- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Why 21K mortgage interest exceeds IRS limitation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why 21K mortgage interest exceeds IRS limitation?

This is my first house and I bought it at 2021. Isn't the limitation 750K? Do I miss anything?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why 21K mortgage interest exceeds IRS limitation?

Yes, the limitation is $750,000, unless your are married filing separately, which is $375,00.

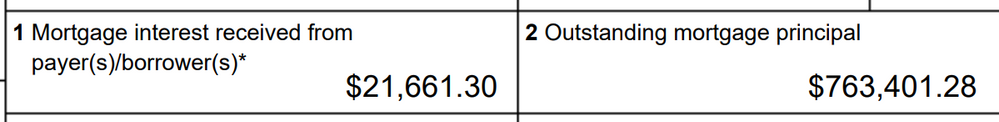

That is the limit for mortgage debt, not the amount of interest. If the amount in box 2 of your 1098-INT is more than $750,000, your deduction will be limited.

There are some other factors that may limit your mortgage interest. If your mortgage not used to buy, build, or substantially improve your home, some of all of your interest will not be deductible.

If the amount of your mortgage exceeds the value of your home, your mortgage interest may be limited.

If you have more than one 1098-INT, you have to be careful about the way you answer the questions in this section.

If you still have questions about why your mortgage interest was limited, please respond back with more details, such as the figure in box 2 of 1098-INT and whether your have more than one 1098-INT.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why 21K mortgage interest exceeds IRS limitation?

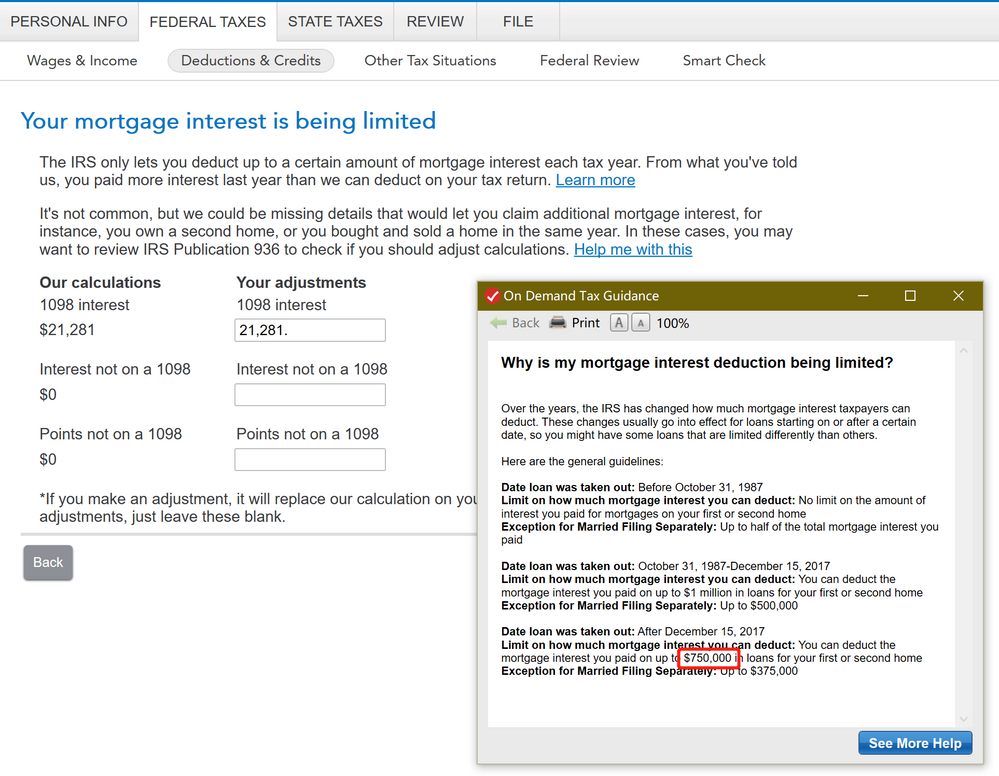

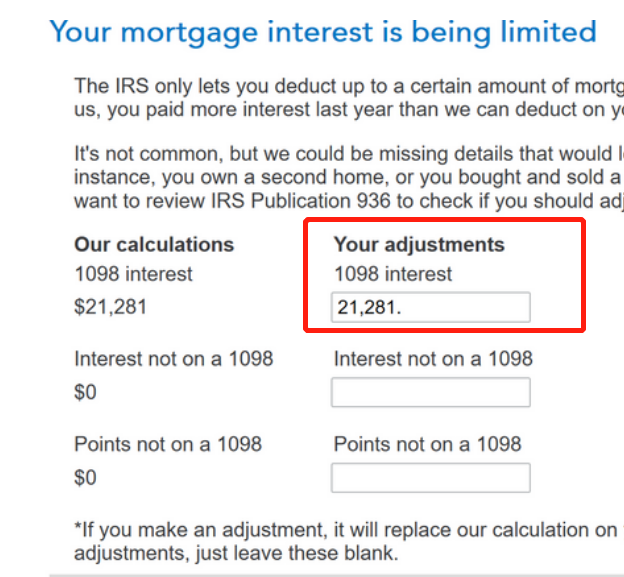

Thank you for you response! Yes, the box 2 exceeds 750K. What makes me concerned, the message from TurboTax says "It's not common, but we could be missing details...", it makes I feel I did something wrong because I think it is very common to have a mortgage balance > 750K.

What should I fill here? Just keep it as 21,281? Or return back to fix something?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why 21K mortgage interest exceeds IRS limitation?

No, leave as is. TurboTax automatically calculates the qualified mortgage interest based on the 750k Limit and prorates it. Looks like you got your total interest deduction based off your mortgage balance, don't change. If you have more than one qualified mortgage, it'll still go by the 750k limit unless grandfathered in; and again prorate based off maximum.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cchid8

New Member

bdcruz

New Member

jeannieb82

New Member

Rhkjr

Returning Member

LCCarroll1

New Member