnect is at ... log in and click the amendment option then skip the amendment process and review your entries and the PDF with the worksheets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

That was actually a IRS error on the worksheet calculations that the IRS required that all tax software use. The IRS issued a correction in May that has not been incorporated in an update. If you filed prior to the May update then the IRS will correct the error for you and send a refund.

See:

And:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

That’s very interesting about the IRS admitted errors described by “macuser_22” – Thanks, that was helpful. The error on my return is related-in-part, but is not the same. The IRS says its errors pertain to Schedule D filers. I did not file Schedule D; I only had Schedule B interest and dividends. My problem is TurboTax used the wrong tax calculation formula. TT incorrectly used the tax table (noted by a tax entry on 1040 Ln 11a) even though I reported interest and dividends. TT should have applied the lower rate tax rate for interest and dividends; it did not. I checked for TT 2018 updates today (15Jul19) and there is no correction by TT for this error. When does TT plan to correct its error in using the wrong 2018 tax calculation method?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

The error was on the *Qualified divided* and Capital Gains worksheet. Same worksheet for both.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

That makes sense – Sch D Worksheet is used even when you do not file a Sch D, if a lower tax rate is indicated for interest and dividend income. So TT failed to use the correct worksheet to calculate my tax due, and IRS had worksheet errors. This is a very major screw-up – no TT customers received lower tax rates on their Interest and Dividend income! Has Turbo Tax indicated when they will issue a software update to correct this error in their 2018 Turbo Tax software? I would like to run my 2018 return using the correct tax calculation method, and confirm that the IRS refund calculation is correct. Also, I want to import a correct 2018 return for use in my 2019 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

@David4486 wrote:So TT failed to use the correct worksheet to calculate my tax due, and IRS had worksheet errors.

TurboTax did not use the wrong worksheet or calculations. TurboTax used the IRS published worksheet calculations that they are require to use according to the IRS e-file provider rules. It is an IRS "screw-up" not TurboTax.

As said above, as soon as the IRS notified TurboTax (and all other e-file providers - including professional software that had the same error), TurboTax issued an update in May. If you are using the online versions then it already has the update. Desktop users need to apply the latest update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

“macuser_22” – I appreciate your follow up. Sadly, the fix has not been implemented in TT Deluxe 2018 Desktop version as of 16Jul19. I am running the 17Jun19 Program Updates and 9Jul19 Fed Forms update, which TT’s update function shows as current as of today (16Jul19). My TT calculated tax is unchanged from the incorrect amount when I filed on 11Apr19. TT still incorrectly uses the tax table (noted by a tax entry on 1040 Ln 11a). How does one learn if or when TT will implement the correction to fix this error in TT Deluxe 2018 desktop?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

@David4486- I misread your original question that the qualified dividend worksheet was not used - I read it that it was used.

If you entered qualified dividends and they are on the 1040 form line 3a, then the smart tax worksheet line A4 must be used.

Do you have an enter on line 3a?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

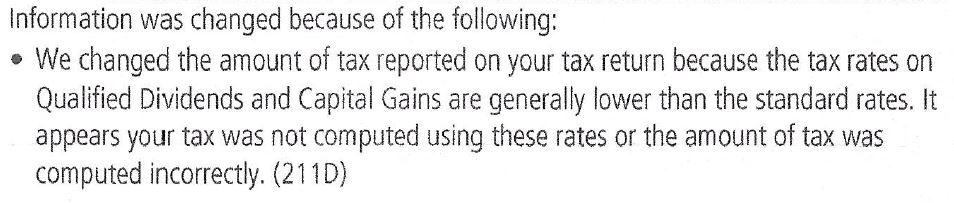

No! 1040 Ln 3a is blank. I had only taxable interest (2b) and ordinary dividends (3b). I did file Sch C and Sch E. Do these trigger use of the different Qualified Dividend and Capital Gains tax rate? Here is the exact language from IRS:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Qualified Dividends tax rate not used

If your actual 1099-DIV forms only have Box 1a and no Box 1b amount then it would appear that the Qualified Dividend and Capital Gains Worksheet should not be used because you had no such qualified dividends.

You should call the IRS number on the notice for more information as to why it was changed.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

William Baldwin

Returning Member

CGCIROBIN

New Member

elml331

New Member

DSP

Level 3

user1451

New Member