- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- 2020 GA Amended Return - software not "continuing" with e-file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

On the final screen, it shows "Continue" but trying to do so - in the downloaded 2020 TurboTax software itself - does not proceed and effectively is blocking me from the final step of wrapping up and filing.

Please help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

The 2020 amended return cannot be e-filed.

In the File section, on the first screen select File by Mail and Not E-file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

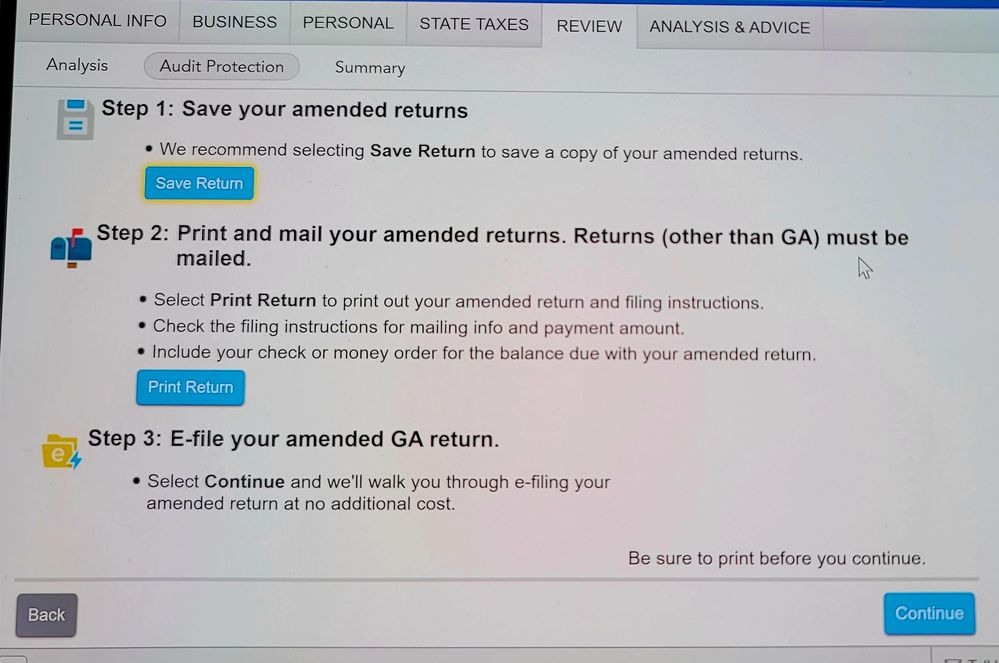

Well, the software indicates that the State CAN be e-filed but NOT the Federal.

Are you instructing that that is in fact not the case for the Georgia State Return?

The screen prompts specifically state the opposite:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

That may well have been true in 2021 with the 2020 software for amending. But it is not true in 2024 for amending the 2020 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

Ok, thank you for that clarification.

I have tried following the steps that you initially outlined but I do not see an option to "File by Mail".

How can I get help with this 2020 software to file my GA state amended taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

When you click on the File tab on the top of the desktop program screen, then click on File a Return or Continue, the next screen should have only two options labeled E-file and File by mail

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

DoninGA meant the following:

Note the arrow on the upper right - this is the File section he meant.

Click on File a Return and click Continue.

The next screen is

Can you do this?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

No, I cannot do that.

Please see my screenshot from earlier in this thread and you'll see that I don't even have those same tabs.

I checked the specific State return and the language therein refers to digital submission - and thus there is no address listed to send it in by mail.

I'm still stuck and confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

Based on your screen shots, I think your only option is to print the return for mailing by select Print returns in Step 2.

You can mail in your Georgia return despite the options you are given on this screen. The address for a mailed Form 500X is:

Georgia Department of Revenue

Processing Center

PO Box 740318

Atlanta, GA 30374-0318

Be sure to send in all five pages of Form 500X and sign it on page 5. You should also attach your amended federal return and anything that documents what you changed on your tax return.

For example, if you added a W-2 form that wasn't on your original return, you should attach just that W-2 to your amended return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

Same here! And can’t save a PDF either for state to print and mail! I’m up against a hard deadline. Did you ever find a viable solution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 GA Amended Return - software not "continuing" with e-file

I am using 2020 TurboTax Desktop Amend but I will try your link. Thank you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Ironsshop

New Member

mike-boruff

New Member

robueno315

New Member

joannabanana6

Level 2

Howard1948

Level 7