- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where is the form 8915-f for 2023 filing of 2022 taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

I am writing to express my extreme disappointment and frustration with the continued delay in the release of the required forms for tax filing. It has now been another day since I sent my previous letter, and I have received no response or update from Turbo Tax.

It is truly shameful that Turbo Tax refuses to take any action or provide any information on the progress of developing and releasing the required forms. The continued delay is causing significant hardship to many taxpayers, and it is unacceptable that Turbo Tax is not taking this matter seriously.

For the love of God, I hope that Turbo Tax will meet its self-imposed deadline and release the required forms as soon as possible. The stress and anxiety among taxpayers are only increasing as each day passes, and Turbo Tax's lack of response and action is only making things worse.

I urge Turbo Tax to take immediate action to rectify the situation and provide regular updates on the progress of developing and releasing the required forms. The continued delay and lack of communication are unacceptable, and I demand that Turbo Tax takes this matter seriously and acts accordingly.

Shame on Turbo Tax for causing such unnecessary difficulties and hardships to taxpayers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Form 8915-F is currently scheduled for release on March 9, 2023. YOu can monitor the form's status in the below help article. If the form becomes available sooner than the currently published date, the article will be updated to reflect the new availability date.

When will my individual tax forms be available in TurboTax?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

@MichelleLO where's the thumbs down button to dislike? We all know where to check for the form because we've all been waiting over a month now with the date changing at least once a week (sometimes more frequently if we're lucky!). All of this while other software has finalized the form which wasn't supposed to change from last year. Thanks but no thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

If this form is not ready tomorrow (March 9), I'm going to use another tax software for 2022 and going forward...not only for me, but also for many other people I prepare returns for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

I'm sorry, but this response is unacceptable. It does not provide any concrete information regarding the development schedule or testing of the Form 8915-F. Instead, it merely suggests that the form is scheduled for release on March 9, 2023, and that I should monitor a help article for updates.

As a paying customer of TurboTax, I demand more transparency and details regarding the delay in releasing this form. I want to know what the hold-up is and what actions are being taken to ensure that the form is released on time. I need this information to plan my tax filing process and avoid any penalties or late fees.

Therefore, I request that a manager be assigned to this response who can provide me with a clear and detailed explanation of the development schedule, testing process, and any other issues that are causing the delay. I expect to receive a prompt and satisfactory response that addresses my concerns and provides me with the necessary information to plan my tax filing process.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

These Turbo Tax experts come In and throw gas on the fire. They don’t truly know when TT will make it available. If you followed my posts from last week, last week I entered in Tax Slayer at a cost of $20 and 90min. Today I received the refund. Guess what, TT isn’t jerking me around!! Not sure why every other tax prep software has the form except TT. Spend $20 and get a refund from TT. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

So you would recommend Tax Slayer? I was also going to look at HR Block. My fed and state return are not complicated, I just have to deal with Fed Form 8915.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

I just spoke to a TaxSlayer rep and she said they do not support the 8915. But you said they do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

@joshgoldstein201 wrote:

I just spoke to a TaxSlayer rep and she said they do not support the 8915. But you said they do.

Yep...the Taxslayer website for forms supported does not show a Form 8915-F - https://www.taxslayer.com/tax-tools/federal-forms-for-taxes/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

yes I would highly recommend. $29 now and 90 minutes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

I filed 8915-F with tax slayer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

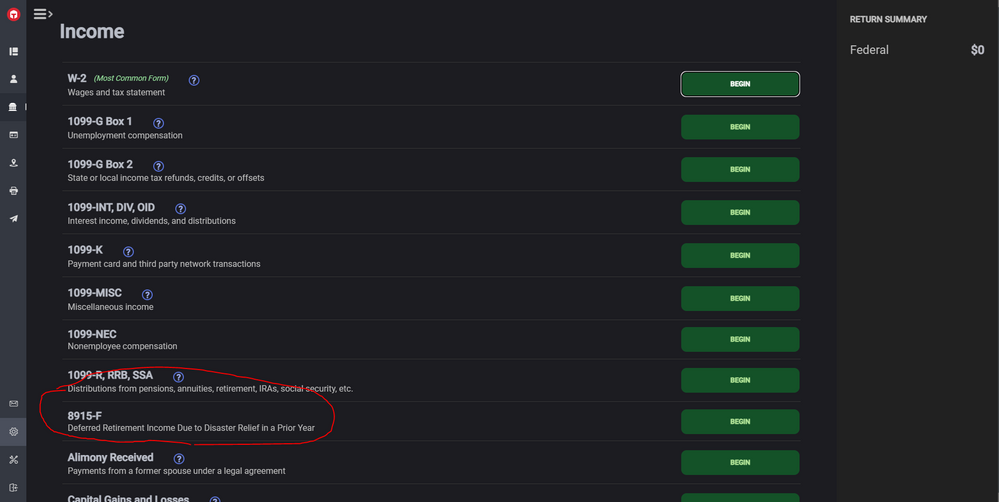

How would you explain this screen shot?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Aww, that's nice. Except all Intuit and Turbo Tax seem to do is move the date - no accountability for delays, no explanation. I've been waiting to file since the end of January on this one form. I would suggest you refund some of your fee for every day delay after the form became available from the IRS. Show some responsibility and accountability for the service you provide.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

And 3/8/23 and it’s still not available. I was told over the phone that it would be ready on 3/9. Last time I called I was told 3/2. So we will see if it’s available tomorrow (3/9). 🤷🏼♂️

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the form 8915-f for 2023 filing of 2022 taxes?

Same here. If TT cannot file it tomorrow, I will be looking at "Freetaxusa". My parents just used that for the first time a few weeks ago and it went well. Form 8915 was not part of their return but everything else went smoothly. They said the Freetaxusa system doesn't hold your hand as much as TT but is still workable and also lets you look at your return forms as you go along. Plus, pricing is awsome!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

psberg0306

Level 2

anthonybrewington21

New Member

littlelindsylue

New Member

g456nb

Level 1

christybarcelo83

New Member