- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Amend 2020 Tax Forms for the Recovery Rebate Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

How can I amend my 2020 Tax Froms to apply or complete the 1040-X form? We recently mailed in the 2019 Tax Froms to the IRS for my daughter. After realizing we forgot to claim her as a dependant in 2019 on our Tax Froms. This may now work in our favor as she should now be qualified for the 3 Stimulus checks.

We recently completed my daughters 2020 taxes via E-File using Turbo Tax Online version. Shortly after while doing our taxes noticed we didn't claim her as a dependant in 2019.

How can we amend my daughters 2020 taxes to trigger the 1040-X form for the Recovery Rebate Credit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

No, you do not have to manually amend her tax return.

Please follow the steps below:

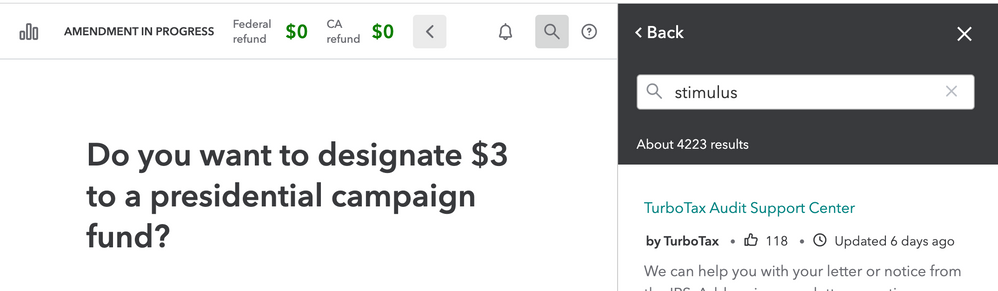

- With her return open, search for stimulus with the magnifying glass tool on the top of the page.

- Select the Jump to Stimulus in the search results to directly go to correct TurboTax page.

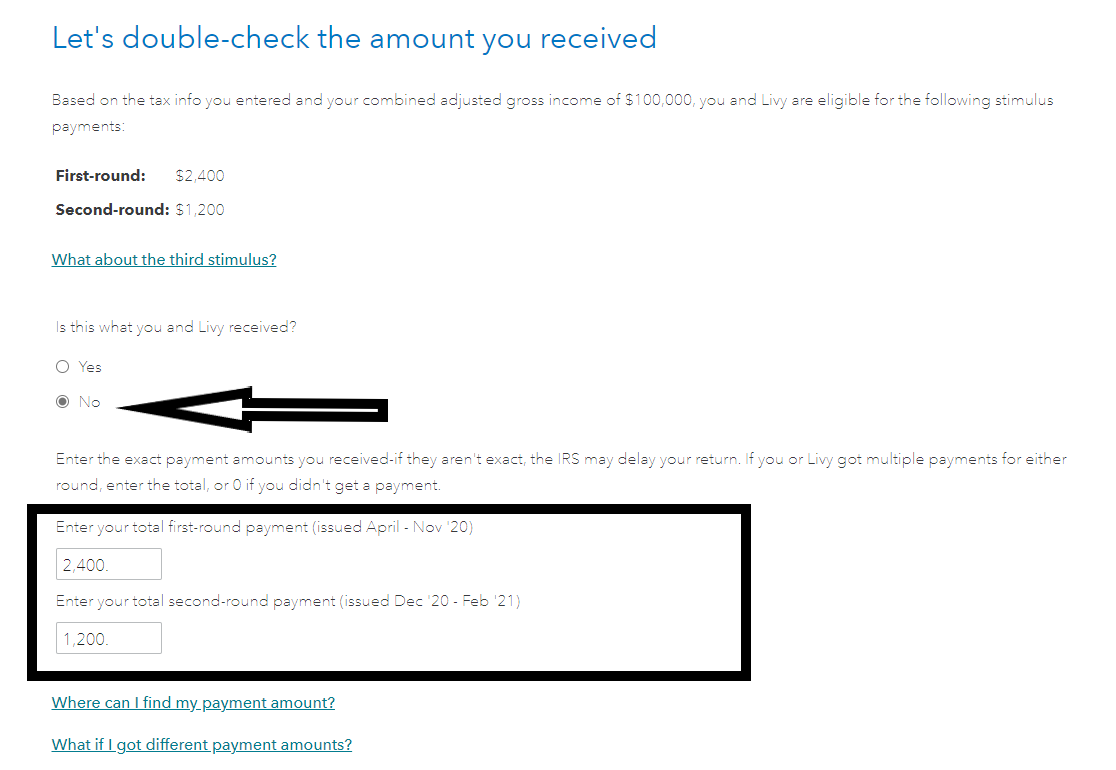

- You will come to a page titled Let's double-check the amount you received and it will list the first-round and second-round payments based on her 2020 return.

- Answer No for the question, Is this what you received?

- Enter the amounts of the first and second round stimulus payments she received ($0). I have attached a screenshot below for additional guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

If you have e-filed your 2020 Federal tax return and the tax return is accepted by the IRS, you will have to amend your 2020 Federal tax return and correct the entries and calculations to receive the Recovery Rebate Credit.

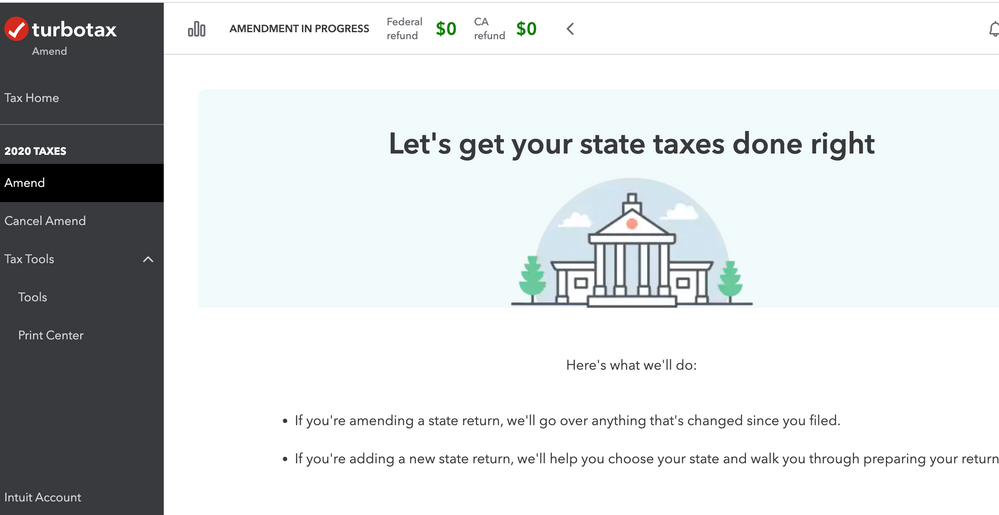

Follow these steps to amend a 2020 Federal 1040 tax return in TurboTax Online.

- Sign in to TurboTax.

- Scroll down to Your tax returns and documents, select 2020, then Amend (change) your return.

- If you only see the option to amend 2019 or earlier, it's because you can't amend an unfiled 2020 return. Instead, select Pick up where you left off so you can make any changes before you file.

- Carefully follow the instructions. Don't worry if your refund changes to $0. This is normal for amended returns.

If you have not received one or both of your stimulus checks, you will receive your payment in the form of a Recovery Rebate Credit on line 30 of your 2020 Federal tax return when you file.

In TurboTax Online, you are prompted to input stimulus check 1 and stimulus check 2 information under Review down the left hand side of the screen. You may also access your stimulus check choices by following these steps:

- Down the left side of the screen, click on Federal.

- Across the top of the screen, click on Other Tax Situations.

- At the screen Let’s keep going to wrap up. Click on Let’s keep going.

- At the screen Let’s make sure you got the right stimulus amount, click Continue.

- At the screen Did you get a stimulus payment? you can update your stimulus check entries.

TurboTax will compare your one or two stimulus payment amounts to the computations within TurboTax. The computations within TurboTax are based upon the information that you have entered into the tax software. If you are due an additional amount, it will be issued as a Recovery Rebate Credit (RRC) on line 30 of the 2020 1040 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

I can get into the 2020 Tax form to Amend, however I see no option to access the page for the Recovery Rebate Credit.?.

Is this an option in the Turbo Tax Delux Online version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

Go to the Federal Review section at the top to enter your stimulus payment info for the Recovery Rebate Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

Hey Marilyn,

That option worked when I originally submitted my 2020 tax forms online, however I am now attempting to amend my 2020 forms & the recovery credit rebate option does not seem to appear.?.

Will I now have to amend the forms manually for the recovery credit rebate option while amending the 2020 forms?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

No, you do not have to manually amend her tax return.

Please follow the steps below:

- With her return open, search for stimulus with the magnifying glass tool on the top of the page.

- Select the Jump to Stimulus in the search results to directly go to correct TurboTax page.

- You will come to a page titled Let's double-check the amount you received and it will list the first-round and second-round payments based on her 2020 return.

- Answer No for the question, Is this what you received?

- Enter the amounts of the first and second round stimulus payments she received ($0). I have attached a screenshot below for additional guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

That did the trick! However, it worked for my taxes as I filled the previous year.

For my daughter’s taxes it will not come up, yet I believe that is because we just sent in her 2019 tax information by mail and still waiting for it to be processed.?. Hopefully once the 2019 tax forms have been processed the stimulus option will appear when we go to amend her 2020 forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

I need to chat / talk with an agent

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

@egouv wrote:

I need to chat / talk with an agent

TurboTax does not have a chat option.

What is your question?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

The fact that you forgot to claim your daughter does not help her get the Rebate Credit.

The box on her return says: "someone can claim me."

To get the Rebate, she would have to file a false return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

Hi, I tried to follow provided steps to amend my 2020 return and claim Economic Impact Payment 2, but the magnifying glass gives me only articles, and no link to jump to stimulus forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

TurboTax will not show you the stimulus page if you are not eligible.

The stimulus page comes up after Federal Review.

- Click on Federal in the left-hand column

- Click Federal Review on the top of the screen

- On the next page you should see Let's make sure you got the right stimulus amount, click on Continue. If you do not, you are not eligible.

You are eligible for the second stimulus, generally, if you’re a U.S. citizen or U.S. resident alien, you may be eligible for $600 ($1,200 for a joint return), plus $600 for each qualifying child, if you (and your spouse if filing a joint return) aren’t a dependent of another taxpayer on a 2019 tax return, have a social security number (SSN) valid for employment (see exception when married filing joint) and your adjusted gross income (AGI) does not exceed:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower;

- $112,500 if filing as head of household; or

- $75,000 for eligible individuals using any other filing status

- The rules for the first stimulus were similar.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

Thank for your reply.

There is no "Federal" in the left-hand column

Stimulus questions didn't pop up, I got through entire Federal amendment.

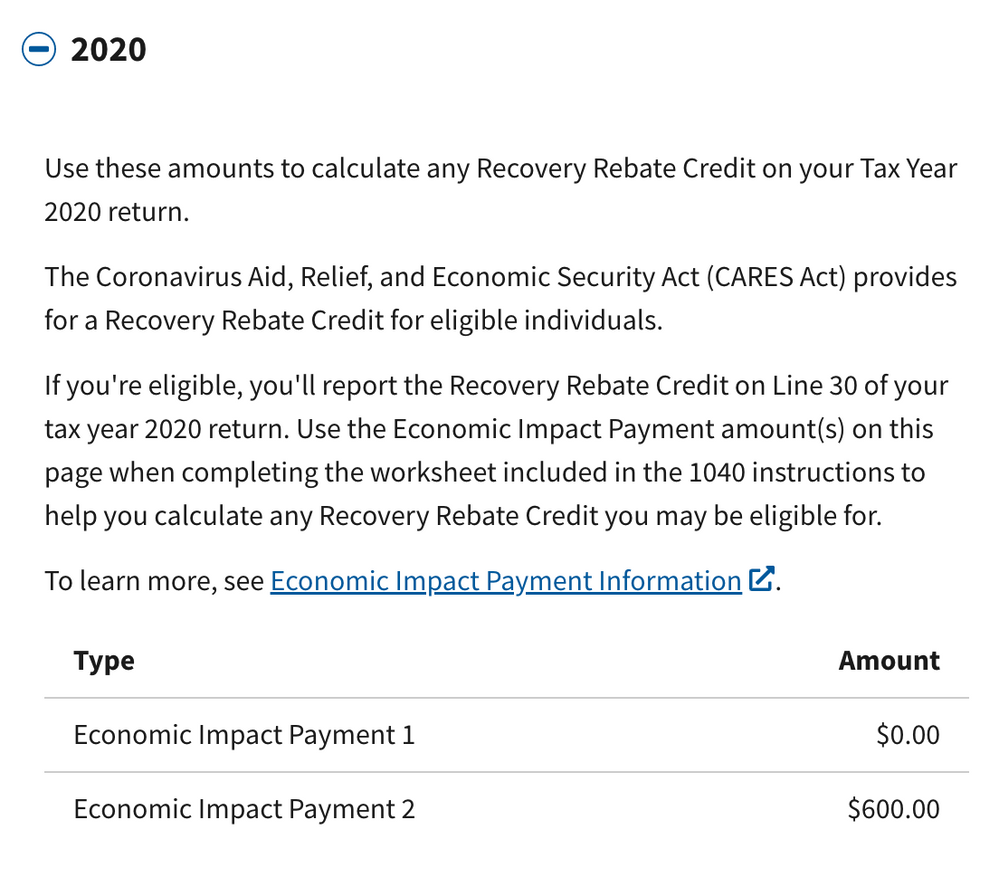

I recently created an IRS account which shows that I was eligible for Economic Impact Payment 2, that I never received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

The qualifications for the first two stimulus payments are:

- you were a U.S. citizen or U.S. resident alien in 2020,

- you were not a dependent of another taxpayer, and

- you have a Social Security number that is valid for employment.

There are income limitations are if your adjusted gross income (AGI) is more than:

- $150,000 if married and filing a joint return or filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 if filing as a single or as married filing separately.

The stimulus payments were based upon 2018 or 2019 tax year information. If you did not receive either of the first two stimulus payments, you may receive that amount through a Recovery Rebate Credit. The credit was based upon 2020 tax information and can be found on line 30 of the 2020 Federal 1040 tax return.

You will need to go through the entire step by step process that you did when you did the original return. If you qualified for the stimulus then the question regarding the stimulus popped up and you must have answered it incorrectly. If you didn't qualify then the question never appears.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amend 2020 Tax Forms for the Recovery Rebate Credit

„You will need to go through the entire step by step process that you did when you did the original return.”

I’d be happy to, but how do i do it? Amending process doesn’t let me…

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kidatheart

Level 1

user17581376415

Level 1

kac42

Level 2

Naren_Realtor

New Member

elliottulik

New Member