- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Yes, you need to file the consent so TurboTax can efile y...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

I don't understand the consent. Do we need to sign it to file our taxes or what?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

Yes, you need to file the consent so TurboTax can efile your returns.

This is what the consent form is allowing us to do:

This is a requirement from the IRS in order to file your return.

I consent to allow my Intermediate Service Provider, transmitter, or Electronic Return Originator (ERO) to send this form to IRS and to receive the following information from IRS

- (a) Acknowledgment of receipt or reason for rejection of transmission, and

- (b) If delayed, reason for any delay in processing the form. The following Electronic Funds Withdrawal Consent and taxpayer signature should only be presented when the taxpayer has selected the Electronic Funds Withdrawal option and the Self-Select Practitioner, Practitioner, or Self-Select Online option is used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

TurboTax website says:

You are not required to complete this form to engage our tax return preparation services. If we obtain your signature on this form by conditioning our tax return preparation services on your consent, your consent will not be valid. Your consent is valid for the amount of time that you specify. If you do not specify the duration of your consent, your consent is valid for one year from the date of signature.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

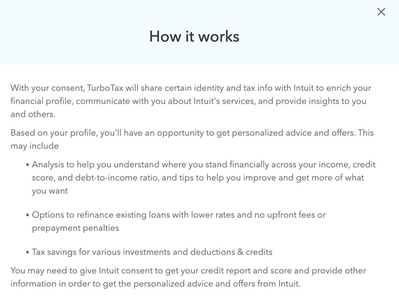

You DO NOT need to sign this form to successfully file your taxes with Intuit. On the same page you saw this request for consent there is a "Learn More" link which show the following popup. It's basically a sneaky way of saying "We want you permit us to access to your tax filing info for purposes other than filing taxes so that we can target you for the sale of other products and services and probably also make money selling your information to third parties."

The extra nose-wrinkling sneaky part is that you have to fill out the form with names and dates and then you click the "Decline" button. You cannot leave the page until you fill the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

Starting off TurboTax with this consent form is just poor. After all these years, I have WASTED 30 minutes trying to understand what this means. Why couldn't they have put a video here to explain, or used some plain language. Like, you can't efile unless you do this. It's a huge waste up front to get started.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

I completed my daughter's tax return without responding to this statement. I clicked continue. It did not stop me from efiling her return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

My daughter's return was simple. Now I am doing my own. I've read this over and over and it makes no sense. Every time they pop up an ad it is equally worded badly. You don't know if you are saying NO I don't want to pay for 3rd service. I'm going to try HRBlock.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

If you need assistance filing the return, please contact us by phone here so we can better assist you. @alisonhunter55

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

Sorry Carissa, but this doesn't answer the question at all.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

It's like TurboTax has used the excuse about efiling consent to get an opt-in for marketing emails.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

This horribly sneaky and misleading and makes me really mad. Everyone in the world should fire TurboTax from having anything to do with their finances and the company should go bankrupt tomorrow for trying to lure us all into a trap. What an insult this is.

I didn't click Decline or Accept and clicked File on the left navigation bar and was able to continue with the Filing process. I went through this same thing last year and remember how infuriated I was. This year it's apparently no different. Buyer beware.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

Very misleading subject and the reply from Cindy0H is misleading (albeit maybe unintentionally). NO you do not need to file consent for the following one: "turbotax use of tax return information to limit offers." (Of course you give consent when it's at the final e-filing stage; but that is very different from the early consent they ask for.)

As to the consent request early in the process, I'm grateful to @jasonandammygabler for this translation of that legalese gobbldee-**bleep**:

You DO NOT need to sign this form to successfully file your taxes with Intuit. On the same page you saw this request for consent there is a "Learn More" link which show the following popup. It's basically a sneaky way of saying "We want you permit us to access to your tax filing info for purposes other than filing taxes so that we can target you for the sale of other products and services and probably also make money selling your information to third parties."

The extra nose-wrinkling sneaky part is that you have to fill out the form with names and dates and then you click the "Decline" button. You cannot leave the page until you fill the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

Thanks to @jasonandammygabler we got a clear translation of the early request for consent that Turbotax asks for (if it's the last consent they ask when about to submit the e-file, yes that consent is needed; but not the following one):

You DO NOT need to sign this form to successfully file your taxes with Intuit. On the same page you saw this request for consent there is a "Learn More" link which show the following popup. It's basically a sneaky way of saying "We want you permit us to access to your tax filing info for purposes other than filing taxes so that we can target you for the sale of other products and services and probably also make money selling your information to third parties."

The extra nose-wrinkling sneaky part is that you have to fill out the form with names and dates and then you click the "Decline" button. You cannot leave the page until you fill the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

this document also allows turbo tax to use this for other purposes other than what is described in your answer about the document!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a question Don't understand the consent. Do we need to sign it to file or what?

Turbo tax will not make it easy to use their service un less you give them permission to use personal information in other ways than for preparing my taxes. I will try to find a better way to prepare my tax return with out turbo tax requiring control over my personal information!!!!!

Richard [PII removed]

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jonelxg

New Member

budreag

Level 1

sandythomas549

New Member

overdrive31

Level 1

GSL85

New Member