- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

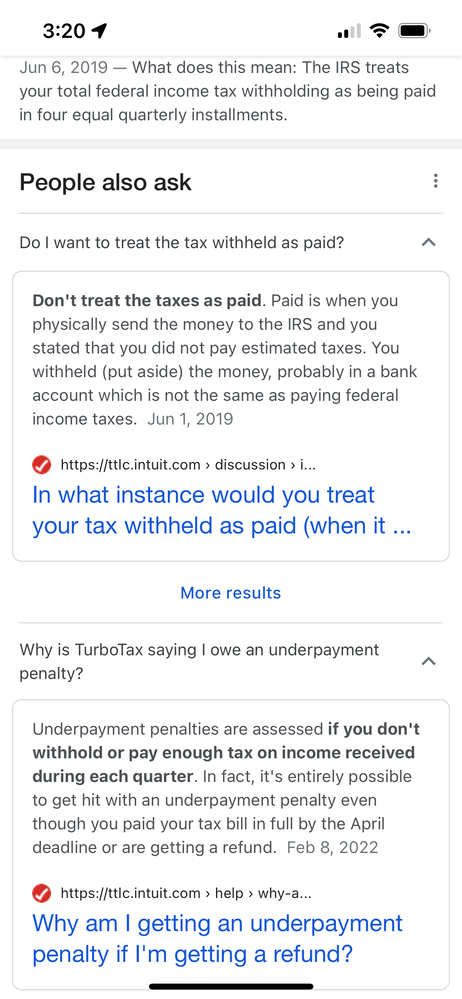

Title on Page is Actual Withholding and it says:

The IRS treats your total federal income tax withholding (from wages, interest, dividends, gambling winnings, etc.) as being paid in four equal quarterly installments.

For purposes of figuring the underpayment penalty, you may elect to treat the tax withheld as paid when it was actually withheld. Would you like to do this?

I don't know if I would like to do this or not. Don't really understand. Can you help

Thanks

Paula

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

When you don't have enough tax withholding and you don't make any estimated tax payments during the year, then the IRS or your state can charge you with an underpayment penalty.

There are some exceptions to this penalty that you may qualify for if you meet any of these requirements:

- You paid in 85% of your 2018 tax liability (Divide Line 16 by Line 15 of your Form 1040)

- You paid in 100% of your 2017 tax liability during 2018 (or 110% if your AGI is over $150,00)

- Login to your return and click "Take Me To My Return"

- Click "Search" in the upper right corner of your screen, then type "underpayment penalty" in the Search Box and click "Find"

- Click the "Jump To" Link

- From here, you can review the underpayment penalty and work through the possible exceptions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

Does turbo tax estimate the penalty? We just submitted are taxes for 2020. Box 38 is empty; however box 37 says this is the amount you owe now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

Does turbo tax estimate the penalty? We just submitted are taxes for 2020. Box 38 is empty; however box 37 says this is the amount you owe now. It appears that you didn't add it in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

Line 38 is your estimated penalty and is not due until you get the bill from the IRS. You can include the amount when you pay either through TurboTax, by check, or through the IRS website - - or wait for the bill. The amount on Line 37 is due by 04/15/21, but the penalty is not due until the date on the bill.

The penalty is calculated on Form 2210. Because Form 2210 is complicated, you can ignore line 38 and the IRS will figure the penalty and send you a bill. They won't charge you interest on the penalty if you pay by the date specified on the bill. And the form will not be ready in TurboTax until the end of the month, so if you want to not wait for the form, this is the option you would use so you can e-file now.

However, if you want a waiver of the penalty or you use the annualized income method to figure the penalty, you have to wait for the form to be finalized. @kayska

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

Are these underpayment penalties extended until May 17 now?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

When you pay your tax in 2021 does not impact the underpayment penalty amount. When you don't have enough tax withholding and you don't make any estimated tax payments during the year, then the IRS or your state can charge you with an underpayment penalty

There are some exceptions to this penalty that you may qualify for if you meet any of these requirements

You paid in 90% of your 2020 tax liability (90% of line 24)

You paid in 100% of your 2019 tax liability during 2020 (or 110% if your AGI is over $150,00)

To visit the section where you can go through possible exceptions to the penalty follow these steps

Login to your return and click "Take Me To My Return"

Click "Search" in the upper right corner of your screen, then type "underpayment penalty" in the Search Box and click "Find"

Click the "Jump To" Link

From here, you can review the underpayment penalty and work through the possible exceptions

If you do not pay you tax by 5/17, then the IRS can charge a failure to pay penalty in addition to the underpayment penalty

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

I filed 2023 turbotax resultswith IRS. TURBOTAX expecetd a $9000 refund. IRS says I owe$27000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

$27000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

@ejmitch wrote:

I filed 2023 turbotax resultswith IRS. TURBOTAX expecetd a $9000 refund. IRS says I owe$27000

That is a huge difference. You must not have entered income on your tax return that the IRS knows you received but did not report.

What exactly does the IRS notice indicate on why you owe this amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax saying I have an underpayment penalty when I never estimate my taxes ?

we have no access to your return or the IRS records.

You should receive a letter of explanation in 2 or 3 weeks. Then, if you disagree or find an IRS error, you can follow the instructions as to what to do if you disagree.

other options.

call the irs

Call 800-829-1040

- Choose your language,

- Then choose option 2

- Then 1

- Then 3

- Then 2

- When it asks you to enter your SSN or EIN do nothing – wait - - After it asks twice, you will get another menu

- Then 2

- Then 3

It should then transfer you to an agent. Note when its phone line are busy you may be on hold for a long while or disconnected

or access your IRS account and print out a transcript or request a copy by mail - form 4506-T

https://www.irs.gov/individuals/get-transcript

in you need help from this forum as to what to do, post back to tell us what the IRS changed - form or schedule and line #

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Omar80

Level 3

teamely5

New Member

jstan78

New Member

sakilee0209

Level 2

mschipani87

New Member