- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If you receive a 1099-INT that includes income already reported in a previous tax year, enter the 1099-INT as is. When you get to the follow-up screen, you can adjust the interest entered and enter an explanation.

This can be done in the section where you entered the interest. When you get to the follow up question about uncommon situations, select that you need to adjust the interest (see screenshot below)

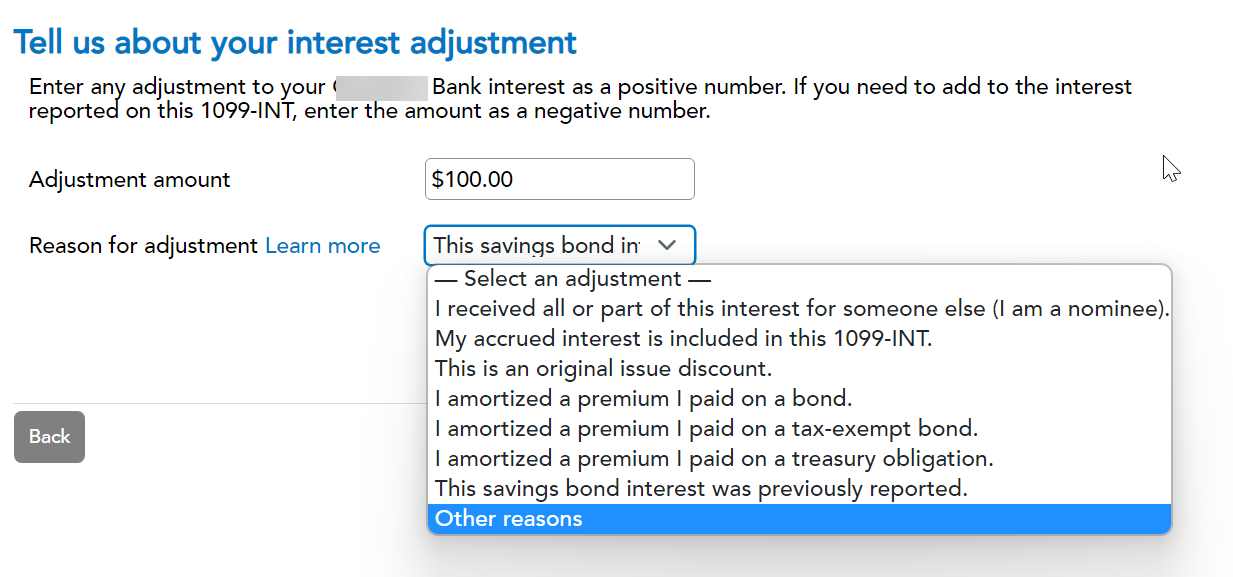

Another screen appears where you can choose a reason for the adjustment (see screenshot below):

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 16, 2025

10:15 AM