- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- where do I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

show that I have had health insurance all year??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

Using the TurboTax software - Click on Federal Taxes - Click on Health Insurance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

Under the Health Insurance tab, that will be the first question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

Still no joy. All those tabs are there and completed on my 2018 return. I'm just starting my 2019 return. Basically I import my 2018 personal info. When I click on fed taxes tab there is no health ins. tab.

I normally go to forms as assorted tax documents arrive. Any ideas? It bugs me that I can't find that question.

We both have health ins for the entire year. I should be able to find that question.

Mel

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

It might not be ready yet. It's very early. There will be many program updates to come. Have you updated the program? Go up to Online-Check for Updates.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

Change in that section will no likely delay completion of that section for the 2019 program ... there will be MANY updates between now and the end of January when the program will be operational enough to efile any return ... at the same time as the IRS will open the efile season ... patience will be needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

Yeah, could be. Yes I have run updates. I started too early, probably.

mel

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

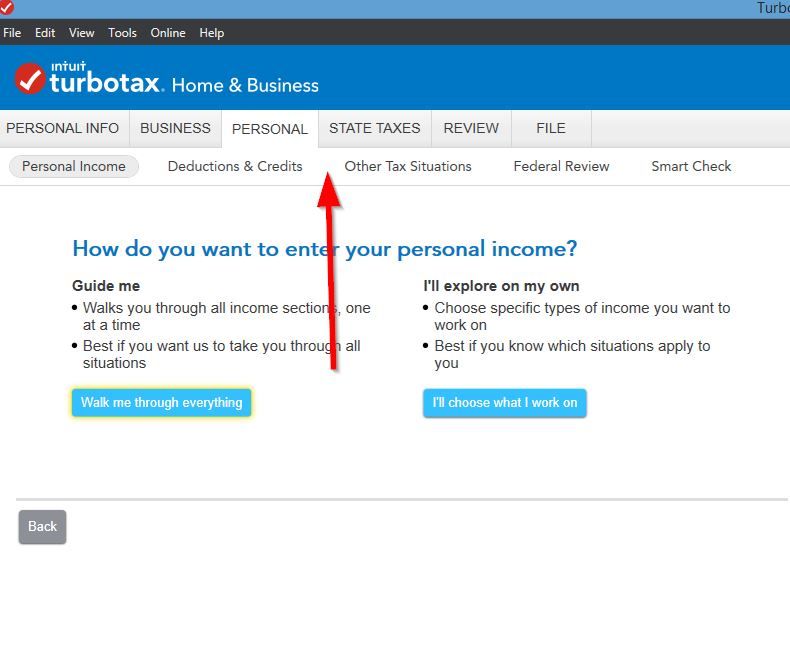

Yes I just checked my Home & Business program. It's not there yet either. In H&B we don't have Federal, we have Business then Personal. But the Health tab should be after Deductions and Credits

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

Since you are not required to have insurance any longer the Health Ins tab may not be used any longer HOWEVER if anyone had insurance thru the ACA and has a 1095-A that form must still be entered ... not sure where in the program that is yet as I do not get the downloaded version and the Online version is not operational yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

As @Critter has said there is no penalty for not having health care insurance for tax year 2019 and beyond. If health insurance was provided from the Marketplace, state or healthcare.gov then a Form 1095-A would be received. The 1095-A is required to be entered so that the Form 8962 Premium Tax Credit can be generated.

The Form 1095-A is entered in the Medical section under Deductions and Credits.

On Affordable Care Act (Form 1095-A), click the start button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

@Critter wrote:

Since you are not required to have insurance any longer the Health Ins tab may not be used any longer...

I do not believe that is correct. My understanding of the 2018 law change did not eliminate or modify the health insurance requirements of the "Affordable Care Act" in any way for 2019 - it is still required. What *was* changed was the penalty for not having health insurance. The penalty was not actually eliminated, it was just reduced to $0.00 for not having insurance.

Congress did not have the votes to change the act itself but they did have the votes to change the amount of the penalty so they changed it to zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I

Correct ... for income tax purposes it is essentially the same thing ... it is not required to be reported so it has no place in the TT interview.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hgg3110

New Member

maryczech1

New Member

krystaapodaca9

New Member

vanessa012290

New Member

linda_busching

New Member