- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- When is interest on a CD reported to the IRS?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

Thank you for your responses.

So, the part in pub 550 -- pg 20 -- that says If you buy a CD with a maturity of more than 1 year, you must include in income each year a part of the total interest due and report it in the same manner as other OID. is not applicable to my case?

Here is another link someone else included in a different threat.

If I decide to to pay interest to the IRS for the 11 months that the CD was open in 2024 and then in 2025 for the 7 remaining months, will that cause and issue with IRS ?? I simply would like to do the right thing and feel secure that I wont be penalized or audited.

Again, all interests in my CDs are not paid until maturity (whether they were 12 months or 18 months).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

No. That should not cause any issues with the IRS. You are simply reporting interest as it accrues and not when it is paid, which is required for a overseas CD according to this link. You should not be audited.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

This question doesn't necessary refer to the foreign account scenario...

If tax is paid for the year in which it was accrued, but not paid, would it be correct to assume there would not have been a 1099-INT issued? Therefore how do you reference that accrued interest in your return?

And if a 1099-INT was not issued for a year in which you declared the accrued interest, how do you explain the difference between the full amount of interest actually paid as shown on the 'final' 1099-INT issued at the time of maturity vs. the smaller amount accrued and paid in the tax year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

If interest is reported as income on your tax return each year as it accrues, then you will reduce the amount on a 1099-INT that is received in the year of redemption or maturity, by the amount already claimed in prior years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

If the financial institution does not issue a 1099-INT until the CD reaches full maturity, and you declare interest accrued annually during the life of the CD, you would have no 1099-INT to reference when you file. And the amount shown on the 1099-INT issued at maturity would not match the amount you declared in the final year,

What form do you use or how do you document the discrepancy?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

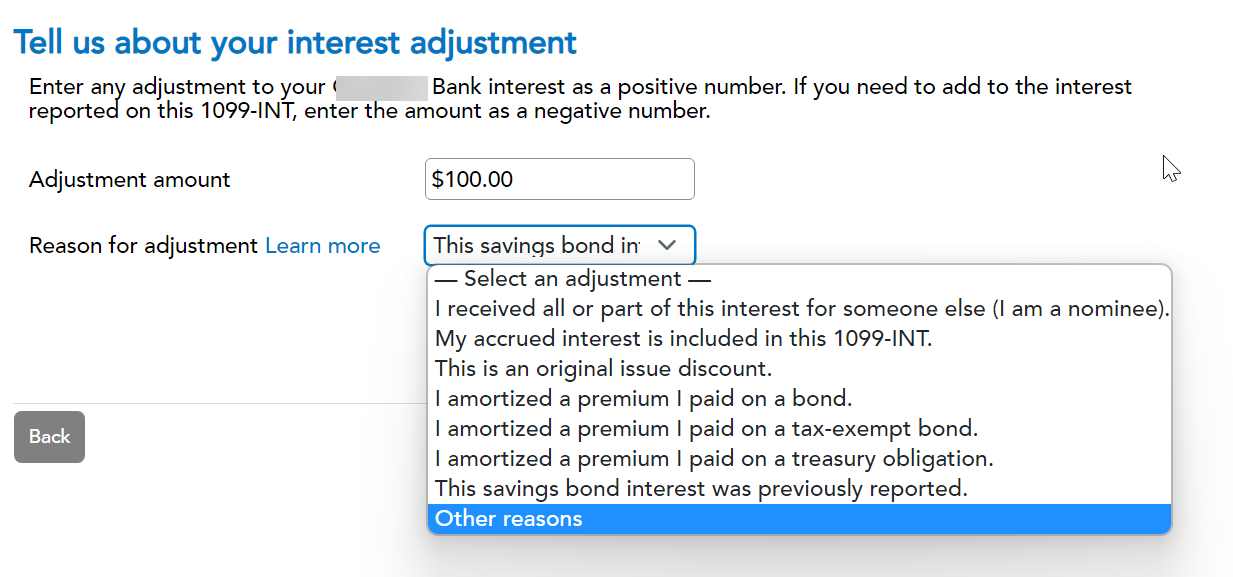

If you receive a 1099-INT that includes income already reported in a previous tax year, enter the 1099-INT as is. When you get to the follow-up screen, you can adjust the interest entered and enter an explanation.

This can be done in the section where you entered the interest. When you get to the follow up question about uncommon situations, select that you need to adjust the interest (see screenshot below)

Another screen appears where you can choose a reason for the adjustment (see screenshot below):

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

Thanks! I have never had to do that. I have always waited, incorrectly, until the 1099-INT arrives.

Good to know!

thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

I wouldn't overcomplicate CDs - tax is paid in the year the interest is paid (which in the case of bank CDs is often paid and compounded to the CD account) and reported on 1099-INT. You should not need/want to pay tax on the accrued interest without a 1099, and doing so effectively reduces your yield which assumes compounding/reinvestment of interest payments until maturity.

The references to Pub 550 "If you buy a CD with a maturity of more than 1 year, you must include in income each year a part of the total interest due and report it in the same manner as other OID."

.... this section is referring to OID - Original Issue Discount. In the CD space this would apply to brokered CDs which are issued and traded on secondary market like bonds, if they happen to be issued at discount. Bank CDs don't have this feature. This has nothing to do with the interest paid due to the coupon on the CD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

actually I may not be correct that the pub550 reference only applies to discount, it's in the OID section but seems to refer more generally to interest on these instruments but lumping the topic under OID. Either way I think you should receive a 1099 for it. Ally for example on their multi year Bank CDs will pay interest annually on 12/31 regardless of anniversary of the CD, and generate a 1099-INT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

No they don't.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

What makes this confusing is that “earned,” “accrued,” and “paid” don’t always mean the same thing with CDs.

Some CDs accrue interest daily but don’t credit it to you until maturity. In that case, nothing is available to you during the term, so many banks wait and report it all at maturity.

Other CDs credit interest monthly or annually, even if you leave it in the account. Once it’s credited and you could withdraw it (even if there’s a penalty), many banks treat that as reportable for that calendar year and issue a 1099-INT.

Then there are CDs longer than one year, which can fall under OID rules. In those cases, interest may have to be reported each year even if it’s not paid out yet, and the bank will usually handle that by issuing the appropriate tax form.

So the real difference is how and when the interest is credited under the terms of that specific CD.

If you’re opening CDs in the future and want to avoid surprises at tax time, check whether the interest is paid only at maturity or credited periodically. Some comparison sites like CD Valet (a CD marketplace listing over 40,000 CDs from federally-insured banks and credit unions across the US) show those term details across different banks and credit unions, which makes it easier to see how it’s structured before committing.

Hope that helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When is interest on a CD reported to the IRS?

Great answer!!!

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nyjerr

New Member

Jackaroo64

Level 2

Bkuei

New Member

diartent

Returning Member

mdames

Level 2