- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Will i put allocated wages on 1040 married filing separately

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will i put allocated wages on 1040 married filing separately

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will i put allocated wages on 1040 married filing separately

Are you in a community property state?

Community property states: AZ, CA, ID, LA, NV, NM, TX, WA, WI

https://ttlc.intuit.com/questions/1901162-married-filing-separately-in-community-property-states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will i put allocated wages on 1040 married filing separately

I an in texas

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will i put allocated wages on 1040 married filing separately

Yes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will i put allocated wages on 1040 married filing separately

Do I enter my w2 on return filing married filing separately or the community income allocation live in Texas

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will i put allocated wages on 1040 married filing separately

Yes texas

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will i put allocated wages on 1040 married filing separately

https://www.irs.gov/pub/irs-pdf/p555.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will i put allocated wages on 1040 married filing separately

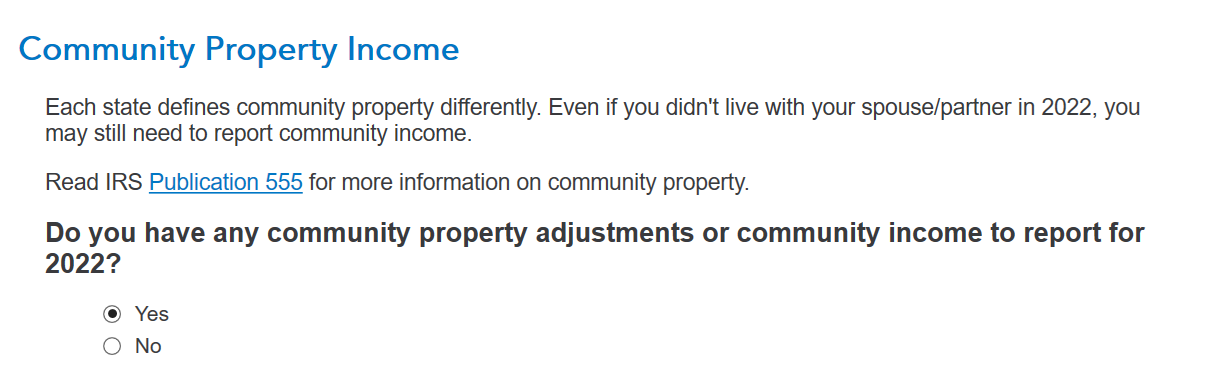

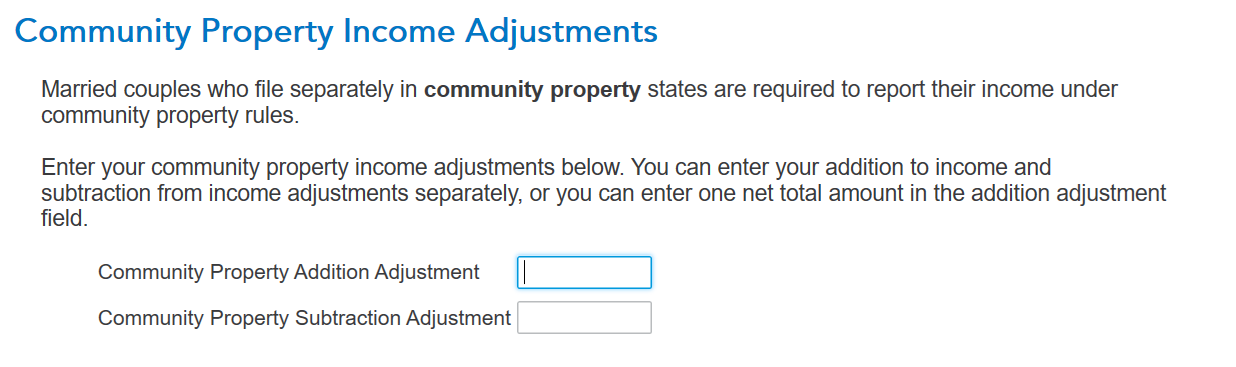

You should enter your W-2 as it is reported. After you enter your income and deductions in TurboTax, you will see a screen that says Community Property Income. You need to indicate that you have community property adjustments.

On the next screen you can enter an adjustment to increase or decrease your income to adjust it to your community property income. After that you will also see a screen where you can adjust your tax withheld, as that is community property as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rtoler

Returning Member

ajm2281

Level 1

user17538710126

New Member

sakilee0209

Level 2

user17524145008

Level 1