- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

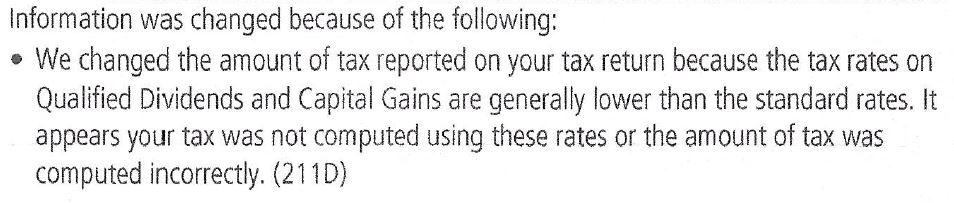

No! 1040 Ln 3a is blank. I had only taxable interest (2b) and ordinary dividends (3b). I did file Sch C and Sch E. Do these trigger use of the different Qualified Dividend and Capital Gains tax rate? Here is the exact language from IRS:

July 16, 2019

1:09 PM