- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why is my 'Credit for Tax Paid to New York' is different than shown in 'Summary of Taxes Paid to Other States'?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 'Credit for Tax Paid to New York' is different than shown in 'Summary of Taxes Paid to Other States'?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 'Credit for Tax Paid to New York' is different than shown in 'Summary of Taxes Paid to Other States'?

Credits for taxes paid to other states often do not equal the amount of tax paid the other states. This is because a resident state will calculate the amount of tax they charge on the same other state income. It very well may be different. For Instance, if you live in Georgia with a 5.75% tax rate and earn income in New York taxed in New York at 6.85%, Georgia is not going to give you a credit for the full amount of tax you pay New York, only the amount of Georgia Tax on that same income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 'Credit for Tax Paid to New York' is different than shown in 'Summary of Taxes Paid to Other States'?

@DavidD66- that makes sense - thank you! Except:

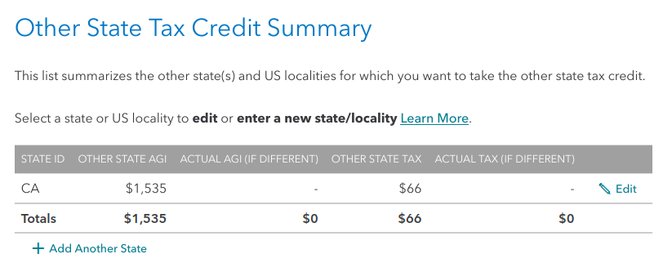

My resident state is GA, but I owe $66 in CA. Turbotax knows about the $66:

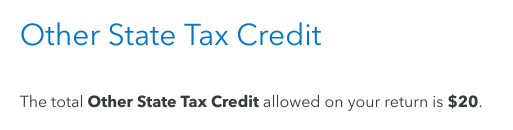

But it's only allowing me $20 on my GA return:

Do you know why that might be the case here? From what I can tell, GA marginal income tax rates are higher than CA's (maybe I'm reading that wrong?), so I would think that the GA taxable amount would actually be higher and thus the full amount would be credited.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my 'Credit for Tax Paid to New York' is different than shown in 'Summary of Taxes Paid to Other States'?

The credit is available only when the business, investment, or employment is in a state that levies a tax upon net income. In no case shall this credit exceed the tax which would be payable to Georgia upon a like amount of taxable income. So, GA is only going to credit you the GA rate for that income. CA rates go from 1-12.3%.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Intellyvest12

New Member

Jefro99

New Member

jetblackus

New Member

admin

New Member

jackkgan

Level 5