- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why is TurboTax Ignoring My Mortgage Interest?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

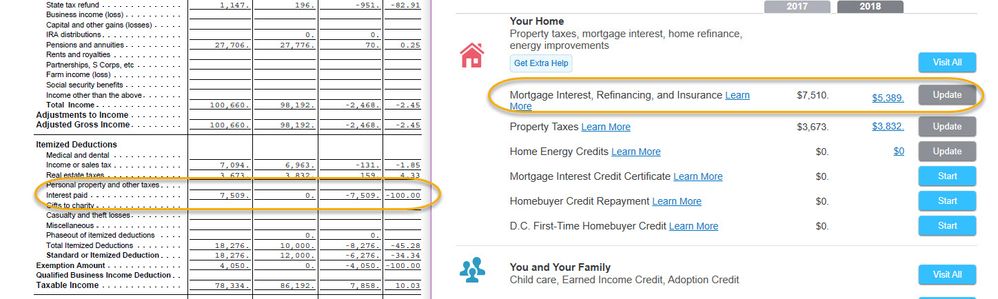

Why is TurboTax Ignoring My Mortgage Interest?

Hi,

The new tax reform is driving me bananas. I am trying to understand the impact (I'm in Oregon) of the SALT changes. I saved my return to do a fine-detail review. I thought mortgage interest was separate from SALT, but I cannot figure out why TT is not including the interest? Am I missing something?

Thanks for any help/ideas.

Paula

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax Ignoring My Mortgage Interest?

OMGosh, sorry for the bother. I read a few more discussions and discovered the "Box 7" issue. Even though the bank entered the same address in Box 8, TT was not figuring the statement was for my personal home. Telling TT that box 7 was checked has resolved the missing mortgage interest calculation.

All good, for now.

Paula

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax Ignoring My Mortgage Interest?

OMGosh, sorry for the bother. I read a few more discussions and discovered the "Box 7" issue. Even though the bank entered the same address in Box 8, TT was not figuring the statement was for my personal home. Telling TT that box 7 was checked has resolved the missing mortgage interest calculation.

All good, for now.

Paula

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax Ignoring My Mortgage Interest?

I'm having the same problem. I have over $40k in interest, and it's still kicking me to the standard deduction. I took the advice of checking box 7, but didn't make a difference. Help!

Any ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax Ignoring My Mortgage Interest?

If you have over $40,000 in mortgage interest you should be using a CPA to do your tax return. Not a diy self prepared return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax Ignoring My Mortgage Interest?

This did not work for me. Turbo Tax entered the interest correctly the first time I entered. When I returned to the program to check for errors, it then pointed out what were supposed to be but were not errors and once this was done, it would no longer include mortgage interest on the Schedule A. I tried this with two highly competent assistants over the phone and they eye-witnessed at least a dozen failures trying different strategies to get the program to do what it is supposed to do. The error is in the Turbo Tax Program, NOT in what was entered. There were several other quirks that I noticed including changing several entries without my doing so. This error is wasting me long hours of precious time and if I had not caught it,it would have cost me almost 1400 dollars in over-payment. I bought this license to save money, NOT lose it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TurboTax Ignoring My Mortgage Interest?

Please look at the adjustment screen to see if you can tell the program to take the mortgage interest deduction:

ONLINE USERS:

Please go back to the Home Mortgage Interest section:

Click Federal on the left side-bar

Click Deductions & Credits along the top

Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add

Scroll down the “Here’s your 1098 info” screen and click Done.

Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue.

On the following screen, you will see the “Original amount”.

Enter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.

The available “original” amount should only be adjusted for any cash out not used on the home, and that amount cannot be claimed for the Federal deduction.

DESKTOP USERS:

Go into Forms (top right)

Enter the amount on Tax & Int Wks

Mortgage Interest Limited Smart Worksheet section

Line A2

OR

Step by Step

Federal

Deductions & Credits

Mortgage Interest, Refinancing and Insurance Click Update

Click Done

Click Yes, one or both of these situations apply to me. And Continue

Enter the Adjusted amount and Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ramseym

New Member

eric6688

Level 1

user17523314011

Returning Member

eric6688

Level 1

mana1o

New Member