- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- What is Schedule D for AMT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

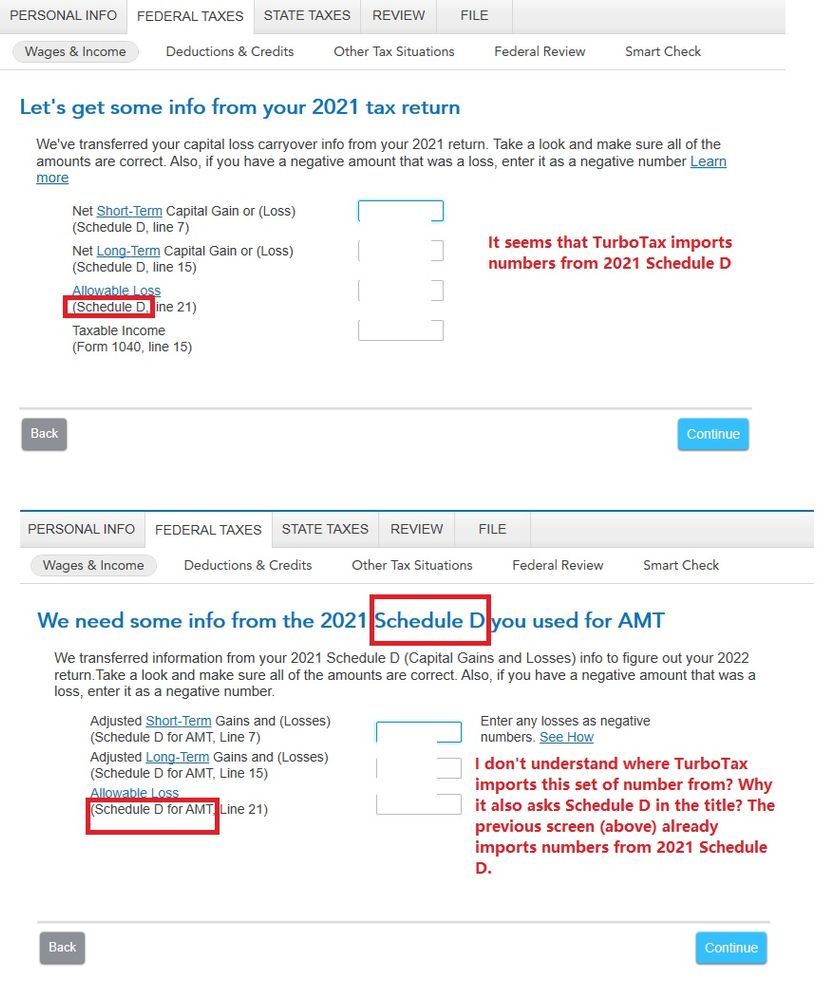

What is Schedule D for AMT

I have only Schedule D in 2021 tax return, and I have no idea where TurboTax imports/calculates numbers in the second screenshot.

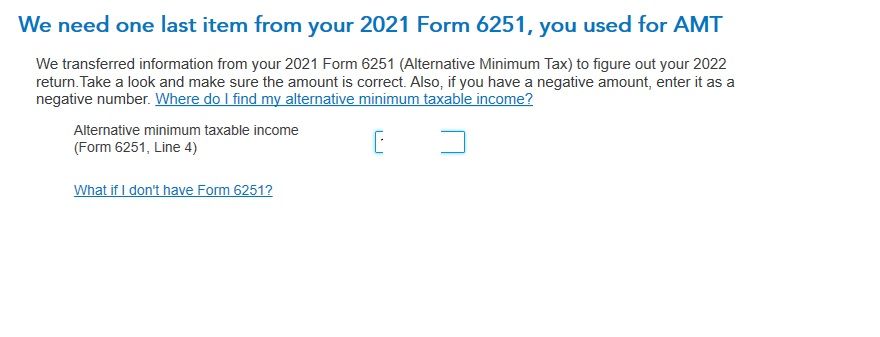

Moreover, it also asks form 6251 line 4, while I did not have form 6251 in 2021 (used TurboTax website)

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is Schedule D for AMT

Did you get any answer to this question? I am facing the same issue. Just like you, I only have schedule D in my 2021 tax return.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is Schedule D for AMT

TurboTax is asking you to varify your capital loss carryover from 2021. It would be the amount on line 7 of Schedule D plus the amount on line 15, less $3,000, assuming the net of line 7 and 15 is a negative amount, or a loss. Since you can only deduct up to $3,000 of capital losses against ordinary income, if you have a loss of $3,000 on line 21 of schedule D, you probably have a loss carryover. If you don't have a loss form 2021, you should leave the worksheet blank.

Since you did not have a form 6251 for alternative minimum tax in 2021, you can leave that worksheet blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is Schedule D for AMT

Hello,

Thank you very much for your response. However, I am still a little confused. As VAer mentioned, initially TurboTax seems to import the capital loss carryover from 2021. The numbers look like they're coming from the 2021 schedule D.

Then, information is requested from the 2021 schedule D used for AMT. It doesn't make sense to ask for the same numbers again. I don't have a schedule D from 2021 used for AMT. I only have the copy of schedule D filed with my taxes.

In the screen entitled "We need some info from the 2021 schedule D you used for AMT" the first entry (Adjusted short-term gains and losses) (Schedule D for AMT line 7) is "0" on my computer. Schedule D line 7 on my 2021 return is a negative dollar amount. The second entry (Adjusted long-term gains and losses) (Schedule D for AMT line 15) is a positive dollar amount, and it is equal to the number on line 13 of my 2021 Schedule D (capital gains distributions). The third entry (Allowable Loss) (Schedule D for AMT line 21) is a dollar amount equal to the number on my 2021 Schedule D line 21.

So, the second and third entries seem to be coming from my 2021 Schedule D, but the first entry (0) just seems to be wrong. As I mentioned earlier, it doesn't seem to make sense to enter the same set of numbers twice. I have my Schedule D from 2021, but I have no record of a 2021 Schedule D used for AMT.

Any further assistance you can provide would be greatly appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is Schedule D for AMT

For most taxpayers, the capital loss carryover amounts will be the same for AMT as they are for regular income tax. Thus, no adjustment needs to be made and you can leave the amount as is.

You might have to make an adjustment for AMT purposes if you had purchased stock through an Incentive Stock Offering (ISO). In an ISO, the AMT measures cost basis by adding the exercise price paid plus the fair market value of the shares. For regular income tax, the stock basis in an ISO is the price the taxpayer paid for the shares. Because the AMT calculates basis differently for an ISO, when comparing this calculation with the way the regular income tax calculates basis in an ISO, there could be a difference in stock basis, which in turn could result in a change in the amount of capital loss carryover.

How did you purchase your stock that resulted in capital loss? If you bought your stock in the public markets, there is probably no adjustment that needs to be made. If purchased through an ISO, or some other non-traditional way, follow-up with that additional information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is Schedule D for AMT

Thank you very much for the information. The stock was bought in the public market, so as you stated, no adjustment should be necessary for the capital loss carryover.

I realize that this whole thing isn't that significant, but I still would like to understand the meaning of the sequence of screens that username VAer posted in the original message in this sequence. Up until the time I started working on my 2022 taxes, I had no awareness of "the 2021 Schedule D you used for AMT". The screen asks you to look at the numbers and make sure all of the amounts are correct. Based on the fact that I still don't know where the numbers that are populating the fields on my PC came from, I certainly cannot verify that the numbers are correct. Am I to understand that the only purpose of these entries is to determine the correct loss carryover for 2023? I just feel that asking a user to verify numbers when they don't know the origin of the data is confusing at least.

Thanks to everyone who responded for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is Schedule D for AMT

Most people know when they are affected by AMT. You are correct that if you have not been affected, you would have no idea what it is.

From the beginning. First understand what AMT is.

Topic No. 556 Alternative Minimum Tax - IRS

The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits.

More In Help · How Is The Amt Calculated? · Am I Subject To The Amt?

The program asks everyone about AMT because you may have had high income one year and been subject to AMT. If you have never been subject to AMT, screens can either be left blank or match the screen for those without AMT.

For example, the sch D above. The program asks the standard information and then asks again to correct for those who have been limited in that area due to AMT.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is Schedule D for AMT

Thanks for the response!

So, I didn't pay the Alternative Minimum Tax last year. Is that the reason that I can't verify the numbers on the TurboTax page asking for information from the 2021 Schedule D that I used for AMT? If that's the case, then I will just ignore the numbers and move on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is Schedule D for AMT

Yes, if you didn't have alternative Minimum Tax last year, you can disregard the questions about your 2021 AMT amounts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is Schedule D for AMT

Strongly recommend Turbotax modify their guidance to make this clear ("Leave the amount(s) blank if you were not subject to AMT in for tax year 2021.") or something appropriate. The existing guidance is confusing and clearly frustrates the vast majority of us out there in tax obfuscation land.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is Schedule D for AMT

Thank you ThomasM125 🙂

I've been literally using Turbo Tax Desktop (TTD) since 2012 and every year I (obviously ) "Import" my previous year (excluding 2012).

I've been taking the 3K capital loss since 2018 and for this 2023 tax year, the "Federal Review" failed, requesting my 2021 Schedule D AMY lines 7 and 15. I easily found end them; Federal Review passes.

My thinking is that TTD should have had the said numbers i.e. been using it every year. I'm a veteran Software Engineer (46 years) and am VERY aware it's impossible to test every permutation, and am amazed that this is the first glitch I found since 2012.

I hope all in our community enjoy doing their taxes this year.

I hope all in our community realize that Federal and State Income Tax Laws are way to complex (WAY TO COMPLEX).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kaseyschnebly

New Member

ennosys

New Member

Cryn0705

New Member

ske711

New Member

talaratate

New Member