- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- At the question "How did you file taxes last year?" It's saying I didn't e-file with turbotax...but i absolutely did. How do i get past this question?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

At the question "How did you file taxes last year?" It's saying I didn't e-file with turbotax...but i absolutely did. How do i get past this question?

"e-filed with a different tax software"

"filed with a CPA"

"Printed and mailed tax return"

"Tried to e-file, but was rejected"

"Didn't file taxes"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

At the question "How did you file taxes last year?" It's saying I didn't e-file with turbotax...but i absolutely did. How do i get past this question?

If you did not use the exact same account and same user ID for 2021 and 2022 then the software cannot recognize that you used TurboTax last year. To find your AGI

Where do I find my AGI?

https://ttlc.intuit.com/community/agi/help/how-do-i-find-last-year-s-agi/01/25947

Your 2021 tax return shows your 2021 Adjusted Gross Income (AGI) If you filed a joint return then the AGI is the same for each of you.

Form 1040 line 11

If you are using the same TT account that you used last year, you should also be able to find this number in your Tax Home for 2021

If entering the amount from your 2021tax return does not work, then try entering “0” instead. If that does not work and you still cannot e-file, then print, sign, and mail your tax return.

You can get a free transcript of your past return from the IRS:

https://www.irs.gov/individuals/get-transcript

Note: If you filed late or amended your return, your correct 2021 AGI may not be in the system.

https://ttlc.intuit.com/questions/1944348-how-do-i-print-and-mail-my-return-in-turbotax-online

Note: If you mail your federal return, you will also need to mail your state return. You will not be able to e-file your state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

At the question "How did you file taxes last year?" It's saying I didn't e-file with turbotax...but i absolutely did. How do i get past this question?

It's the UserID....d'oh! I got divorced and had to create a new account.....Thank you!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

At the question "How did you file taxes last year?" It's saying I didn't e-file with turbotax...but i absolutely did. How do i get past this question?

I found this helpful until when I tired filing by mail it said for my federal I will have to e-file. Then was lead right back to this question. I file on TT last year so.... I'm literally stuck and don't know what to do next.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

At the question "How did you file taxes last year?" It's saying I didn't e-file with turbotax...but i absolutely did. How do i get past this question?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

At the question "How did you file taxes last year?" It's saying I didn't e-file with turbotax...but i absolutely did. How do i get past this question?

If you did not use your same login information from 2022, it will appear as if you did not use TurboTax from the prior year. Try saying that you filed using another software and see if that moves you forward.

Or

You can try to recover your account from 2022.

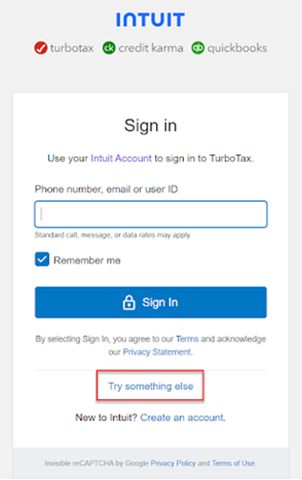

If you’re having trouble signing in to your Intuit Account to access TurboTax, we’re here to help you get in. We’ll show you how to sign in if you lost or forgot your user ID or password or if you're locked out of your account, or recover your account if you can’t get a verification code. Read further to learn other sign-in tips and troubleshooting.

Note: If you can sign in to your Intuit Account, but need to update your contact info, we have instructions to help you.

I forgot my user ID or password

If you forgot your user ID or password, but still have access to your phone or email on file, you can still access your account. This is the fastest way to access your account if you lost or forgot your credentials.

- Go to our sign-in help page.

- Enter the phone number, email address, or user ID for your account.

- If you enter a phone number or email address, we’ll send you a text or email with a verification code. If you enter a user ID, choose which method you prefer.

- Enter the verification code we sent, or follow the instructions in the message. We may ask you for a little more info to make sure it’s really you.

- When prompted, reset your password. Or, you can select Skip.

If that doesn’t work, select Try something else to verify your identity and account ownership a different way.

We'll ask additional questions about you, such as your last name, date of birth, Social Security number, and zip code, to verify your identity.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ndelossantos

New Member

AnnieBersch

New Member

Singincowboy

New Member

JQ6

Level 3

m12345$$!!6

Level 2