- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What is the difference between purchasing Turbo Tax at store or doing it on line?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between purchasing Turbo Tax at store or doing it on line?

Yes click on State Additional under the price. If you pay now (before filing) you can lock in the price. On March 1 it goes up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between purchasing Turbo Tax at store or doing it on line?

I see the self employed is $79 at Sams and comes with state download an e-file. The online versions is more and doesn’t come with state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between purchasing Turbo Tax at store or doing it on line?

You mean the Home & Business version?

ONLINE VS DESKTOP

ONLINE

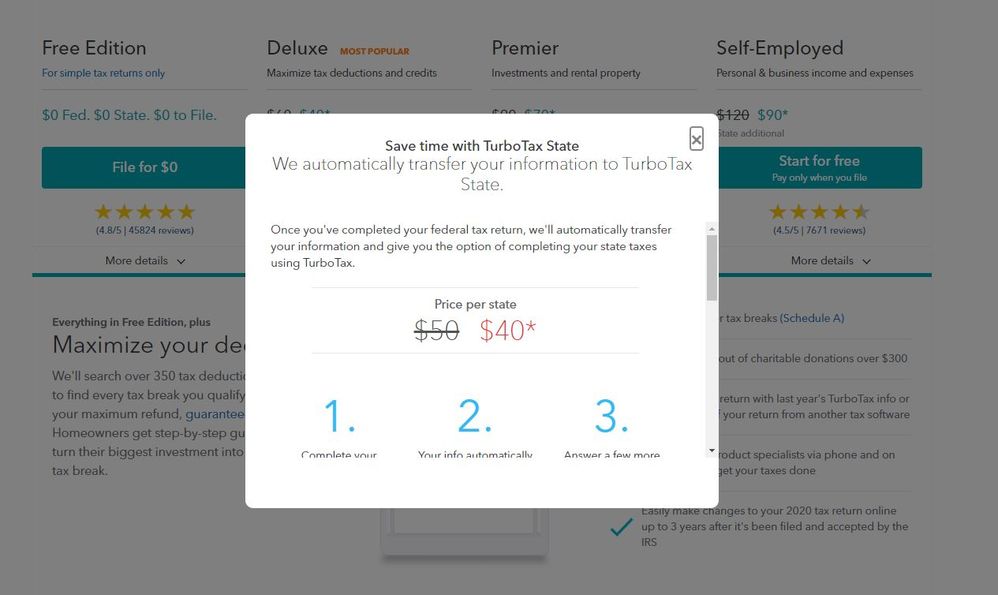

The Online web version is different than the Desktop CD/Download program you install. The pricing structure is totally different.

Online you pay to prepare the return whether you efile or print and mail. Efiling is free and included in all versions. And state is a separate additional charge in Deluxe and above. Oh and Online is only good for 1 Account and 1 return.

In the Online versions you have to use a higher versions to enter certain types of income like investments and self employment. Online you can’t see the actual forms like the Desktop program until you pay.

You can access an online return from any computer and device. Your return is stored at Turbo Tax. So be sure to download the pdf and .tax files to your computer when you are done or you may not be able to access it when you need a copy. Or if you ever need to amend.

DESKTOP

Some advantages of the Desktop CD/Download program over the Online version, https://ttlc.intuit.com/community/choosing-a-product/help/what-are-the-advantages-of-the-turbotax-cd...

Desktop you buy and install the program which can do unlimited returns. The returns are only saved on your computer and can not be accessed from anywhere else. And not saved at Turbo Tax. So Be sure to save Frequently and make backups. You get 5 federal efile for free. In Deluxe and above you get 1 state PROGRAM download to prepare unlimited state returns (in that state). Each state return including the first one is $20/25 to efile or you can print and mail the state for free.

Desktop also has many other features and advantages over the Online version. You can do more than 1 return. You can see and enter into the actual forms. And you can use a lower version because all the Desktop versions have ALL the same forms. You just get more help in the higher versions. In online you have to upgrade to enter certain kinds of income. Like Premier for investments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between purchasing Turbo Tax at store or doing it on line?

I need to file a return for my soon to be 98 yr old mother-in-law. No W2 income only SS and investment income. What package do I use. Do I need to register differently for her returns? I did mind earlier this month and not a problem. But now I want to do hers and cannot seem to register her. Please help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is the difference between purchasing Turbo Tax at store or doing it on line?

It depends on the investment income. if the investment income involves a little bit of interest or dividends, you may get by filing with a free version of Turbo Tax. If involving stock or bond sales reported on a 1099B, then you will need Turbo Tax Premier to file.

If your mother is under the filing threshold. If the amount of her investment income and 1/2 of her social security is less then $14,250, she does not need to file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

christysetliff21

New Member

i-nejabat

New Member

Ryan_TX

New Member

sdbrehm

New Member

mrtate1965

New Member