- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why do I have an estimated tax penalty on line 38 of my 1040?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have an estimated tax penalty on line 38 of my 1040?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have an estimated tax penalty on line 38 of my 1040?

The estimated tax penalty is a penalty for not paying your taxes in full throughout the year. So if you have a tax due of more than 10% of your tax liability, you will have a penalty. If you are seeing a penalty, you can go back into the program under Other Tax Situations>>Additional Tax Payments>>Underpayment penalties and select start or update next to Underpayment Penalties. These questions are meant to help you apply for the exemption to the penalties.

Some exceptions to the penalty are

- You had $0 tax liability in 2022

- You paid 100% of your 2022 tax liability

- You paid 90% of your 2023 tax liability

- You or your spouse (if you file a joint return) retired in the past 2 years after reaching age 62 or became disabled and you had reasonable cause to underpay or pay your estimated tax late

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have an estimated tax penalty on line 38 of my 1040?

The estimated tax penalty is a penalty for not paying your taxes in full throughout the year. So if you have a tax due of more than 10% of your tax liability, you will have a penalty. If you are seeing a penalty, you can go back into the program under Other Tax Situations>>Additional Tax Payments>>Underpayment penalties and select start or update next to Underpayment Penalties. These questions are meant to help you apply for the exemption to the penalties.

Some exceptions to the penalty are

- You had $0 tax liability in 2022

- You paid 100% of your 2022 tax liability

- You paid 90% of your 2023 tax liability

- You or your spouse (if you file a joint return) retired in the past 2 years after reaching age 62 or became disabled and you had reasonable cause to underpay or pay your estimated tax late

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have an estimated tax penalty on line 38 of my 1040?

Thank you, Vanessa . You are helpful and awesome!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have an estimated tax penalty on line 38 of my 1040?

Hello, I made an over payment on my estimated taxes that is greater than 90% of my Federal Taxes due (in fact, it was way over).

I did only make one payment last year but that's because all of my revenue was in Q4 2023.

I don't understand how or why TurboTax is still charging me an penalty? I went through questions but TurboTax was not able to eliminate the penalty.

Can you help? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have an estimated tax penalty on line 38 of my 1040?

The penalty is not only based on how much you pay, it also includes the timing.

Annualizing your Income can be used to reduce those penalties.

Since you had a major portion of your income at the end of the year, you may want to try this alternative.

As an alternative you can go to the main menu.

- Select Tax Tools

- On the drop-down select Tools

- There will be 4 green boxes

- Select Topics Search

- Type Annualizing your income

- This will bring you to the screen Underpayment Penalties

- Continue through the questions and it will be posted to your return.

Please contact us again with any additional questions or to provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have an estimated tax penalty on line 38 of my 1040?

Ok thank you. Unfortunately that didn't help to eliminate the penalty. I'll just have to make sure I don't make any late payments this year.

My income is not uniform though, so that's a challenge.

Does TurboTax have a tool that would help me calculate quarterly Estimated Tax payments? I have a mix of W2 and freelance (via single member LLC) income.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have an estimated tax penalty on line 38 of my 1040?

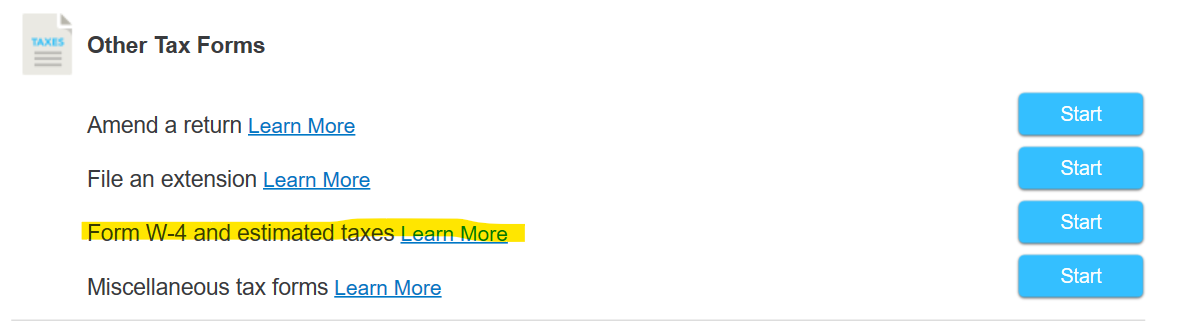

Yes, you can calculate estimated tax payments in the federal section of TurboTax. Look for Other Tax Situations, then choose Form W-4 and estimated taxes which you will find under Other Tax Forms.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilian

Level 1

Kiwi

Returning Member

Omar80

Level 3

bill Pohl

Returning Member

az148

Level 3