- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- what to put on schedule A line 8?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put on schedule A line 8?

background: i rent a portion of my primary house, and calculate to split allocation based on rental portion.

Then, on schedule A line 8: home mortgage interest report on Form 1098, what should i put there:

1, box 1 amount on Form 1098, which is total interest

2, take out rental portion of that amount, ie. if rental portion is 30%, total interest amount report on 1098 is $10000, then put $7000 here? but it will be different than what reported on Form 1098 and seems not what the words really asking for.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put on schedule A line 8?

restart over to make sure no error that i input all info correct based on turbotax ask and i use recommend method to let turbo tax calculate portion allocation from partial rental to personal use. so not sure why turbo tax adds the total interest paid with personal allocate calculated? does this an error from turbo tax, if so, it will be too silly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put on schedule A line 8?

The recommended way to enter your mortgage Interest, property tax, and other allocable expenses would be to enter them in the rental property section of TurboTax. In the rental property section under your Property Profile, indicate that you rented out part of your home.

On the page, Let Us Calculate Your Expense Deductions for You, a yes answer will allow you to enter the entire mortgage expense and TurboTax will do the math for you based on the rental % of your home. If you choose this method, then you wouldn't enter the deductible personal portion again. TurboTax would transfer the personal portion to Schedule A.

All other expenses directly related to the Rental should be entered on Schedule E. Once you complete your return, review both Schedule A and E to ensure the expense allocations are correct.

In addition to Mortgage and Property Tax, you will also need to depreciate a portion of your home:

Rental portion only

For example, suppose you paid $90,000 for your house, including $30,000 for land. In your case, enter 1/3 x $90,000 or $30,000 for the cost and 1/3 x $10,000 for the land. TurboTax will depreciate the rental portion of your property ($30,000 - $10,000 = $20,000) which is one-third of the total house - less land.

- On the rental property info screen – select Add expense or asset

- Select Rental property

- EDIT your rental property under Assets

- Select Rental Real Estate Property

- Choose Residential Rental Real Estate

- On Tell Us About This Enter Asset, enter one-third (1/3) of the total cost and one-third of the land price. This will depreciate one-third of your property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put on schedule A line 8?

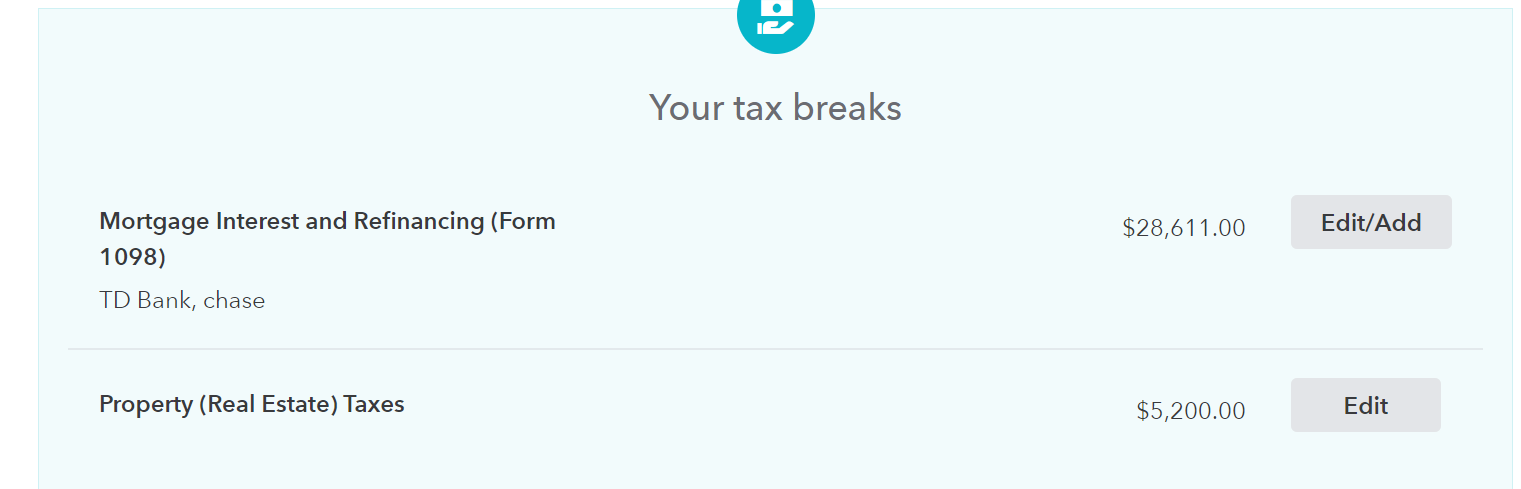

@HopeS thanks and yes, i actually did the same thing as you outlined to let turbotax calculate the portion allocation for me:

total amount reported in form 1098 is $10,000, while the calculated relocation for personal use based on rental portion is $8,000.

however as you see in the summary page, the turbotax adds up $10,000+$8,000=~$19K here. I think the correct amount shall be personal portion, which is $8000.

so it seems a software error from turbo tax?

And Turbo tax put the amount $19K here, which i think is an error. So for California state Tax part, should it be the same amount as Federal amount, which is allocated for personal use, like $8,000?

and where in the specific form i can check to make sure form is correct? schedule A for federal? how about for California state, which form specifically?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put on schedule A line 8?

I believe it is appearing this way because you are entering the Form 1098 Information in the "Deduction and Credit" section of your Return.

Therefore, you need to revisit that section and delete Form 1098. The mortgage balance and interest on none of the information should be entered due to the fact that you are claiming partial rent. See the screenshots below. Click on Edit

On the next page, Click Trash.

You will repeat the same step for Property Tax.

Once your Federal Return is fixed you should not have an issue with California since the information should flow correctly.

If you are not able to delete the Mortgage Interest using the Trash, then use the Tool Feature on the Left to delete: See steps below: Also clear Cache before logging back in by clicking Here.

- Log in and open your return

- Click Tax Tools from the left side of the screen

- Select Tools from the drop-down menu

- Click the Delete a Form hyperlink click to delete Form 1098

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put on schedule A line 8?

@HopeS thank you so much for your reply. so just making sure i understand it correctly, you mean for partial room rental in my primary house case, after i allow turbotax auto calculate the allocation, then i no longer need to edit anything in personal deduction section for loan interest and property tax?

for instance, in deduction page for home loan interest, we just click on "NO"?

and for property tax, i just leave these to be blank? and click on "continue"?

and then in the summary page, i got only the amount calculated for personal use for schedule E, does this time looks right?

and finally checked for State, it now matches same number as Federal, does that looks correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what to put on schedule A line 8?

Correct, you don't need to enter anything else in Personal Deduction Section. Since doing so will overstate your Schedule A deductions.

Once you complete your returns, please print and preview them before efiling. You will be able to preview it once you pay your TurboTax fees.

See the steps below:

- Sign in to your TurboTax account and open your return by selecting Continue or Pick up where you left off

- Select Tax Tools from the left menu, then Print Center (on mobile devices, tap in the upper left corner to expand the menu)

- Select Print, save, or Preview this year's return, and follow any additional instructions

- Once your PDF opens in Adobe Acrobat Reader, select the printer icon near the top

- Make any adjustments in the Print window and then select Print at the bottom

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RobertShillito

New Member

slbeavers1959

New Member

pbflanary

New Member

user17707743243

New Member

diane.guccione

New Member